With stocks back in “climb” mode (at least for now!), it could seem like a good time to look for a hedge against the next downturn.

If you’re looking for hedges that also pay big dividends, you might be considering resource funds—especially those in oil and gas, or maybe even gold.

Today, I’m going to show you why you should resist this strategy, or at least be very careful about it. Closed-end funds (CEFs), which yield 8.3% on average today, are my beat at my CEF Insider service, so I’ll use CEFs (which we love, especially outside the resource space!) as examples, in light of their outsized yields.

Energy CEFs: A Quick Introduction

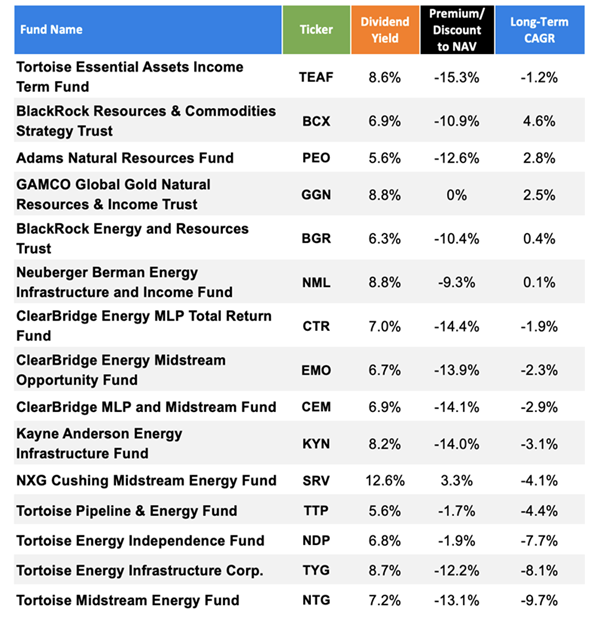

Right now, there are 15 liquid CEFs covering energy, and they yield 7.6% on average (I say liquid because there are a couple other CEFs that are simply too tiny and hard to invest in for me to write about).

Already, we can see that this figure is below the 8.3% average yield across CEFs.

Why do energy funds yield less? Two reasons: lower returns and the fact that it’s tough to turn rapidly fluctuating commodity returns into steady income. A look at the energy CEFs out there explains both points.

I know there’s a lot happening here, but the first to note is that as of this writing, all but two of these funds trade at discounts to net asset value (NAV, or the value of their underlying holdings), with the Tortoise Essential Assets Income Term Fund (TEAF) and ClearBridge Energy MLP Total Return Fund (CTR) offering the biggest markdowns.

We can also see why all of these funds should be short-term plays at best. In the long run, here meaning 10 years or since the fund’s IPO if it went public within the past decade, their returns are poor.

Clearly, when we do invest in energy or gold CEFs, we need to limit ourselves to the best of them. That’s really only the BlackRock Resources & Commodities Strategy Trust (NYSE:BCX), the Adams Natural Resources Fund (NYSE:PEO) and the GAMCO Global Gold Natural Resources & Income Trust (NYSE:GGN), going by the past returns in the table above.

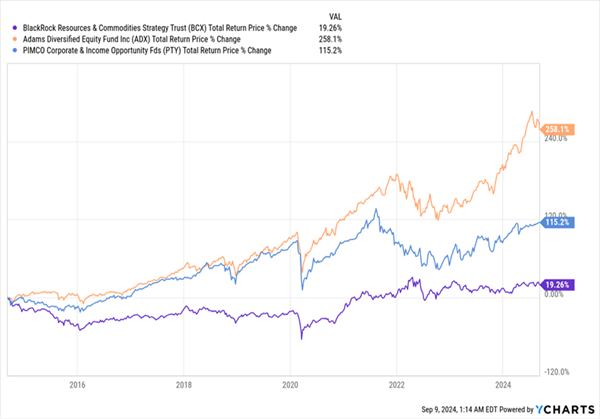

Bear in mind, though, that even the best of those three, BCX, still trails the best stock and bond CEFs, such as the Adams Diversified Equity Closed Fund (NYSE:ADX), in orange below and a long-time equity-fund holding in CEF Insider, and the bond-focused PIMCO Corporate & Income Opportunity Fund (NYSE:PTY), in blue.

