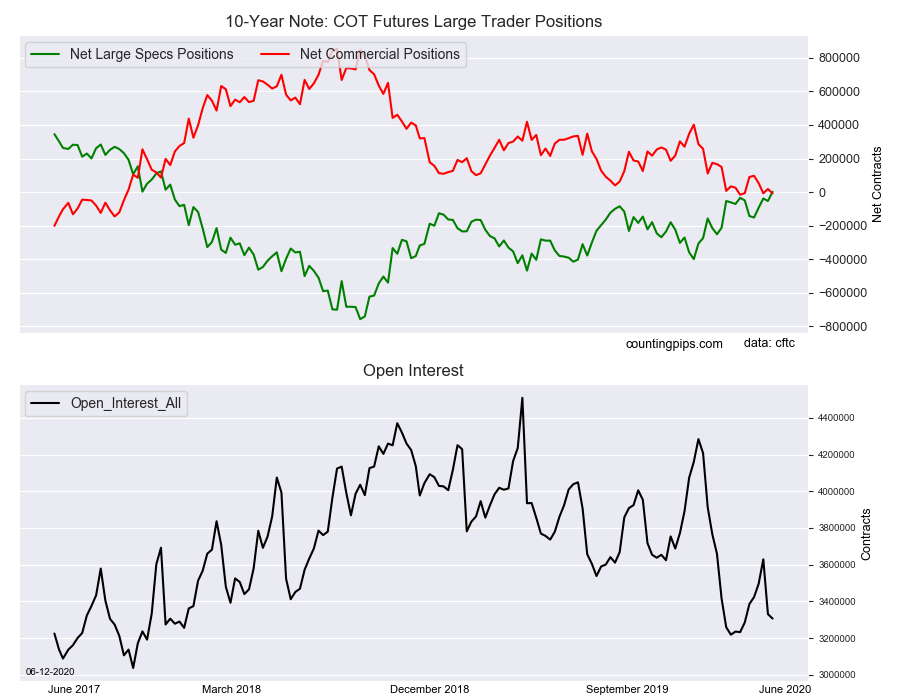

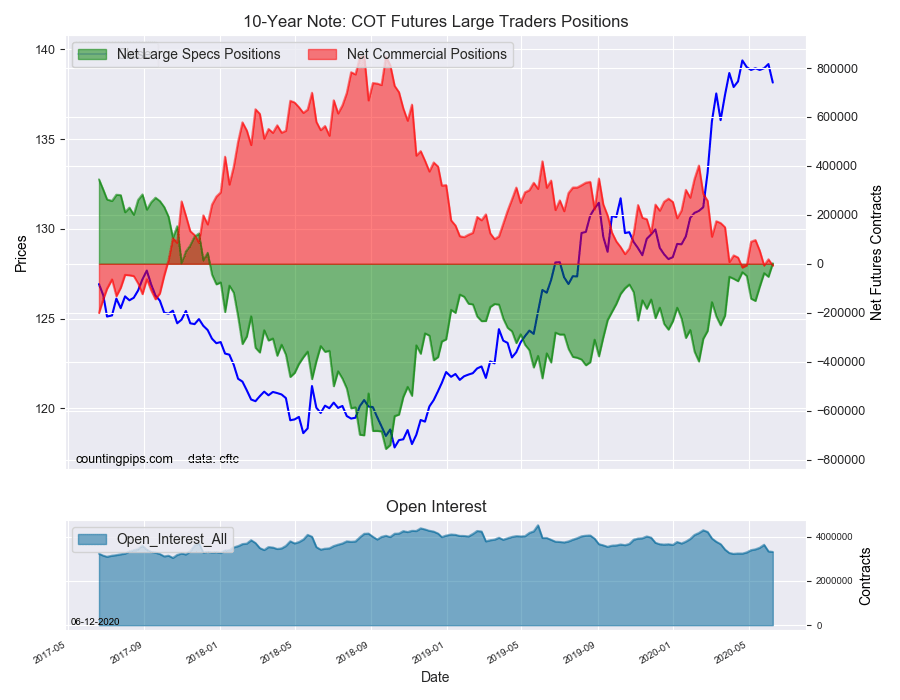

10-Year Note Non-Commercial Speculator Positions:

Large bond speculators turned their net position bullish for the first time in over two years in the 10-Year Note futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of 10-Year Note futures, traded by large speculators and hedge funds, totaled a net position of 2,254 contracts in the data reported through Tuesday June 9th. This was a weekly gain of 55,174 net contracts from the previous week which had a total of -52,920 net contracts.

The week’s net position was the result of the gross bullish position (longs) growing by 23,695 contracts (to a weekly total of 701,546 contracts) combined with the gross bearish position (shorts) which dropped by -31,479 contracts for the week (to a total of 699,292 contracts).

The 10-Year speculators raised their bets for a third time in the past four weeks and the net position turned positive for the first time since December 12th of 2017, a span of 130 weeks. The past four weeks have seen a total of +153,741 net positions come into the market and helped push the position into the small bullish standing. Since the last time the position was net bullish, the speculative levels managed to drop to over -700,000 contracts three times in 2018 including the all-time record bearish position of -756,316 contracts on September 25th of 2018. Since then, the speculator positions started paring bearish bets and the price of the 10-Year Note began its reversal.

10-Year Note Commercial Positions:

The commercial traders' position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of -7,301 contracts on the week. This was a weekly decline of -25,799 contracts from the total net of 18,498 contracts reported the previous week.

10-Year Note Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the 10-Year Note Futures (Front Month) closed at approximately $138.15 which was a fall of $-1.03 from the previous close of $139.18, according to unofficial market data.