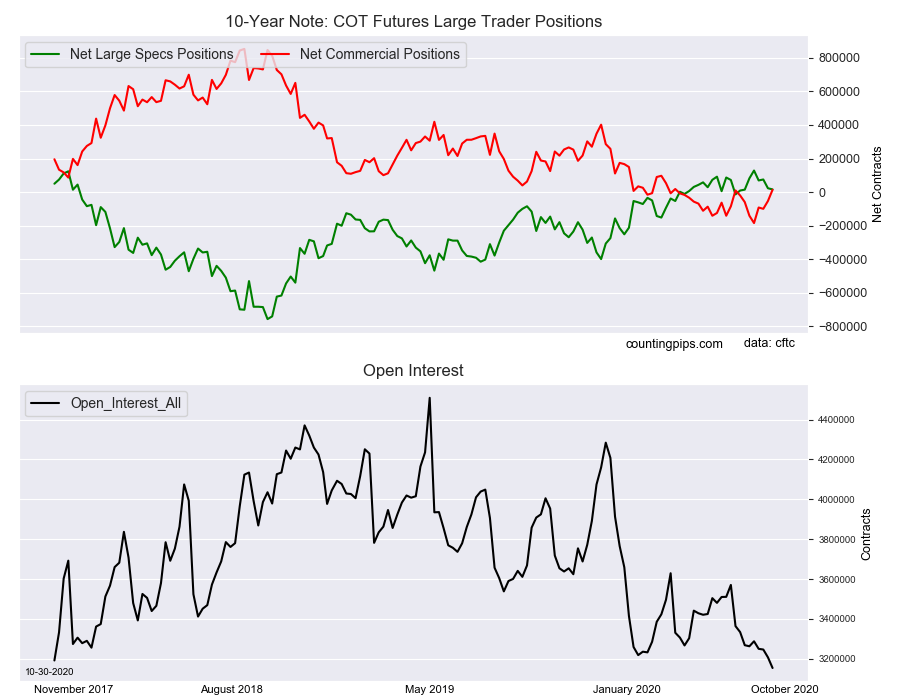

10-Year Note Non-Commercial Speculator Positions:

Large bond speculators cut back on their bullish net positions in the 10-Year Note futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of 10-Year Note futures, traded by large speculators and hedge funds, totaled a net position of 16,212 contracts in the data reported through Tuesday, October 27th. This was a weekly fall of -6,784 net contracts from the previous week which had a total of 22,996 net contracts.

The week’s net position was the result of the gross bullish position (longs) declining by -17,476 contracts (to a weekly total of 544,854 contracts) while the gross bearish position (shorts) decreased by a lesser amount of -10,692 contracts for the week (to a total of 528,642 contracts).

The 10-Year speculative positions slid on Tuesday and fell for the third time in the past four weeks. The net position has now fallen by -112,364 contracts over that time-frame and is currently sitting at a small bullish position of just over +16,000 contracts. The speculator sentiment has continued to hover around a small bullish now for the past twenty-one weeks after breaking a streak of 129 weeks of continuous bearish positions that dated back to December 19th of 2017.

10-Year Note Commercial Positions:

The commercial traders' position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of 13,934 contracts on the week. This was a weekly gain of 66,940 contracts from the total net of -53,006 contracts reported the previous week.

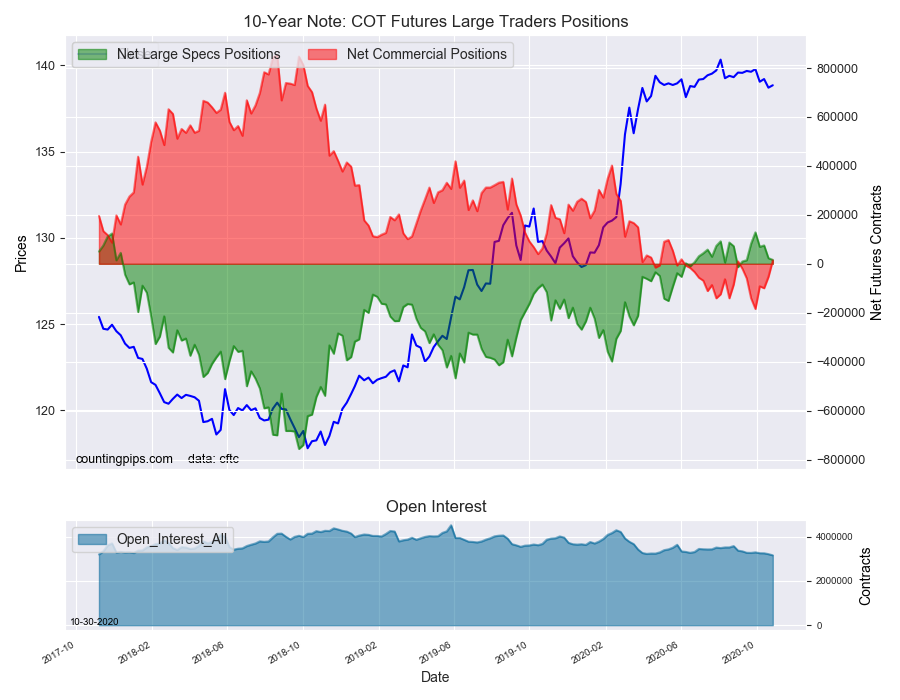

10-Year Note Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the 10-Year Note Futures (Front Month) closed at approximately $138.84 which was a rise of $0.14 from the previous close of $138.70, according to unofficial market data.