Time to revisit everyone’s favourite metal, namely gold, and regular readers of my analysis will know I was bullish on gold when it was trading around the $1,664-per-ounce region, and the reason for this was the clear anomaly on the weekly chart, which signalled a lack of selling pressure following the extreme volatility of the last few weeks. If you missed the post from the 9th April the link is here.

In this post, my initial target for the precious metal was $1.700 per ounce but this now been breached since when gold has risen strongly to attack the $1.800 per ounce level. So the question now is whether this level is likely to be achieved and if so when?

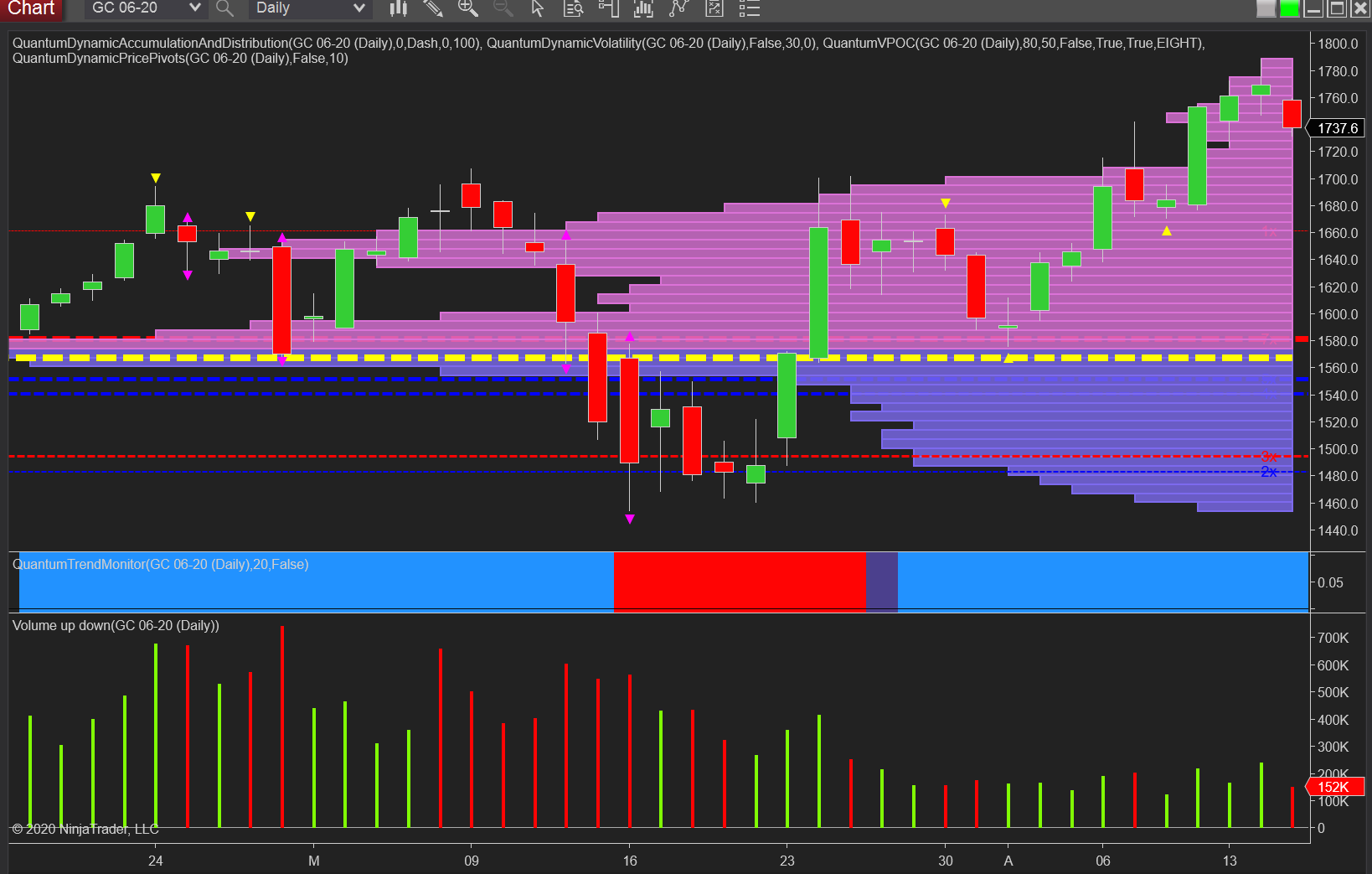

If we focus on the daily chart, progress higher this week has been muted and recorded a signal of weakness to come, with the rising volume and narrower spread price of Monday through to Tuesday. So today’s correction has been no surprise but muted selling under average volume suggests this is primarily profit-taking.

And the important point to note, from a technical perspective, is the volume point of control histogram, which has volume falling away dramatically towards the low volume node at $1,780 per ounce and beyond. With such light volume and no price based resistance, it will not take a great deal of effort to drive through this region and achieve the $1,800 per ounce price point. Note too the trend monitor indicator remains firmly bullish thus reflecting the longer term bullish sentiment for the precious metal.