- 13F filings came out yesterday.

- Several major investors and funds have radically reshuffled their portfolios.

- In this piece, we'll take a look at what Buffett, Dalio, Gates, and Burry sold and bought.

- For less than $8 a month, InvestingPro can help you find which stocks legendary investors are buying and selling.

The Q2 13F filings were published yesterday, providing investors with valuable information on the positions of the most famous investors and major hedge funds.

These are filed with the SEC and are a legal requirement for funds and investors managing over $100 million. They detail purchases and sales of shares in listed companies and ETFs for the quarter just ended.

Given the breathtaking long-term performance of legends such as Warren Buffett and Ray Dalio, 13Fs can provide individual investors with investment ideas, and help them better understand the long-term vision of large funds.

In this article, we'll take a look at the main portfolio movements of some famous investors in the second quarter of 2024.

Warren Buffett: 2 Big Buys, 1 Big Sell

Warren Buffett, arguably the world's most famous investor, reshuffled his portfolio extensively during Q2, closing several positions and opening others, although the biggest moves were reductions or increases in existing positions.

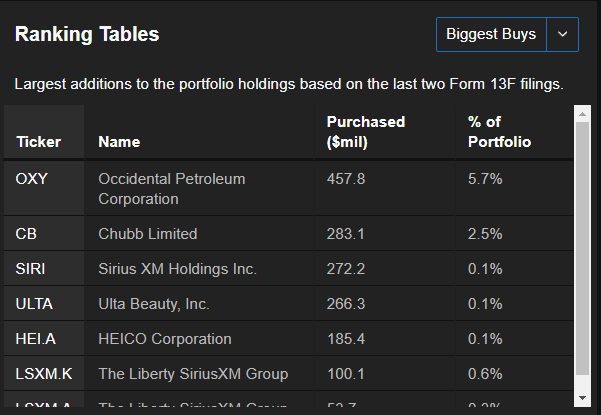

Oracle of Omaha opened new positions in Ulta Beauty (NASDAQ:ULTA) and Heico (NYSE:HEI), for $266 million and $185 million respectively.

Source: InvestingPro

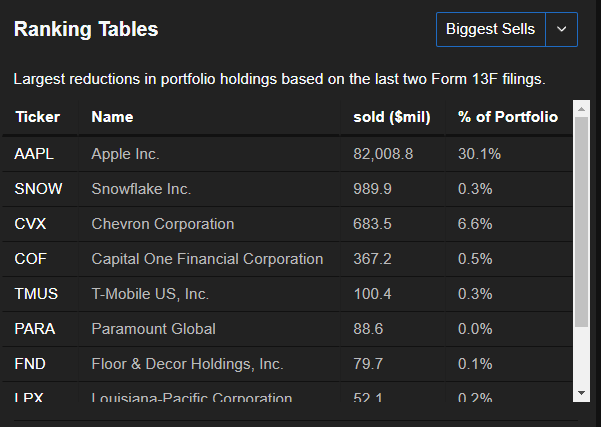

Conversely, Buffett completely liquidated his positions in Snowflake (NYSE:SNOW) and Paramount (NASDAQ:PARA).

However, the reduction of his position in Apple (NASDAQ:AAPL) was Buffett's biggest move during the third quarter. Although he still holds over $80 billion worth of shares, the position has been roughly halved over Q1 and Q2.

Source : InvestingPro

The investor also reduced his position in Chevron (NYSE:CVX) by over $600 million.

Finally, Buffett significantly increased his position in Occidental (NYSE:OXY) Petrotelum, to the tune of over $450 million, while his position in Chubb (NYSE:CB), opened in the previous quarter, was bolstered by around $280 million.

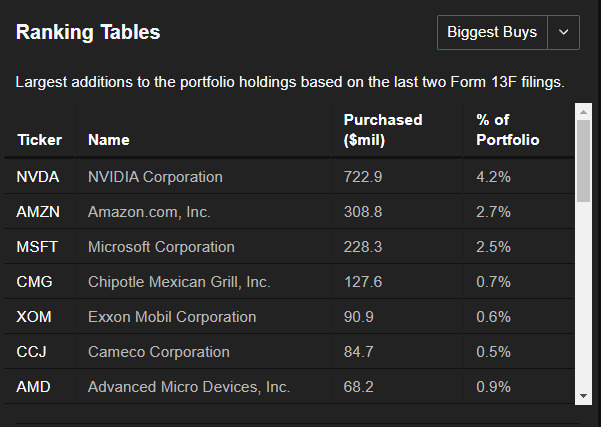

Ray Dalio Bets Big on Nvidia

Another legendary investor, Ray Dalio, also radically reshuffled his portfolio in Q3, taking advantage of the weakness observed in Nvidia (NASDAQ:NVDA) shares to buy them for over $722 million.

