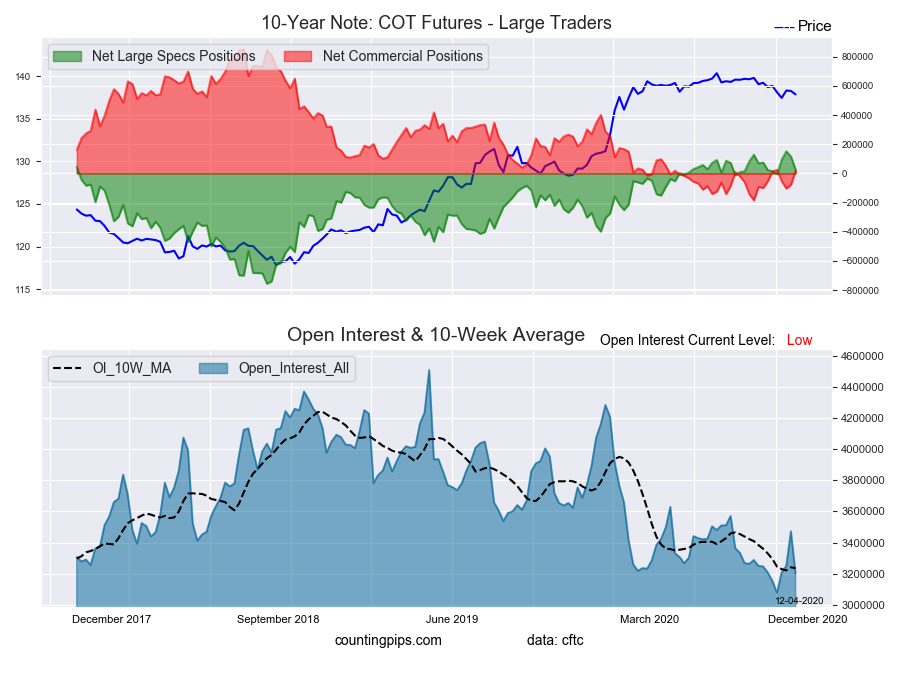

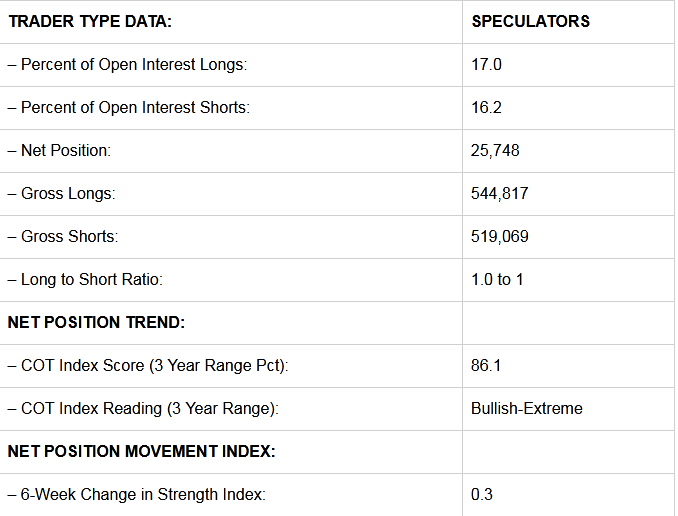

10-Year Note Large Trader Net Positions:

The week’s net position was the result of the gross bullish position (longs) lowering by -59,080 contracts (to a weekly total of 544,817 contracts) while the gross bearish position (shorts) gained by 30,147 contracts for the week (to a total of 519,069 contracts).

Speculative positions fell sharply this week for a second straight week and dropped the overall bullish standing to the lowest level of the past month. The bullish position has fallen by a total of -126,571 contracts in just the past two weeks and brought the current standing to a small bullish position of just +25,748 contracts. The speculative position has mostly remained in a small bullish level since ending a long streak of bearish positions in early June.

