Here is a synopsis of what the Federal Reserve had to say at its much-anticipated meeting Wednesday afternoon:

- The Fed Is committed to maintaining its bond buyback program of $85 billion per month until the job outlook shows steady improvement. However, it expects to be able to ease up the pace around the end of this year.

- A 6.5% jobless rate in 2014 is predicted. The Fed will base itself on achieving this target to determine the next increases in the key interest rate. 15 of the 19 members expect the first rate hike in 2015.

- The downside risks to the outlook for the real estate sector and labour markets have diminished.

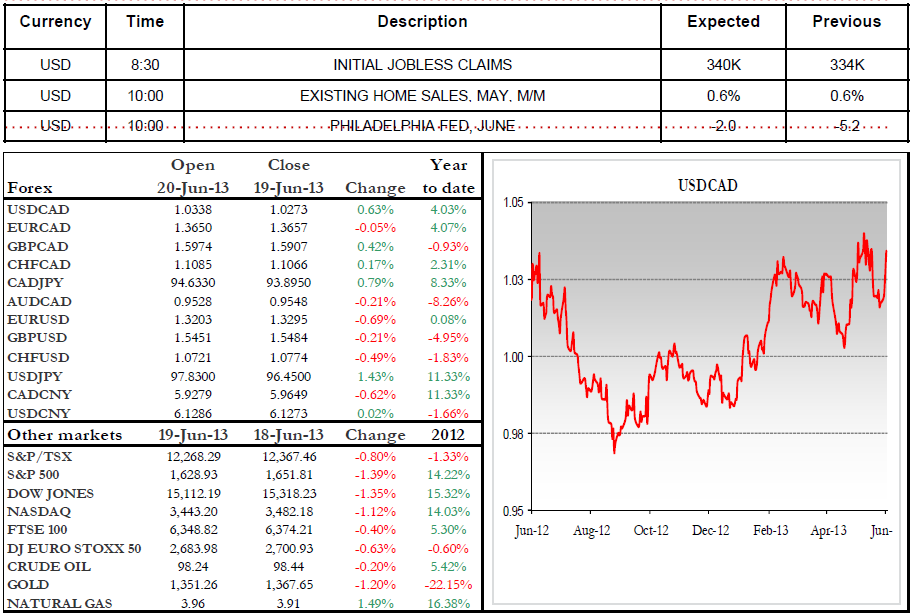

Impact on markets at closing:

- Bonds - CAN 5 years: +11 pts, CAN 10 years: +14 pts, US 5 years: + 20pts, US 10 years: +18 pts

- Equities - S&P 500: -1.4%, DOW: -1.3%, TSX:-0.8%

- Energy - natural gas: +1.2%, crude oil: -0.7%

- Currencies - USD/CAD: +0.0060, EUR/USD: -0.0098, GBP/USD: -0.0162, USD/JPY: +0.98

Wishing you a great day

Rana Karim

Range of the day : 1.03-1.0425