Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

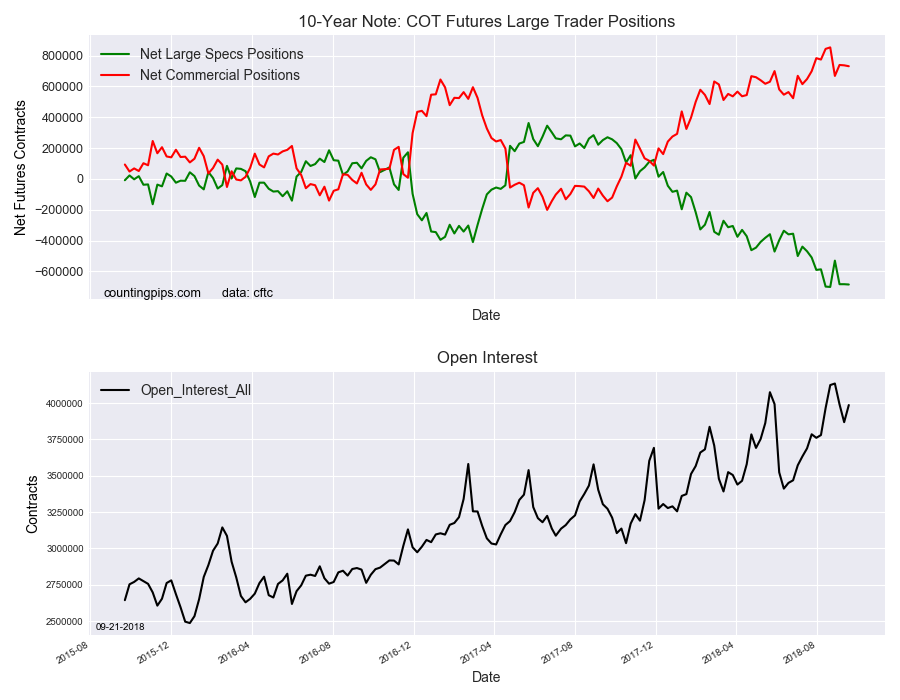

10-Year Note Non-Commercial Speculator Positions:

Large bond speculators slightly increased their bearish net positions in the US 10 Year T-Note Futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of 10-Year Note futures, traded by large speculators and hedge funds, totaled a net position of -684,712 contracts in the data reported through Tuesday September 18th. This was a weekly addition of -2,028 contracts to the bearish position from the previous week which had a total of -682,684 net contracts.

The speculative bearish position has seen very little movement over the past two weeks (+73 contracts and -2028 contracts, respectively) after the previous two weeks saw huge changes in weekly contracts (+170,694 contracts and -152,937 contracts, respectively).

The current standing remains over the -680,000 net contract level for a third straight week and is still not far off of the record high bearish level of -700,514 net contracts on August 21st.

10-Year Note Commercial Positions:

The commercial traders position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of 730,767 contracts on the week. This was a weekly decline of -5,828 contracts from the total net of 736,595 contracts reported the previous week.

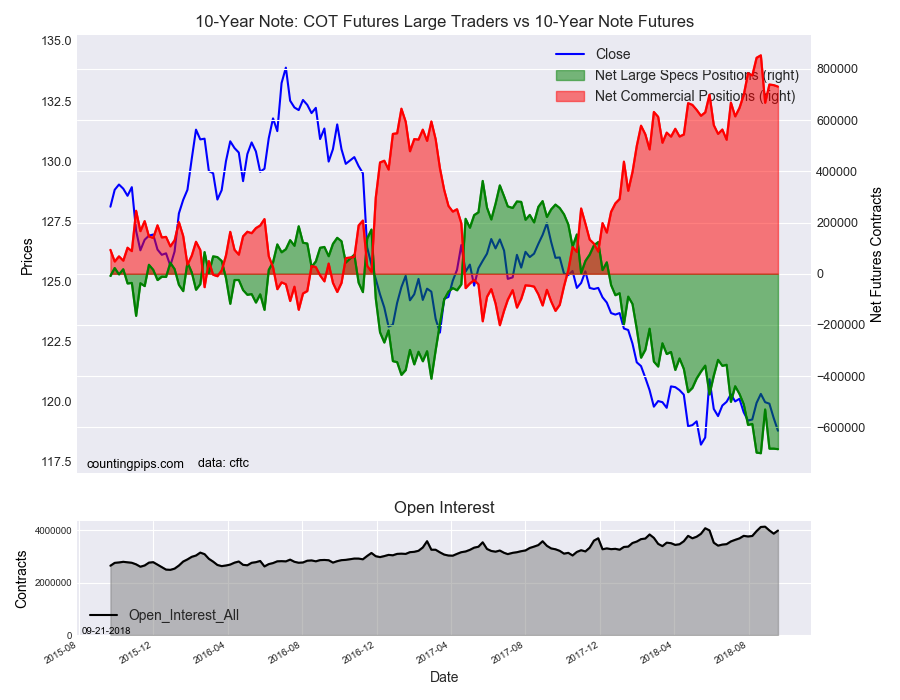

10-Year Note Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the 10-Year Note Futures (Front Month) closed at approximately $118.79 which was a decline of $-0.53 from the previous close of $119.32, according to unofficial market data.