10-Year Note Non-Commercial Speculator Positions:

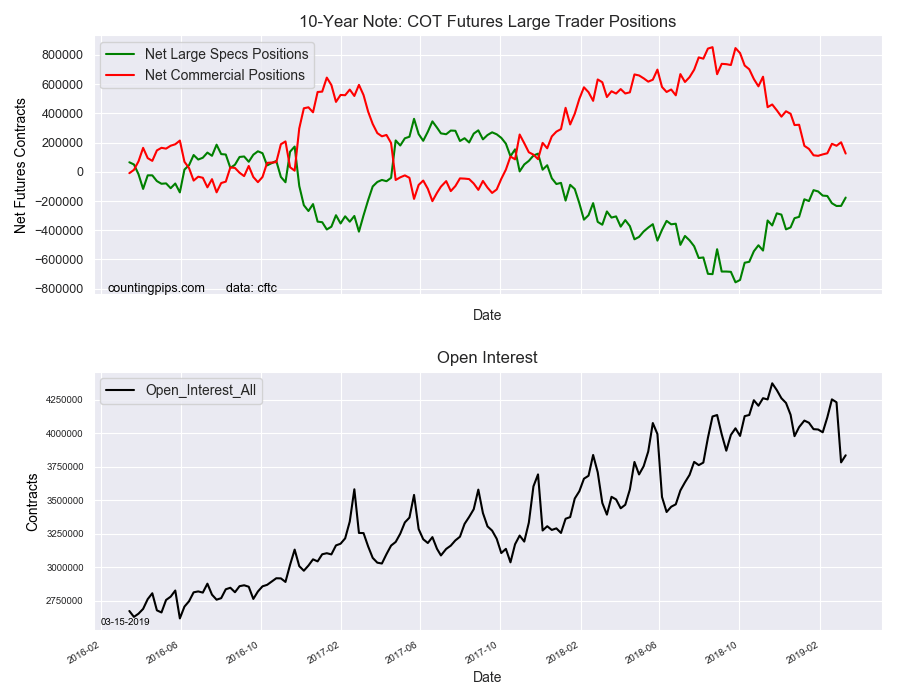

Large bond speculators decreased their bearish net positions in the 10-Year Note futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of 10-Year Note futures, traded by large speculators and hedge funds, totaled a net position of -176,434 contracts in the data reported through Tuesday, March 12th. This was a weekly change of 56,942 net contracts from the previous week which had a total of -233,376 net contracts.

The week’s net position was the result of the gross bullish position (longs) gaining by 81,978 contracts to a weekly total of 636,459 contracts that overcame the gross bearish position (shorts) which saw a gain by 25,036 contracts for the week to a total of 812,893 contracts.

The strong paring of bearish positions this week follows a small decrease last week and brings the overall speculator position back under the -200,000 contract level for the first time in a month. This week’s 56,942 contract change is the largest since January 8th when spec positions rose by 120,219 contracts.

10-Year Note Commercial Positions:

The commercial traders' position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of 124,729 contracts on the week. This was a weekly shortfall of -77,383 contracts from the total net of 202,112 contracts reported the previous week.

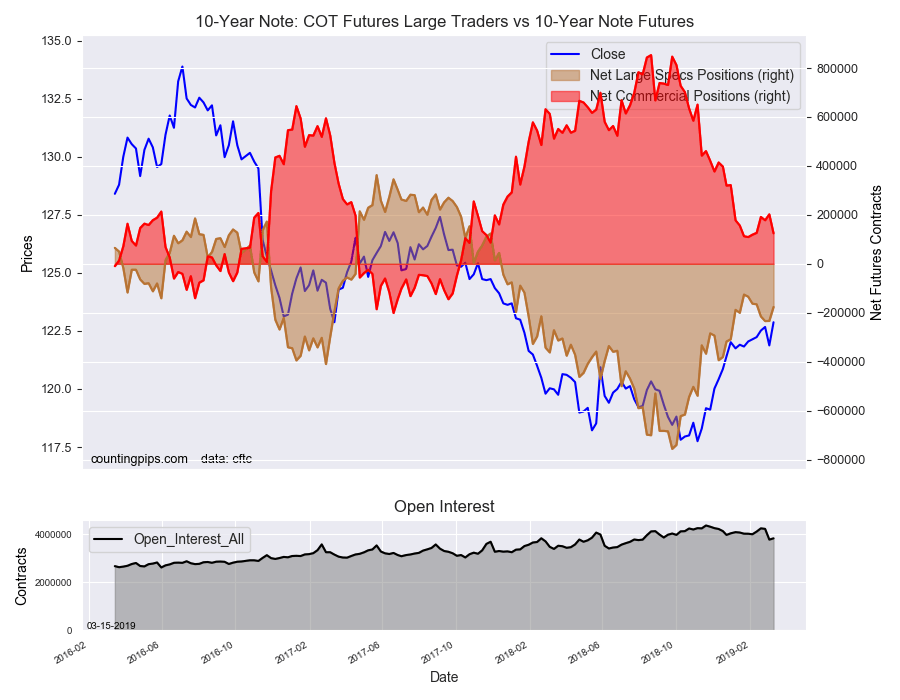

10-Year Note Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the 10-Year Note Futures (Front Month) closed at approximately $122.87 which was a rise of $1.00 from the previous close of $121.87, according to unofficial market data.