US 10 Year Note Non-Commercial Speculator Positions:

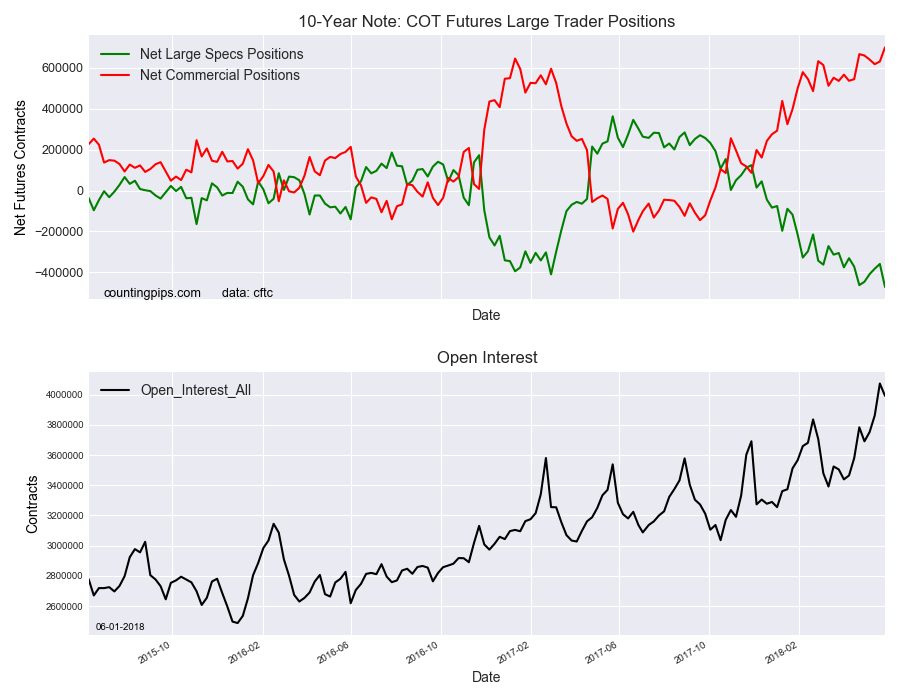

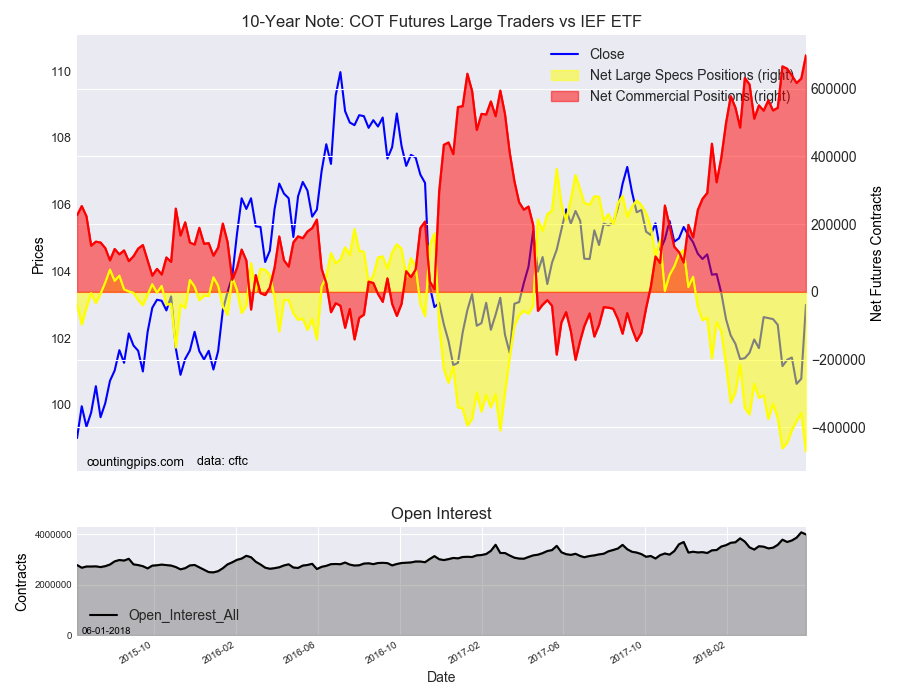

Large bond speculators sharply boosted their bearish net positions in the 10-Year Note futures markets to a new record high this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of 10-Year Note futures, traded by large speculators and hedge funds, totaled a net position of -471,067 contracts in the data reported through Tuesday May 29th. This was a weekly decrease of -112,440 contracts from the previous week which had a total of -358,627 net contracts.

Speculative bearish bets saw the largest one-week jump in the past two months and pushed the new record high bearish position above the -470,000 net contract level. This new record level surpasses the previous record that was registered on April 24th with a total of -462,133 contracts.

10-Year Note Commercial Positions:

Meanwhile, the commercial traders position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of 699,183 contracts on the week. This was a weekly gain of 68,970 contracts from the total net of 630,213 contracts reported the previous week.

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the 7-10 Year Treasury Bond ETF (IEF) closed at approximately $103.0 which was an uptick of $2.22 from the previous close of $100.78, according to unofficial market data.