Source : InvestingPro

It also strengthened its position in Amazon (NASDAQ:AMZN) by over $3028 million, and its position in Microsoft (NASDAQ:MSFT) by $228 million.

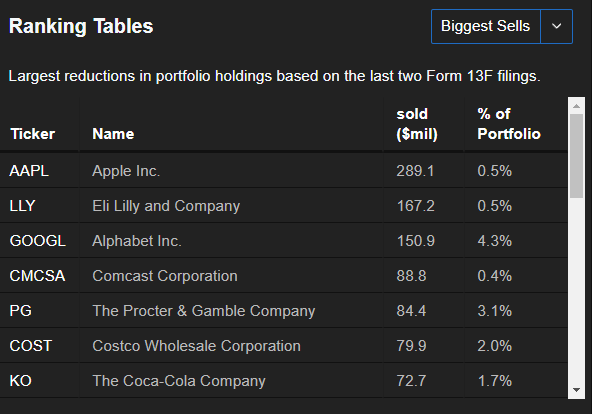

In terms of sales, the company sold Apple for $289 million, Eli Lilly (NYSE:LLY) for $167 million, and Alphabet (NASDAQ:GOOGL) for $150 million.

Source: InvestingPro

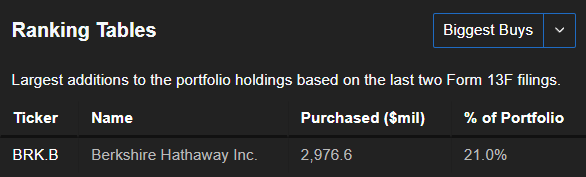

Bill Gates Buys Berkshire, Sells Microsoft and Carvana

Bill Gates' portfolio adjustments were less than the investors above, with one purchase and two sales.

Source: InvestingPro

The recent purchase was built on the existing position in Berkshire Hathaway (NYSE:BRKa), for almost $3 billion.

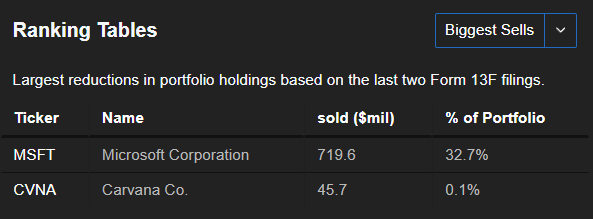

Source: InvestingPro

The sales involved positions in Microsoft and Carvana (NYSE:CVNA), which were reduced by $719 million and $45 million respectively.

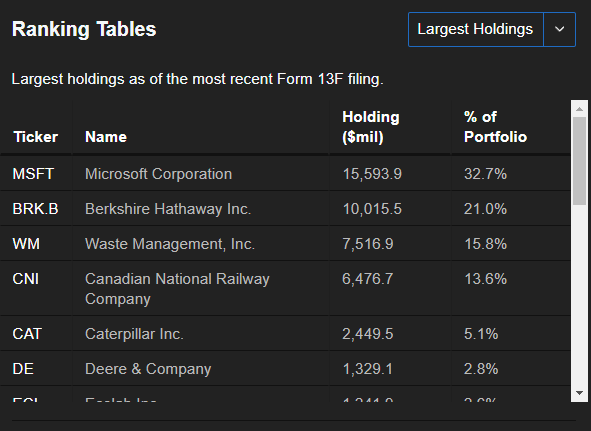

Microsoft remains the largest position in Gates' portfolio, while Berkshire is now the second largest:

Source : InvestingPro

Michael Burry Halves the Size of Equity Portfolio

Michael Burry, who became famous for successfully betting against the US real estate market during the 2008 crisis, also deserves a mention.

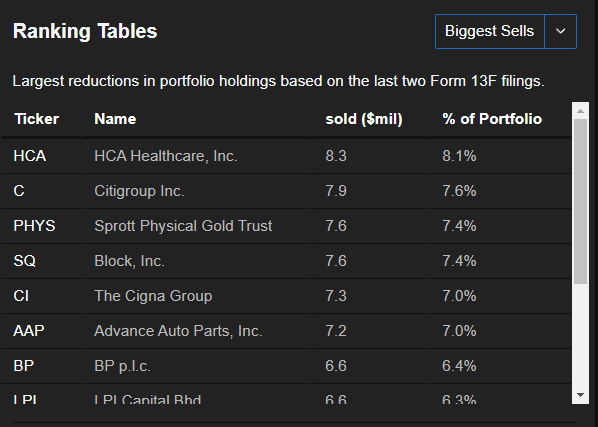

Source : InvestingPro

His Scion asset management fund halved the size of its equity portfolio, closing positions in HCA Healthcare (NYSE:HCA), Citigroup (NYSE:C), Block (NYSE:SQ), and others.