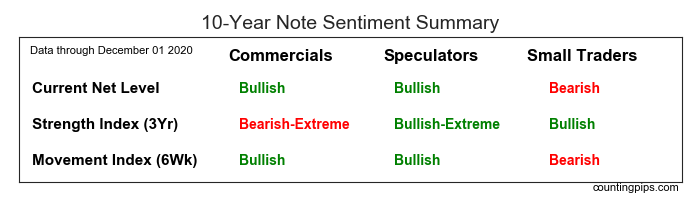

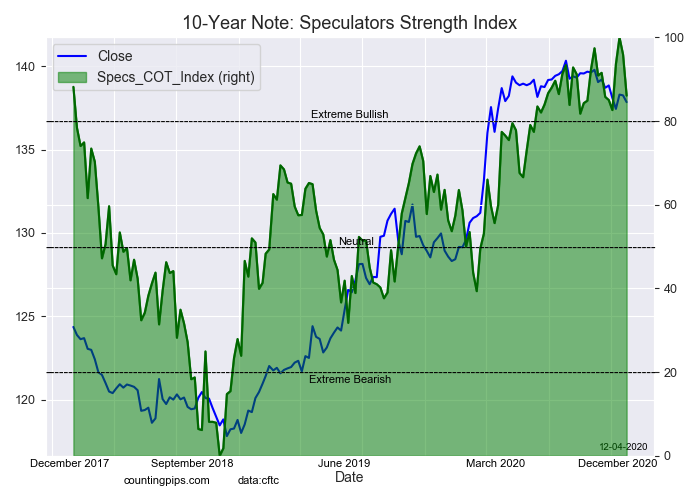

The large speculators Strength Index level, the current score for traders compared to levels of the past three years, shows that specs are currently at a Bullish-Extreme level with a score of 86.1 percent.

Speculators are seen as trend followers and usually trade in tandem with the price direction (blue line in above chart). At the extreme levels, specs are very important to watch as they have a tendency to bet the wrong way (that the trend will continue to even more extreme levels).

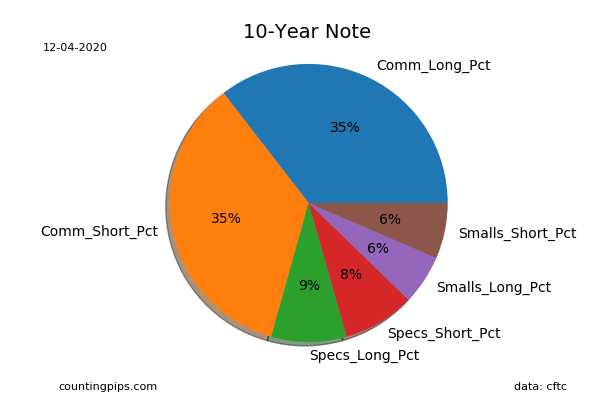

Current Trader Positions as Percent of Open Interest:

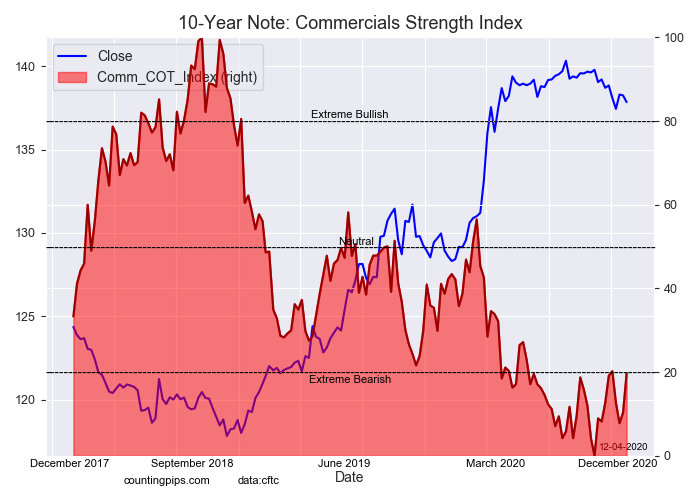

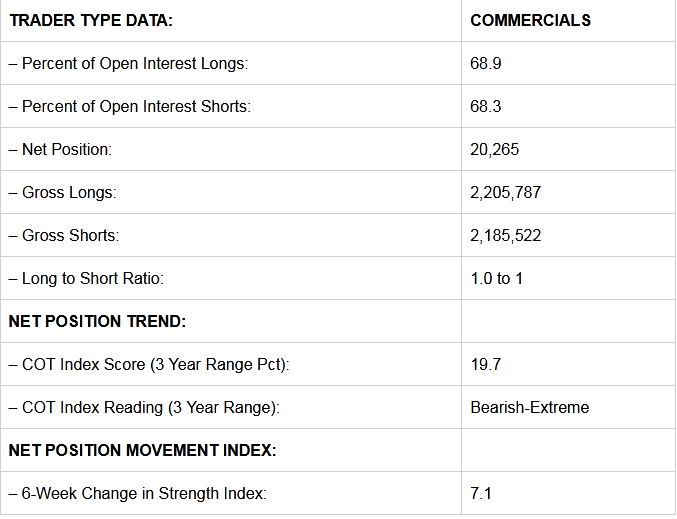

Commercial Trader Positions:

The commercial traders position this week came in at a total net position of 20,265 contracts. This was a weekly change of 97,594 contracts from the total net of -77,329 contracts reported the previous week.

The commercials Strength Index level, a score that measures the contract levels of the past three years within a range of 0 to 100, shows that Commercials are currently at a Bearish-Extreme level with a score of 19.7 percent.

At the extreme levels, commercials are very important to watch as they have a tendency to be correct at the major turning points in price trends.

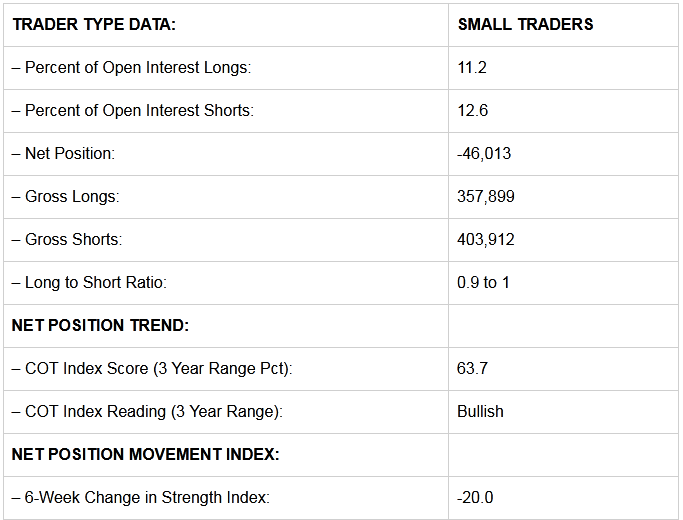

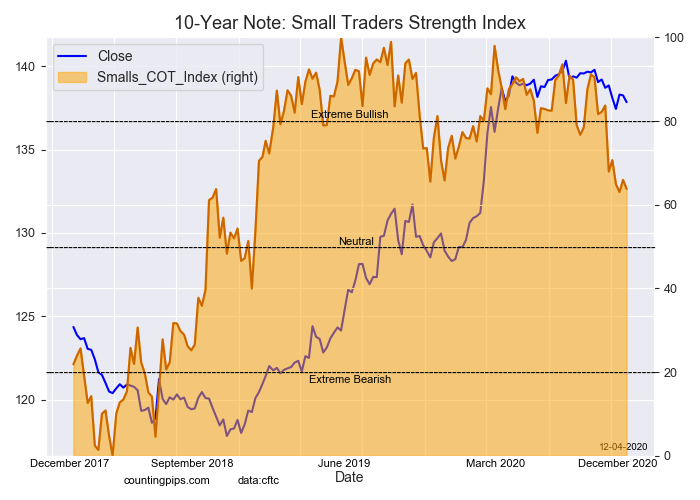

Small Trader Positions:

The small traders position this week totaled a net position of -46,013 contracts. This was a weekly change of -8,367 contracts from the total net of -37,646 contracts reported the previous week.

The small traders Strength Index level shows that smalls are currently at a Bullish level with a score of 63.7 percent.

Small traders are less important to watch (in most cases) as their numbers tend to be just a small part of the total trading open interest.