Top Energy CEF Still Lags the Stock and Bond Competition

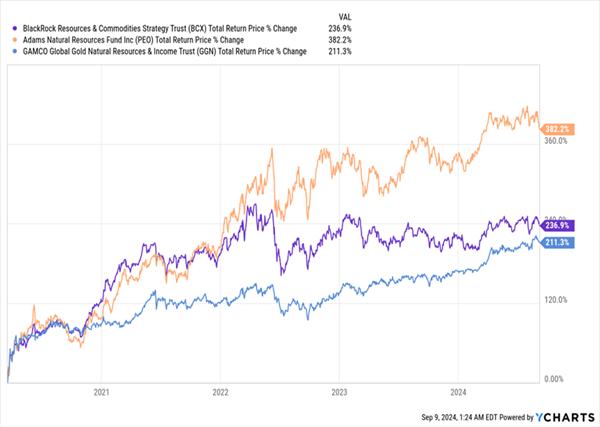

But all of that said, you still can make money buying a well-managed energy fund. We just need to do so at the right time. Consider how BCX (in purple below), PEO (in orange) and GGN (in blue) have performed since the pandemic lows:

Energy, Gold CEFs Soar Off a Low Base

When these funds get oversold due to a panic like what we saw in early 2020, they become clear profit-makers over the long term. Which is why I will enthusiastically recommend one during our next global flirtation with disaster.

But until then, beware, especially since the market seems to be overbidding the weakest performer of these three funds. The gold fund, GGN, trades exactly at par in relation to its net asset value (NAV, or the value of its holdings), despite having the lowest returns from the market lows in 2020.

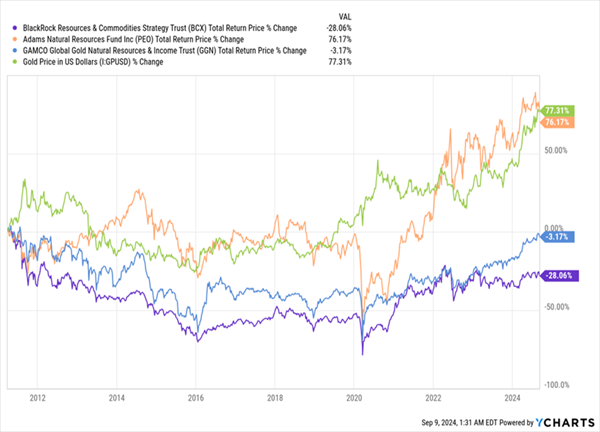

Meanwhile, over the long term, GGN (in blue below) has been a money loser even though its focus—gold—is up over 77% during that period:

GGN Losing Investor Money

Granted, it has done better than BCX (in purple), but both funds are negative for the same reason: they invest in commodities and promise stable income (6.9% dividends for BCX, and 8.8% for GGN).

But commodity prices fluctuate a lot, and with gold seeing a meager 4.7% annualized gain in value in the time period charted above, you can see how 6.9% and 8.8% yields are unsustainable. Oil has done worse: the WTI spot price is down 31.7% over this period.

All told, energy and income are a tough mix, which, as mentioned, is why these funds are only buys when investors have thrown in the towel. That’s far from the case now.

These 4 Contrarian Plays (Yielding 9.8%) Crush Energy (and Gold) Funds

Clearly, energy and gold funds are not reliable long-term wealth generators. But you know what is (the answer will surprise you)?

AI investments—specifically the 4 high-yielding AI funds (average payout: 9.8%) I’m pounding the table on now.

It’s true!

Because here’s the thing about AI that everyone is missing: It’s NOT going to cause a massive overhaul of the economy this year, or even next.

As the Apple (NASDAQ:AAPL) event we saw last week showed, AI’s true potential is as a longer-term productivity booster, as it gets worked into the iPhones, tablets, apps and other hardware we use every day.

What we don’t want to do, then, is buy overpriced, low-dividend-payers like NVIDIA (NASDAQ:NVDA). Instead, we’re looking for off-the-radar AI plays with big dividends—like the 9.8%-paying funds I’m urging investors to buy now.

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, "7 Great Dividend Growth Stocks for a Secure Retirement."