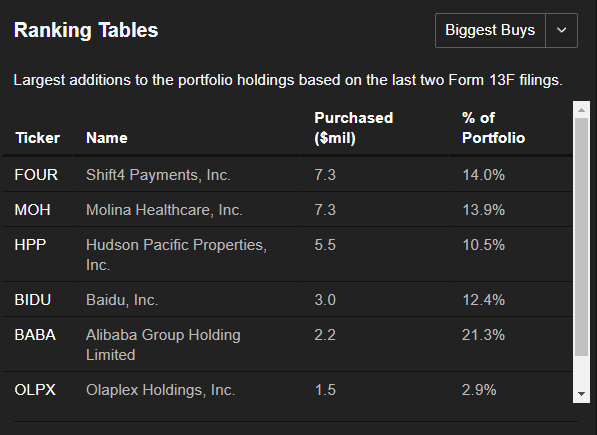

However, Burry also opened a few positions, including Shift4 Payments (NYSE:FOUR) and Molina Healthcare (NYSE:MOH), and also strengthened his positions in Alibaba (NYSE:BABA) and Baidu (NASDAQ:BIDU).

Source: InvestingPro

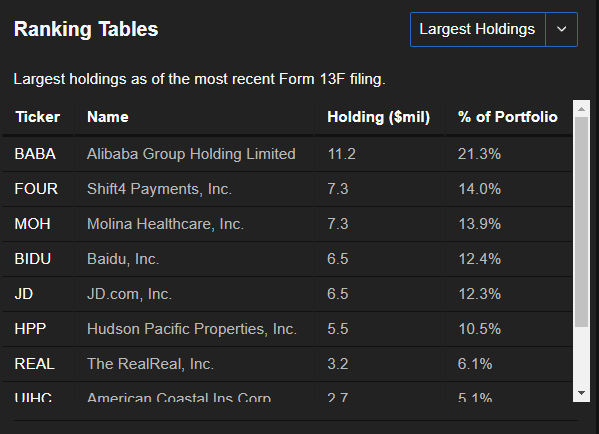

Alibaba is now the largest position in Burry's portfolio:

Source : InvestingPro

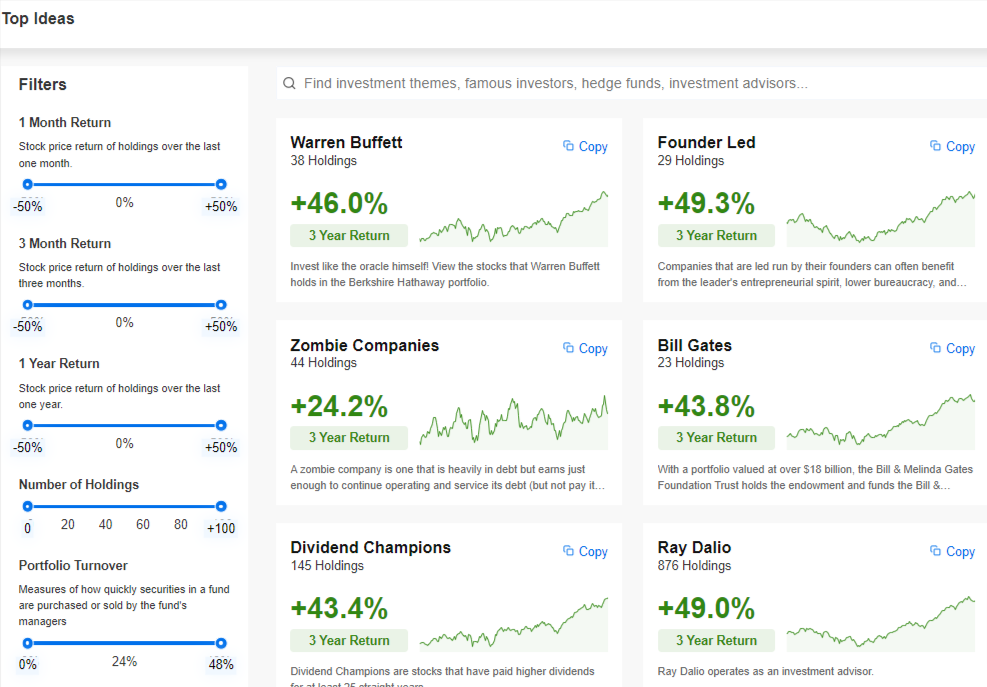

InvestingPro subscribers can gain key insights from all 13F filings here.

In just a few clicks, the “Ideas” section provides all the information you need to analyze and track the positions of the best investors, with the option of copying positions to your own watchlist.

Source: InvestingPro

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.