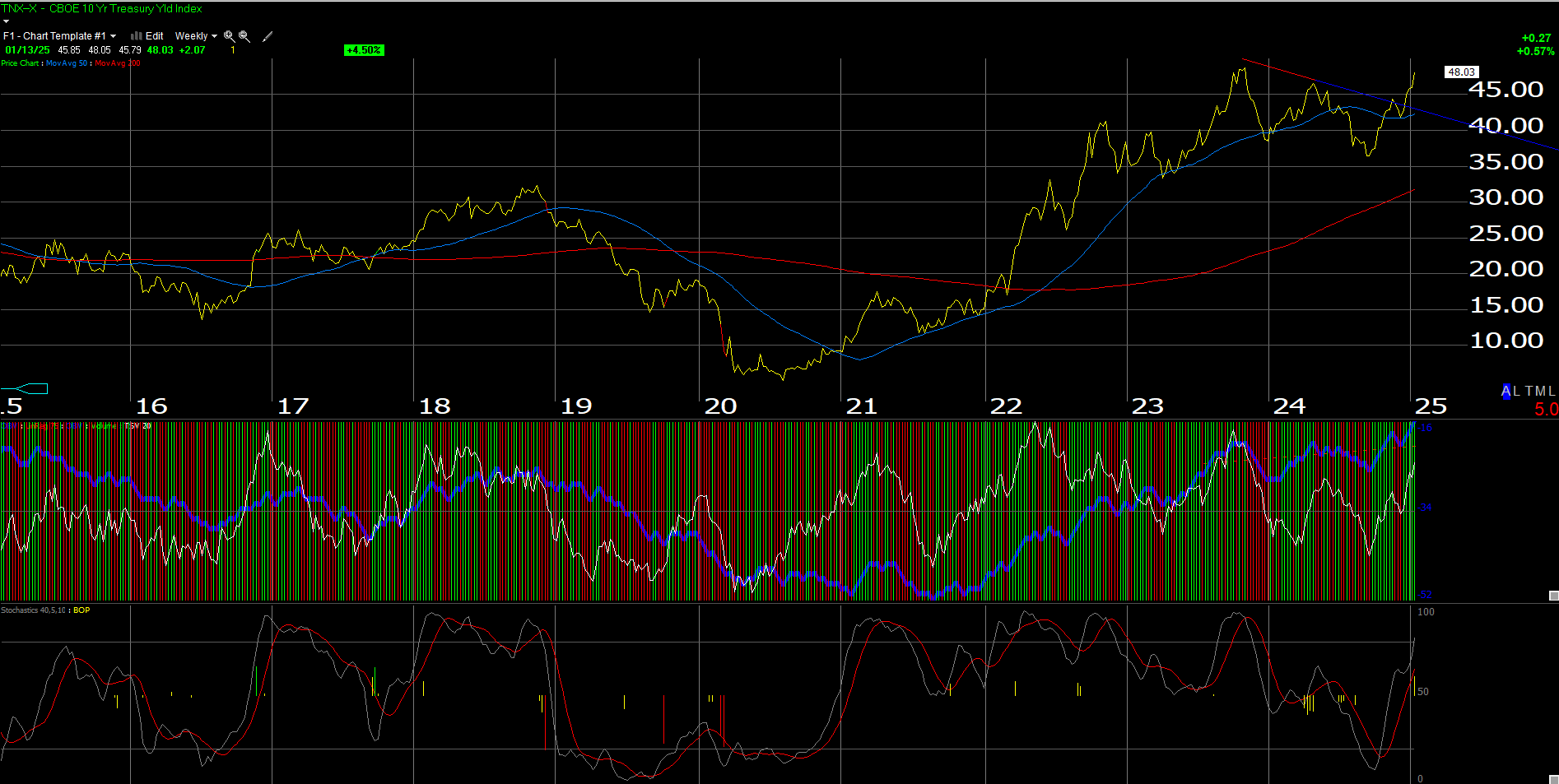

The chart below is the 10-year Treasury “yield” contract, traded at the CBOE.

Readers can see a break in the chart in the upper-right-hand corner as the 10-year Treasury yield broke the downtrend line from the October ’23 high yield tick in the 10-year of 4.99%, and now we are working back up towards the 4.99% level from 14 months ago.

With PPI due out today, January 14th ’25, and the CPI due out Wednesday, January 15th, ’25, the sentiment on the Street is expecting another move higher in the 10-year Treasury yield.

However, if you look at the charts of the TLT and the various Treasury ETF’s, those ETF charts are heavily oversold.

The above chart, from Gary Morrow, a technician whose work this blog frequently uses, shows the futures price of the 10-year Treasury Note entering a solid support area.

Lots happens Wednesday morning with many big financials reporting but we also get the December CPI at 7:30 am central.

Pay attention to the Core CPI – per Briefing.com economist consensus, the expectation is +0.2%, which would likely be well received (in my opinion) by both the Treasury and equity markets.

Conclusion:

Like any other advisor, I have CNBC on during the day, and listening to all the fearful forecasts of higher inflation, higher Treasury yields, and the higher dollar and what all this will due to stocks, is anxiety-inducing to say the least.

The real problem—as I see it—is if (or when) the 10-year Treasury yield breaks above 5% on heavy volume. It saw a 4.99% yield in October ’23, and before that, you have to go back to 2006 – 2007 to find a 5.25%—5.35% level.

Is this a different era for bonds and Treasuries? It could be. The durable strength in the US economy seems to be driven by a US consumer that was permanently enriched with discretionary income thanks to the mortgage refi boom in 2020 and 2021. Also the fact that unemployment has risen very little despite the 550 basis point fed funds rate increase from March, 2022, through July ’23 is just remarkable.

That 550 basis point rate increase should have been a significant shock to the US economy, and the US economy took it right on the chin and has kept rolling along completely unphased.

If the 10-year Treasury yield convincingly trades above 5%, I worry about a lost decade for bonds, like 2000 to 2009 was for stocks.

Disclaimer: Remember, none of this is advice or a recommendation, but only an opinion. Past performance is no guarantee of future results. Investing can and does involve the loss of principal, even for short periods of time. All chartwork is taken from Worden or Gary Morrow at @garysmorrow.

Thanks for reading.