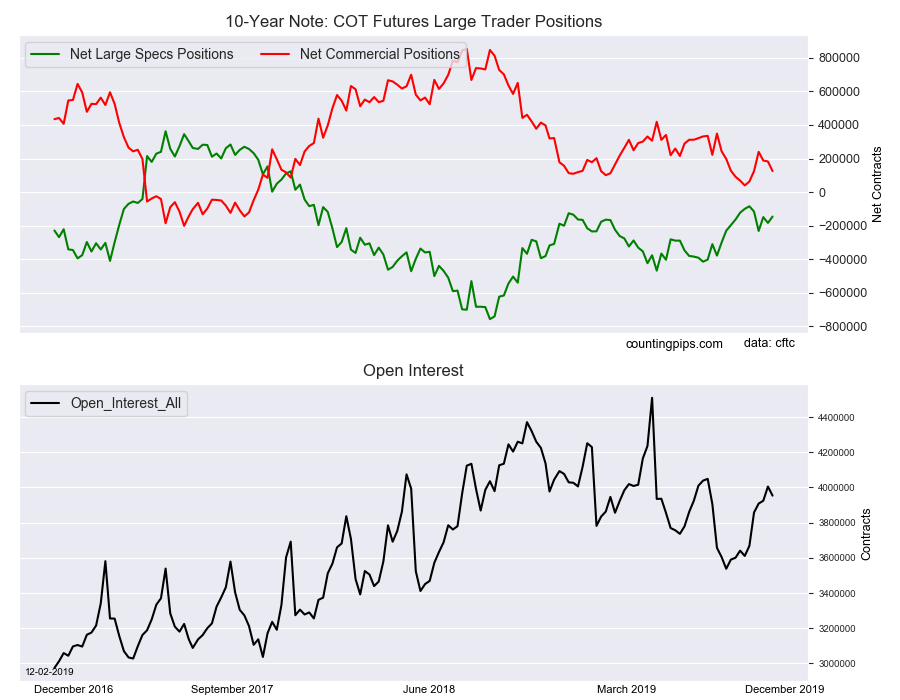

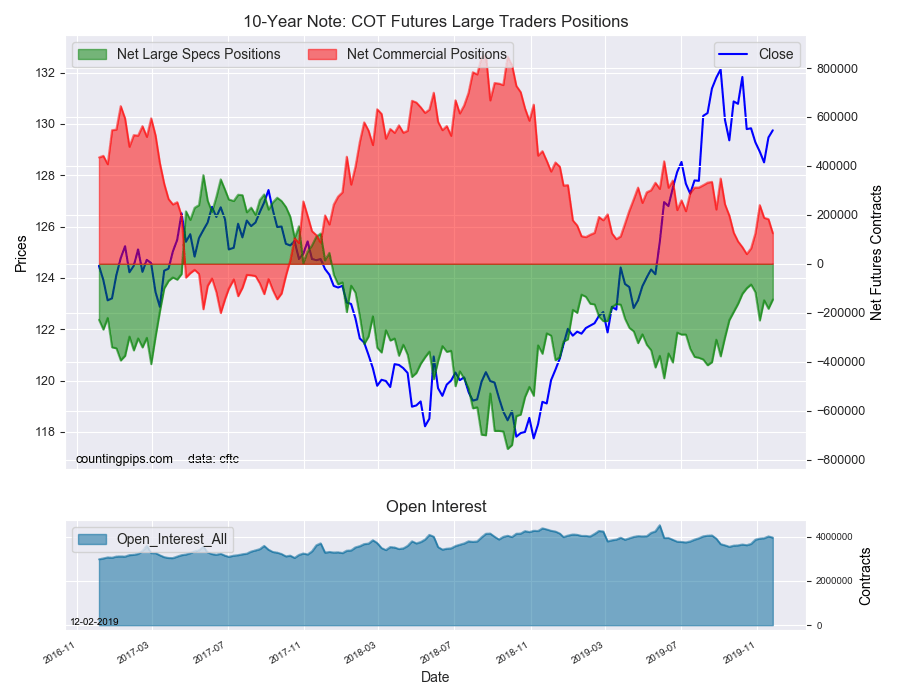

10-Year Note Non-Commercial Speculator Positions:

Large bond speculators reduced their bearish net positions in the 10-Year Note futures markets last week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Monday (delayed due to Thanksgiving holiday).

The non-commercial futures contracts of 10-Year Note futures, traded by large speculators and hedge funds, totaled a net position of -145,745 contracts in the data reported through Tuesday, November 26th. This was a weekly change of 37,779 net contracts from the previous week which had a total of -183,524 net contracts.

The week’s net position was the result of the gross bullish position (longs) gaining by 30,587 contracts (to a weekly total of 708,296 contracts) while the gross bearish position (shorts) fell by -7,192 contracts for the week (to a total of 854,041 contracts).

Ten-year speculators cut back on their bearish bets for the second time in the past three weeks and for the ninth time out of the past twelve weeks. The overall net position has now been under the -200,000 contract level for ten straight weeks, dating back to September 24th.

10-Year Note Commercial Positions:

The commercial traders position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of 125,305 contracts on the week. This was a weekly fall of -57,333 contracts from the total net of 182,638 contracts reported the previous week.

10-Year Note Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the 10-Year Note Futures (Front Month) closed at approximately $129.75 which was an advance of $0.28 from the previous close of $129.46, according to unofficial market data.