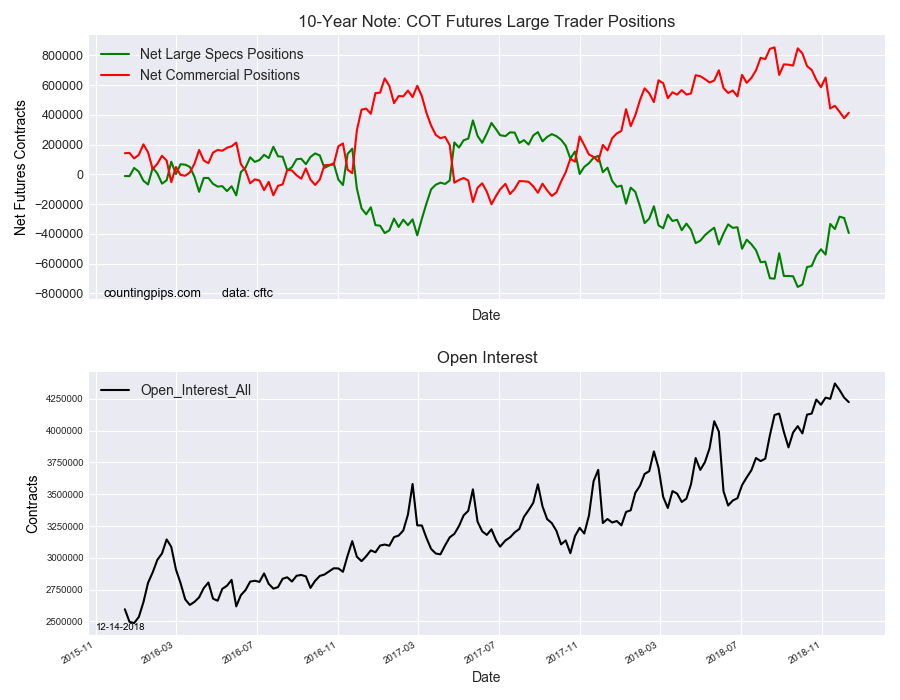

10-Year Note Non-Commercial Speculator Positions:

Large bond speculators sharply added to their bearish net positions in the 10-Year Note futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of 10-Year Note futures, traded by large speculators and hedge funds, totaled a net position of -393,802 contracts in the data reported through Tuesday, December 11th. This was a weekly change of -100,616 net contracts from the previous week which had a total of -293,186 net contracts.

This week’s net position was the result of the gross bullish position falling by -53,250 contracts to a weekly total of 603,949 contracts combined with the gross bearish position which saw a lift by 47,366 contracts for the week to a total of 997,751 contracts.

The speculative position has been shedding large amounts of bearish positions over the past few months before a turnaround in the past two weeks. The speculative standing had gone from a record high bearish position of -756,316 contracts on September 25th to a total of -284,223 contracts two weeks ago. This week’s turnaround pushed the bearish bets level back up over the -350,000 contract level and to the highest bearish standing since November 6th.

10-Year Note Commercial Positions:

The commercial traders position, hedgers and traders engaged in buying and selling for business purposes, totaled a net position of 414,180 contracts on the week. This was a weekly advance of 36,873 contracts from the total net of 377,307 contracts reported the previous week.

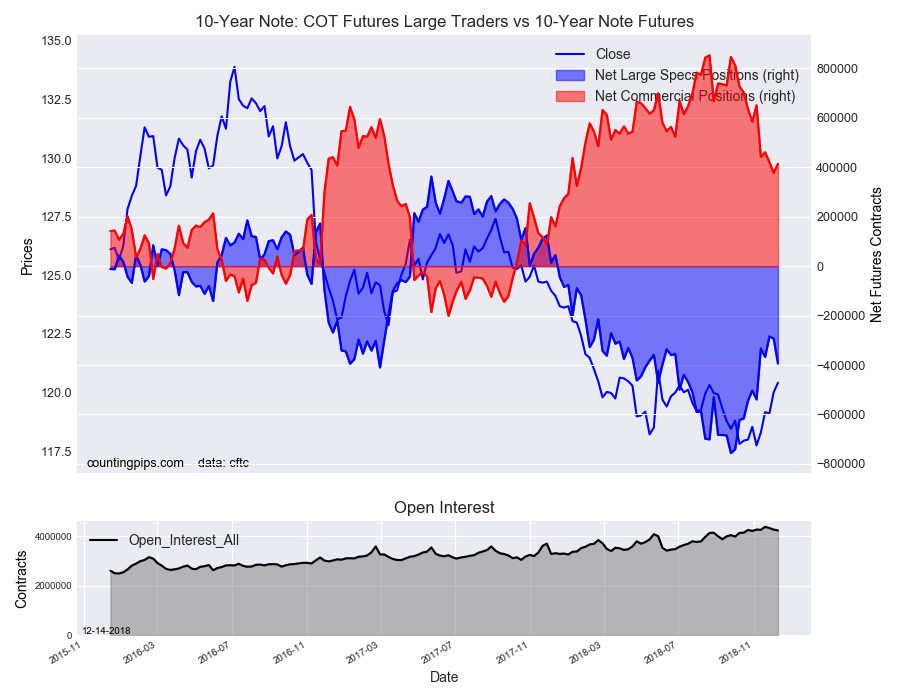

10-Year Note Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the 10-Year Note Futures (Front Month) closed at approximately $120.42 which was a boost of $0.40 from the previous close of $120.01, according to unofficial market data.