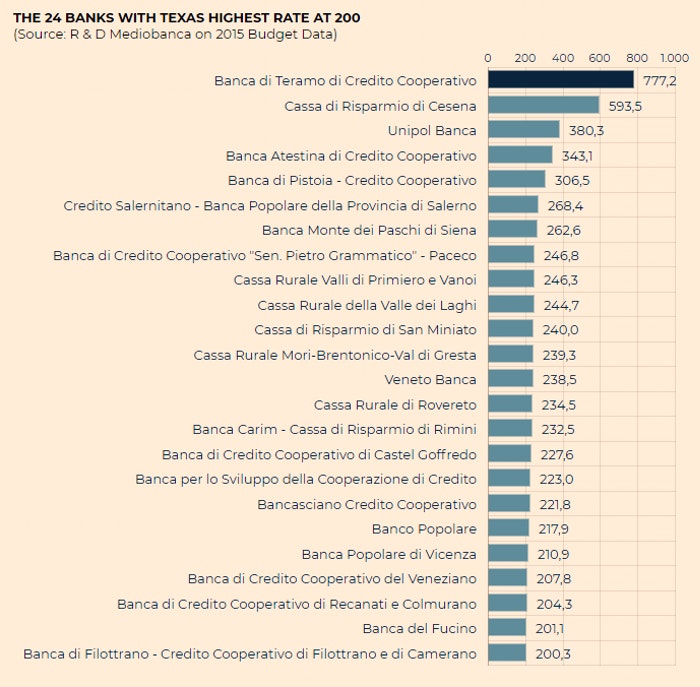

114 Italian banks have non-performing loans that exceed tangible assets. Ratios above 100% are signs of severe stress.

The headline image is from the from ilsole24ore.com. The article is dated March 25, 2017. The translated headline reads "Here are the 114 Italian banks at risk for suffering"

The image shows 24 banks where non-performing loans total 200% or more of tangible assets.

The image title "Texas Highest Rate" refers to a measure of banking stress called the "Texas Ratio".

The Texas Ratio was developed by Gerard Cassidy and others at RBC Capital Markets. It is calculated by dividing the value of the lender's non-performing assets (NPL + Real Estate Owned) by the sum of its tangible common equity capital and loan loss reserves.

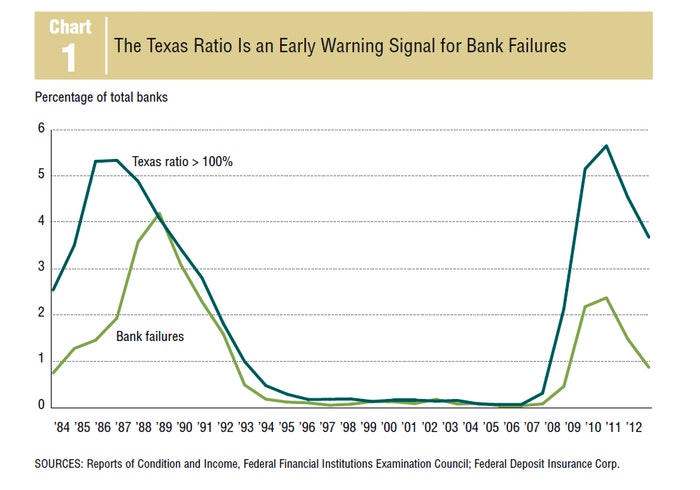

In analyzing Texas banks during the early 1980s recession, Cassidy noted that banks tended to fail when this ratio reached 1:1, or 100%. He noted a similar pattern among New England banks during the recession of the early 1990s.

Texas Ratio Analysis

In 2012, the Dallas Fed did an article on the So-Called Texas Ratio.

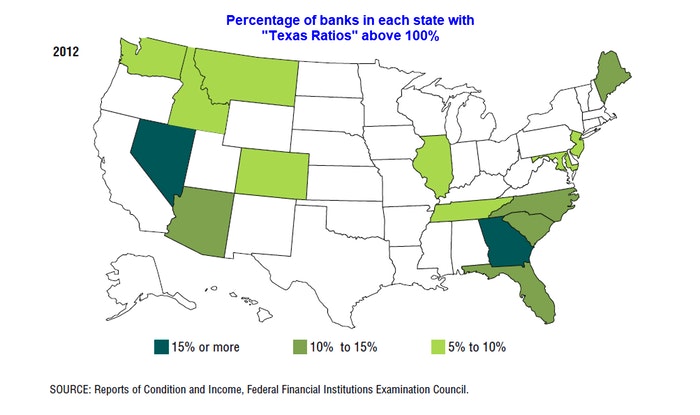

"So-called" pertains to a discussion as to whether or not the measured should be renamed the "Georgia Ratio".

Georgia Ratio?

US vs Italy (6% vs 23%)

At the peak of the SNL crisis in the 1980s, just over 5% of US banks had Texas ratios over 100%.

In the Great Financial crisis the number approached but did not top 6%.

In Italy, 114 of "almost" 500 banks have NPLs that exceed tangible assets. If were to add real estate owned (bank-owned real estate) to the Italian banks, they would be in even worse shape.

2015 Data

The caveat in this analysis is the article's numbers are from 2015. But are Italian banks better or worse today?

I suspect worse.

Target2 Analysis

Meanwhile, Target2 imbalances from Italy continue to mount.

In case you missed it, please consider my November 9 article Italy Target2 Imbalance Hits Record €432.5 Billion as Dwindling Trust in Banks Plunges.

It is no coincidence that Target2 imbalances are on the rise as faith in banks collapses. Target2 is a measure of capital flight, despite the ECB's assurances to the contrary.

Italy owes creditors (primarily Germany), a record €432.5 Billion that will never be paid back except by an ECB emergency bailout.