Investing.com’s stocks of the week

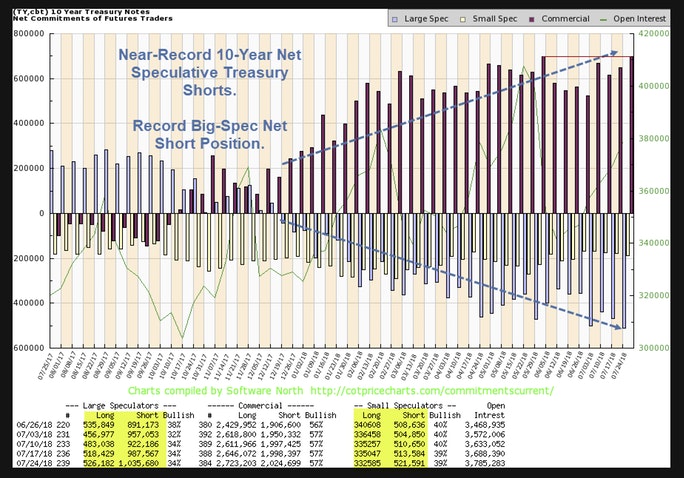

COT Futures reports for Tuesday came out today. Treasury bears are pressing short positions.

I see reports of new record shorts but I think we slightly missed the mark.

Big Specs

- In the past month, the number of long contracts fell from 535,849 to 526,182

- In the past month, the number of short contracts rose from 891,173 to 1,035,680. That's a new record.

- Current Net Short: 509,498. That's a new record.

- Net Short Increase Since June 26: 154,174

Small Specs

- In the past month, the number of long contracts fell from 340,606 to 332,585

- In the past month, the number of short contracts rose from 508,636 to 521,591

- Current Net Short: 189,006.

- Net Short Increase Since June 26: 20,976

Big Specs + Small Specs are net short a combined 698,504. That is slightly under the May 29 Net Short Total of 699,183. (Scroll down to find 10-year-Treasuries).

When this economy turns, the recent treasury bears will get blown out of the water.