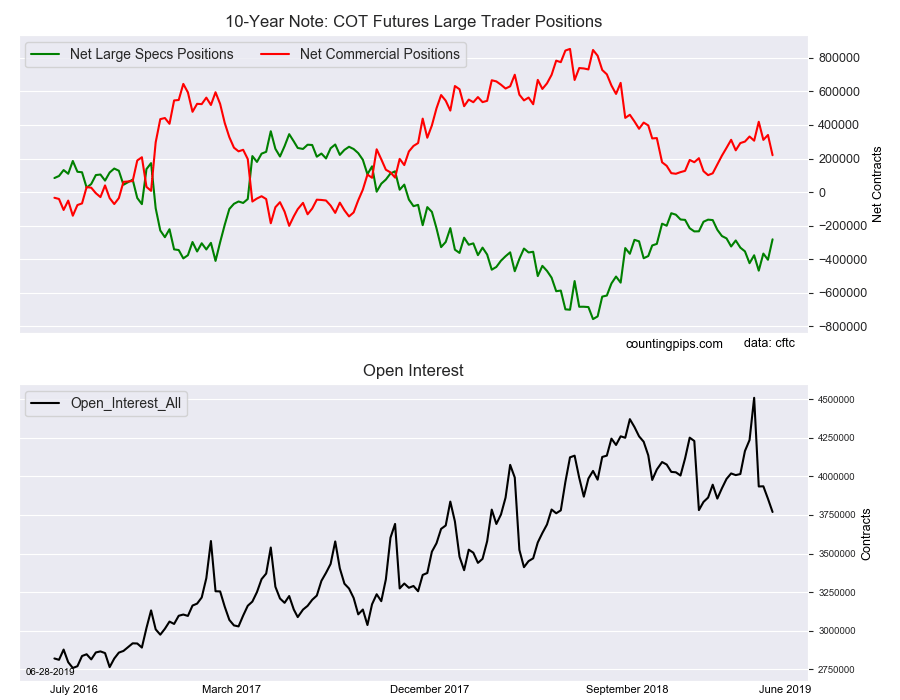

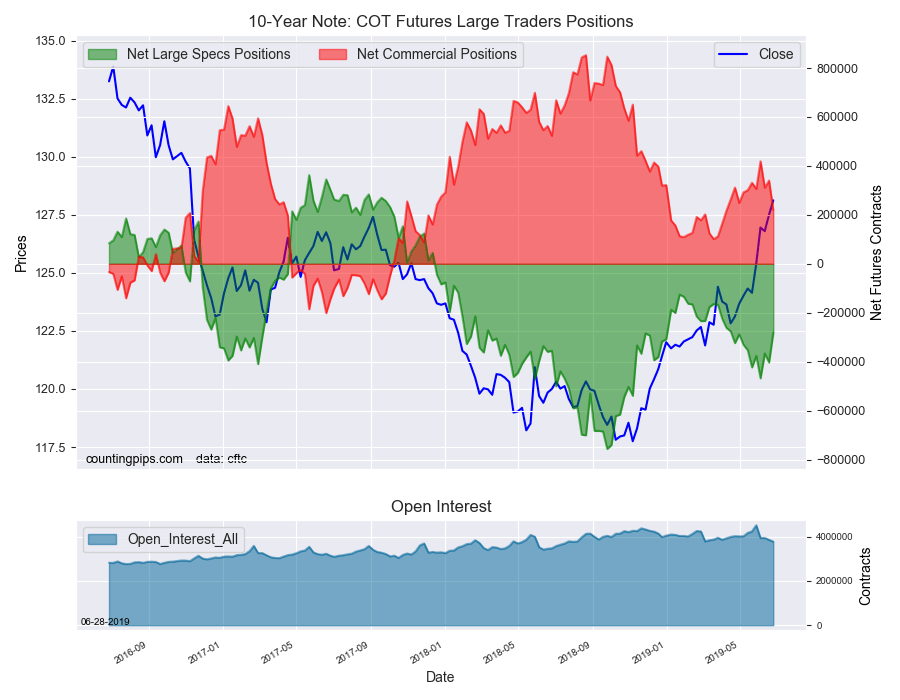

10-Year Note Non-Commercial Speculator Positions:

Large bond speculators sharply pulled back on their bearish net positions in the 10-Year Note futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of 10-Year Note futures, traded by large speculators and hedge funds, totaled a net position of -281,099 contracts in the data reported through Tuesday, June 25th. This was a paring of the bearish position by 121,885 net contracts from the previous week which had a total of -402,984 net contracts.

The week’s net position was the result of the gross bullish position (longs) gaining by 51,131 contracts (to a weekly total of 672,136 contracts) that combined with the gross bearish position (shorts) that declined by -70,754 contracts for the week (to a total of 953,235 contracts).

Large Specs have been betting the wrong way

The 10-year note speculators sharply reduced their bearish position this week by over one hundred thousand contracts and by the largest one-week amount since November 13th of 2018. This works out to approximately a thirty percent cut in their bearish positions on the week.

The 10-year speculators had been adding to their bearish bets in ten out of the previous thirteen weeks despite the strength of the US Treasury bonds. These usually reliable trend-followers have been caught on the wrong side of this market as 10-year bonds have rallied approximately 7.5% this year and yields have plummeted with the 10-year yield currently at 2.00%.

This week’s sharp pullback for speculators bring the current standing under the -300,000 net contract level for the first time in eight weeks and the lowest bearish standing since April 16th.

10-Year Note Commercial Positions:

The commercial traders' position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of 219,912 contracts on the week. This was a weekly drop of -120,487 contracts from the total net of 340,399 contracts reported the previous week.

10-Year Note Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the 10-Year Note Futures (Front Month) closed at approximately $128.12 which was a boost of $0.62 from the previous close of $127.50, according to unofficial market data.