Investing.com’s stocks of the week

Michael Kramer and the clients of Mott Capital own Acadia, Apple (NASDAQ:AAPL), Mastercard (NYSE:MA), Netflix (NASDAQ:NFLX)

The of week of January 14 kicks off earnings seasons, with Citigroup (NYSE:C), Bank of America (NYSE:BAC), JP Morgan, and Netflix all reporting. We also get the producer price index the morning of January 15, followed by a parliamentary vote on Brexit later in the day. It makes for what could an exciting start of the week.

Banks

The banks find themselves in an unenviable position with their stock prices well of their 2018 highs. In fact, JPMorgan Chase & Co (NYSE:JPM)is the only bank that isn’t down by more than 20%. The banks certainly did not have a healthy housing market in the fourth quarter to work with, nor did they have rising rates. About the only thing that went in favor of the banks was the financial market volatility. It makes for what could be a rocky earnings seasons.

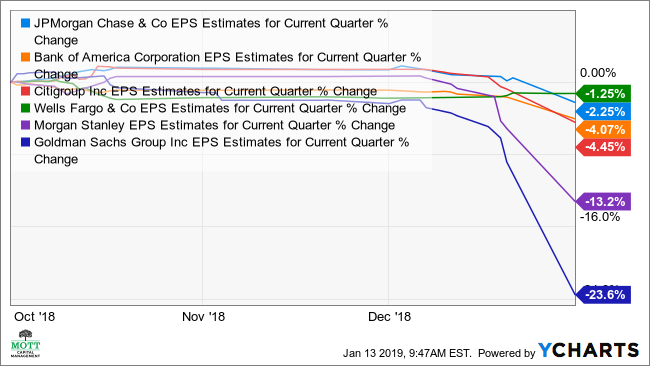

Earnings estimates for the banks, most notably Goldman and Morgan Stanley (NYSE:MS), have fallen sharply. It seems as if it will not be too hard for the banks to the surprise investors and deliver better than expected results.

JPM EPS Estimates for Current Quarter data by YCharts

Citigroup (C)

Citigroup Inc (NYSE:C) stock looks like it could rally a bit further, with a technical gap to fill up at $61. Just be mindful of the downtrend, should the bank fail for the third time at the downtrend, it would be very bad news.

Bank of America (BAC)

Bank of America Corp (NYSE:BAC) is on the cusp of breaking out should it rise above $26. If that happens, the stock could rise to around $28.

JP Morgan (JPM)

JP Morgan’s chart doesn’t look great after it failed at resistance around $102.5. The stock could be heading lower again towards $95.

Goldman Sachs (NYSE:GS)

Goldman could be on its way to $183. I know it is not saying much, but is there anything positive going Goldman’s way to change this trend?

Morgan Stanley (MS)

I can’t say that I have ever seen a chart like Morgan Stanley (NYSE:MS) before. Look at how firm the stock has held its downtrend, and for so long and consistently. The chart still looks horrible.

Netflix (NFLX)

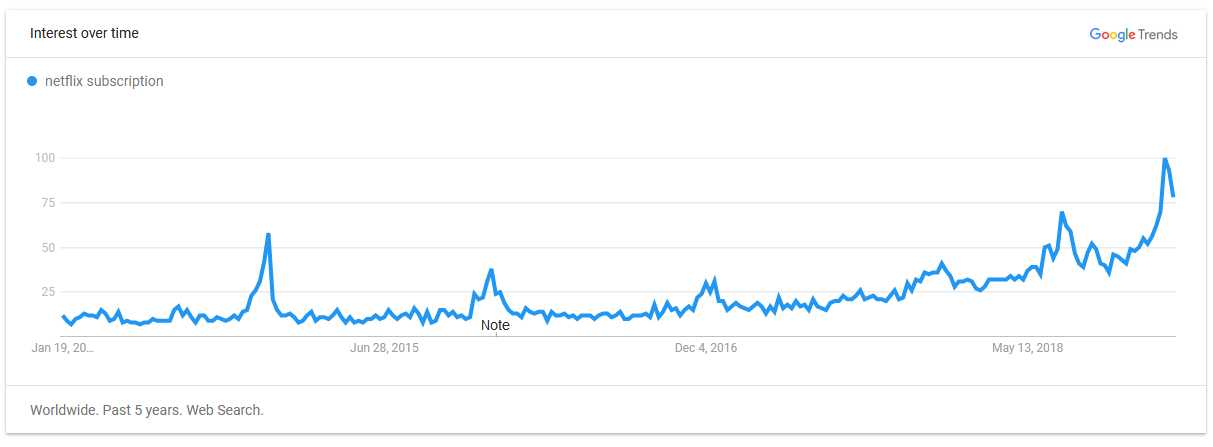

Netflix Inc (NASDAQ:NFLX) is the total opposite of the banks with expectations for the stock rising sharply over the past few weeks. For this, we need to only look at the stock price. The stock is up 26% this year on no noteworthy news, just rising expectations. For now, the next level of resistance is $355, but that could quickly change by Thursday. This stock should be consider day-to-day.

Google (NASDAQ:GOOGL) trends suggest subscriber growth is extremely strong.

Apple (AAPL)

Apple Inc (NASDAQ:AAPL) stock will likely continue to struggle this week. The shares managed to refill a gap up to $155, and failed 2 times. It is hard to imagine that the stock can find enough positive momentum this week to get to rise above $155. Earnings are still a few weeks off and I think until investors get some more clarity on how the rest of the year may shape up, $155, is likely to stay firm resistance.

Amazon (NASDAQ:AMZN)

Amazon’s stock has stalled out after the news of Jeff Bezos’ divorce. It isn’t clear what impact it may have on the stock or not, but it is on top of investors minds. We can see in the chart how the stock has stopped in its tracks.

$1,620 is support and a break below that price, which seems likely, takes it down to $1520.

Micron (NASDAQ:MU)

Micron is the cusp of a potentially big break out should it rise above $36. The stock could be on its way to $40.

Nvidia (NVDA)

It would seem there is a level of resistance in NVIDIA Corporation (NASDAQ:NVDA) stock around $150, which I hadn’t notice before. If the stocks can climb over $151 it can probably go on to rise to $160. If not, than it likely heading back to $139.

Roku

Roku Inc (NASDAQ:ROKU) is probably heading back towards $34.

Acadia (ACAD)

ACADIA Pharmaceuticals Inc (NASDAQ:ACAD) managed to finish the week above $21 and may be heading towards $24.

Square (NYSE:SQ)

Square is consolidating nicely around $65.50, and I still think it can head towards $75.

Mastercard (MA)

Mastercard could be on its way to $204.