US 10-Year Note Non-Commercial Speculator Positions:

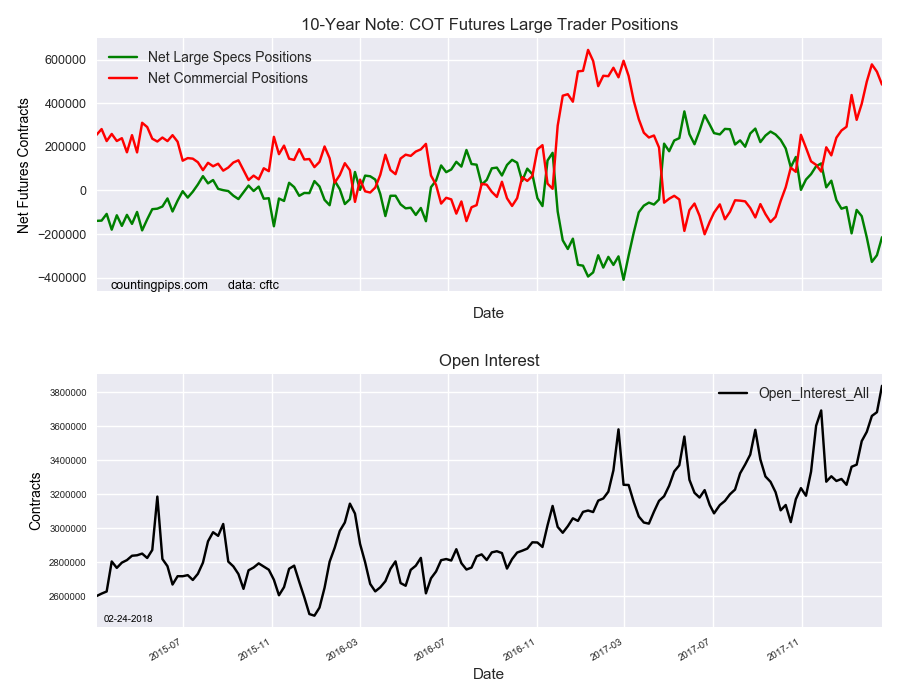

Large treasury speculators reduced their bearish net positions in the 10-Year Note Futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of 10-Year Note futures, traded by large speculators and hedge funds, totaled a net position of -214,480 contracts in the data reported through Tuesday February 20th. This was a weekly lift of 82,455 contracts from the previous week which had a total of -296,935 net contracts.

Speculators cut back on their bearish positions for a second consecutive week this week and pushed bearish levels to the lowest standing in four weeks. Despite the gains of the past two weeks, the overall net speculator position remains below the -200,000 contract level for a fourth straight week.

10-Year Note Commercial Positions:

The commercial traders position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of 485,506 contracts on the week. This was a weekly shortfall of -59,093 contracts from the total net of 544,599 contracts reported the previous week.

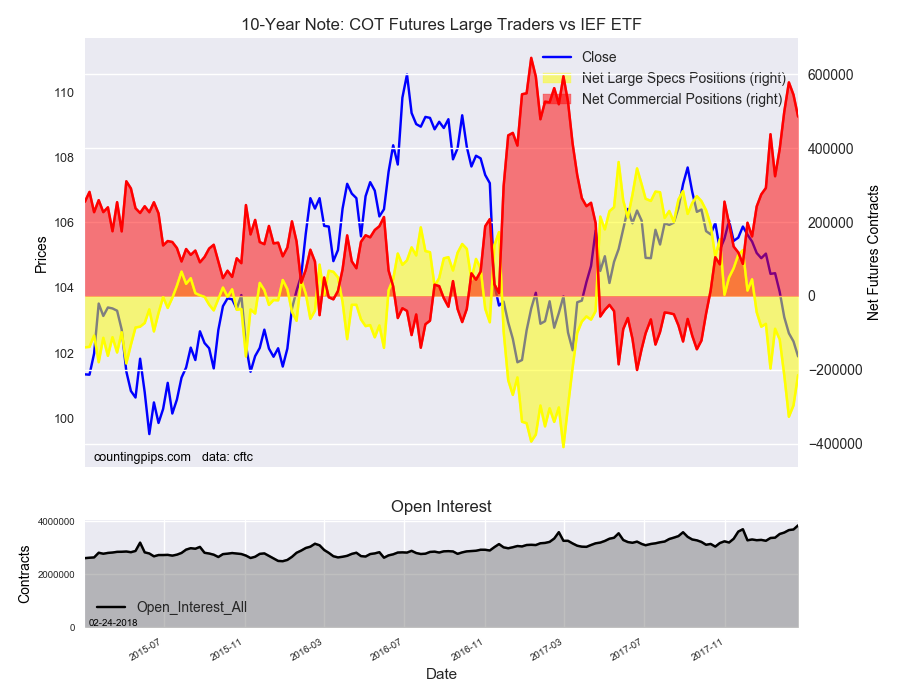

IEF ETF:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the 7-10 Year Treasury Bond ETF (IEF) closed at approximately $101.90 which was a shortfall of $-0.46 from the previous close of $102.36, according to unofficial market data.