10-Year Note Non-Commercial Speculator Positions:

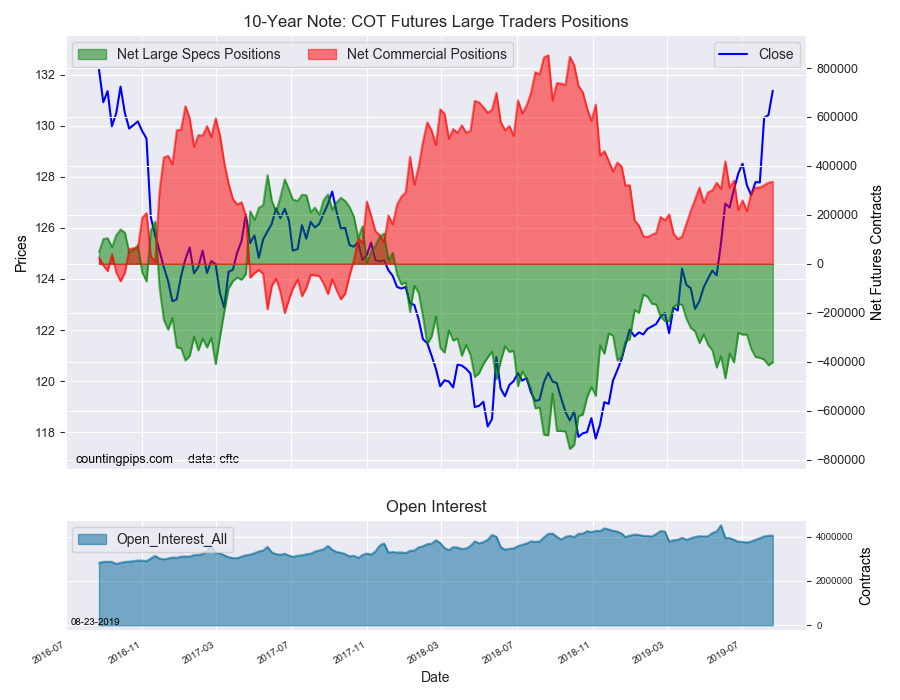

Large bond speculators cut back on their bearish net positions in the US 10 Year T-Note Futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of 10-Year Note futures, traded by large speculators and hedge funds, totaled a net position of -401,804 contracts in the data reported through Tuesday August 20th. This was a weekly change of 12,542 net contracts from the previous week which had a total of -414,346 net contracts.

The week’s net position was the result of the gross bullish position (longs) dropping by -14,921 contracts (to a weekly total of 620,463 contracts) while the gross bearish position (shorts) lowered by -27,463 contracts for the week (to a total of 1,022,267 contracts).

Speculators reduced their bearish bets this week following five straight weeks of gaining bearish positions. The large speculators had been consistently raising their bearish positions since the beginning of July despite prices of the 10-year note going the opposite way (higher prices, lower yields).

The overall speculative position continues to be very bearish and above the -400,000 net contract level for a second week.

10-Year Note Commercial Positions:

The commercial traders position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of 334,999 contracts on the week. This was a weekly boost of 3,319 contracts from the total net of 331,680 contracts reported the previous week.

10-Year Note Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the 10-Year Note Futures (Front Month) closed at approximately $131.37 which was an advance of $0.95 from the previous close of $130.42, according to unofficial market data.