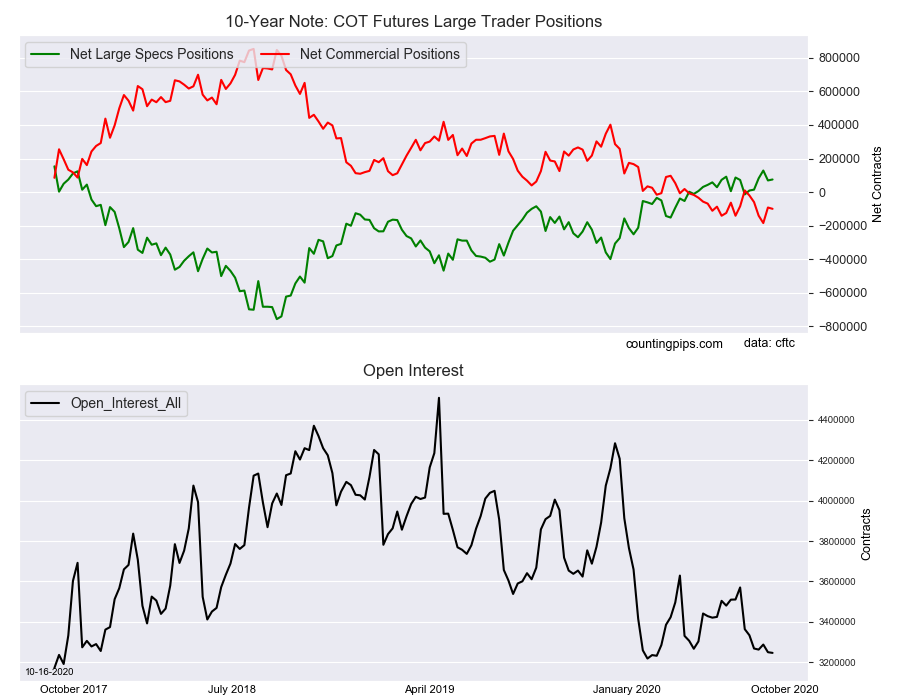

10-Year Note Non-Commercial Speculator Positions:

Large bond speculators increased their bullish net positions in the 10-Year Note futures markets again this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of 10-Year Note futures, traded by large speculators and hedge funds, totaled a net position of 75,257 contracts in the data reported through Tuesday October 13th. This was a weekly gain of 5,744 net contracts from the previous week which had a total of 69,513 net contracts.

The week’s net position was the result of the gross bullish position (longs) decreasing by -43,266 contracts (to a weekly total of 585,180 contracts) while the gross bearish position (shorts) dropped by a larger amount of -49,010 contracts for the week (to a total of 509,923 contracts).

The 10-Year speculators slightly added to their net bullish bets this week and raised their wagers for the fifth time in the past six weeks. The rise in bullish positions follows a sharp decline last week when spec sentiment fell by -59,063 contracts. The overall standing has now been in bullish territory for six straight weeks (after a dip on Sept. 1st) and has been bullish in sixteen out of the past seventeen weeks.

10-Year Note Commercial Positions:

The commercial traders position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of -99,519 contracts on the week. This was a weekly decrease of -7,820 contracts from the total net of -91,699 contracts reported the previous week.

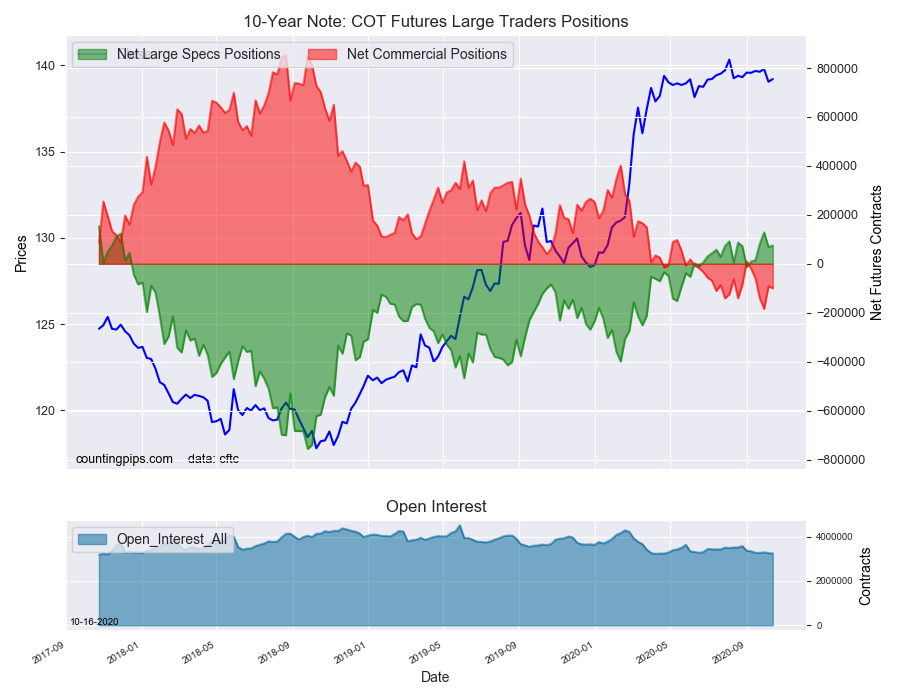

10-Year Note Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the 10-Year Note Futures (Front Month) closed at approximately $139.20 which was an advance of $0.16 from the previous close of $139.04, according to unofficial market data.