10-Year Note Non-Commercial Speculator Positions:

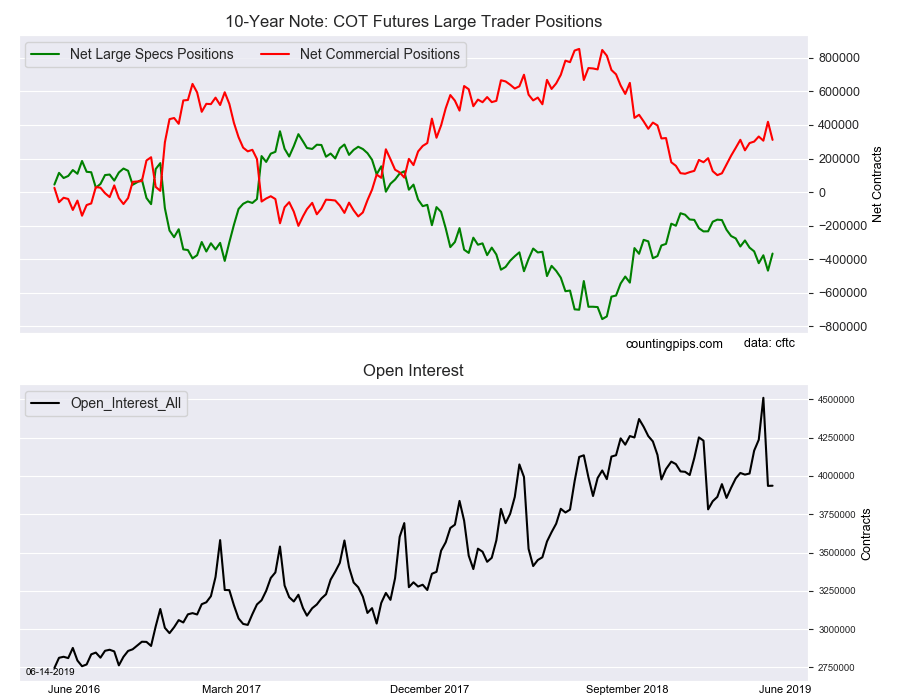

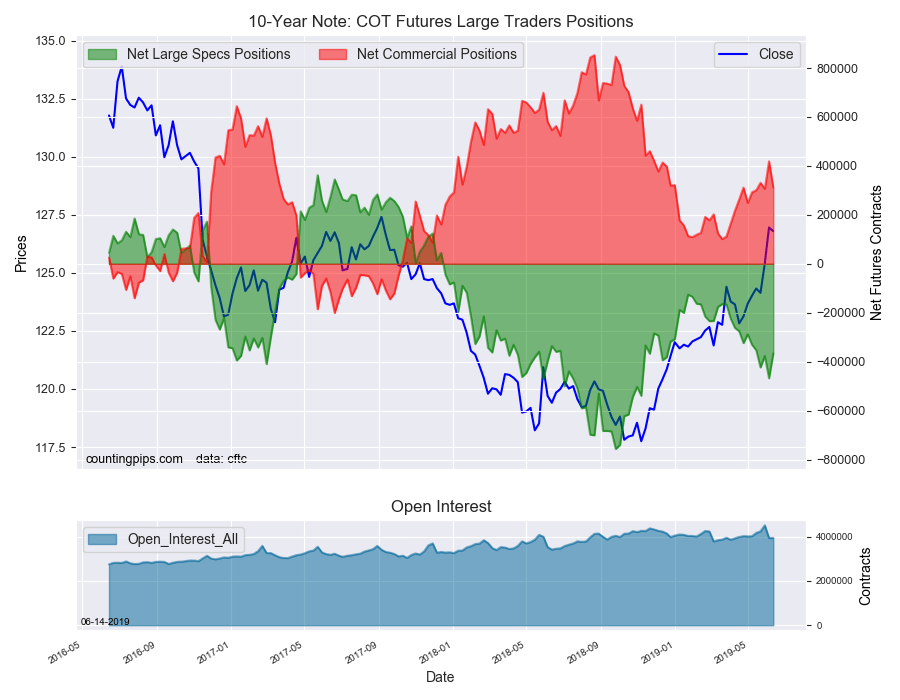

Large bond speculators reduced their bearish net positions in the 10-Year Note futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of 10-Year Note futures, traded by large speculators and hedge funds, totaled a net position of -365,988 contracts in the data reported through Tuesday, June 11th. This was a weekly change of 101,714 net contracts from the previous week which had a total of -467,702 net contracts.

The week’s net position was the result of the gross bullish position (longs) gaining by 30,228 contracts (to a weekly total of 643,501 contracts) while the gross bearish position (shorts) dropped by -71,486 contracts for the week (to a total of 1,009,489 contracts).

Speculators sharply reduced their bearish bets this week by the largest one-week amount since January 8th of this year. The speculative positions had seen higher bearish sentiment in three out of the previous four weeks before this week’s turnaround.

The current net standing (-365,988 contracts) is now back below -400,000 contracts this week after rising above that threshold last week and reaching the most bearish level since November 2018.

10-Year Note Commercial Positions:

The commercial traders' position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of 311,124 contracts on the week. This was a weekly loss of -107,837 contracts from the total net of 418,961 contracts reported the previous week.

10-Year Note Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the 10-Year Note Futures (Front Month) closed at approximately $126.79 which was a shortfall of $-0.15 from the previous close of $126.95, according to unofficial market data.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI