10-Year Note Non-Commercial Speculator Positions:

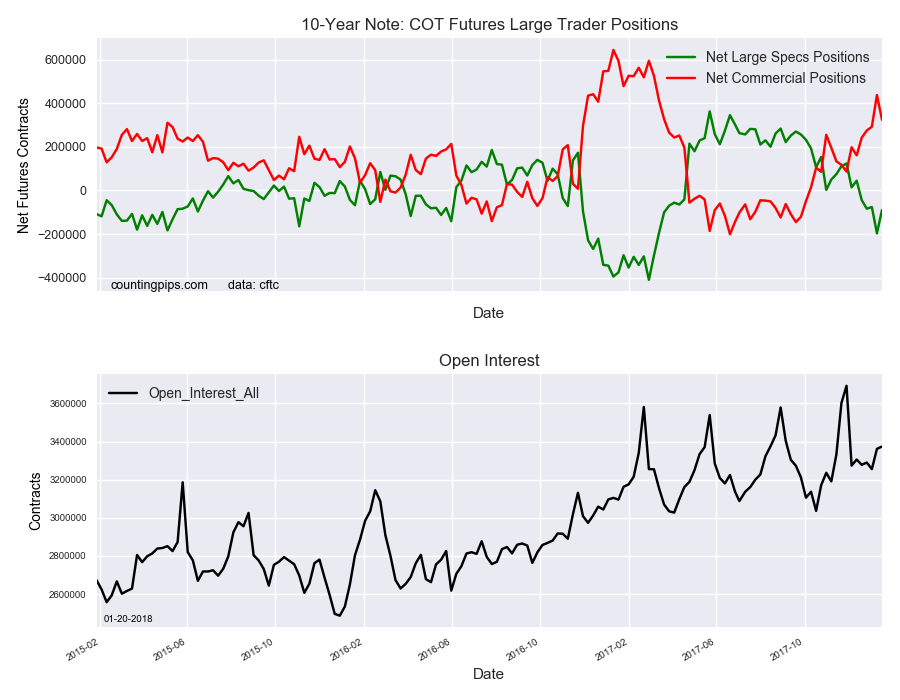

Large bond speculators sharply reduced their bearish net positions in the 10-Year Note futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of 10-Year Note futures, traded by large speculators and hedge funds, totaled a net position of -89,259 contracts in the data reported through Tuesday January 16th. This was a weekly gain of 107,594 contracts from the previous week which had a total of -196,853 net contracts.

Speculators had boosted their bearish bets to the most bearish level since March last week before a strong pull back in bearish positions this week. The overall net level has now been in bearish territory for five straight weeks after turning over on December 19th.

10-Year Note Commercial Positions:

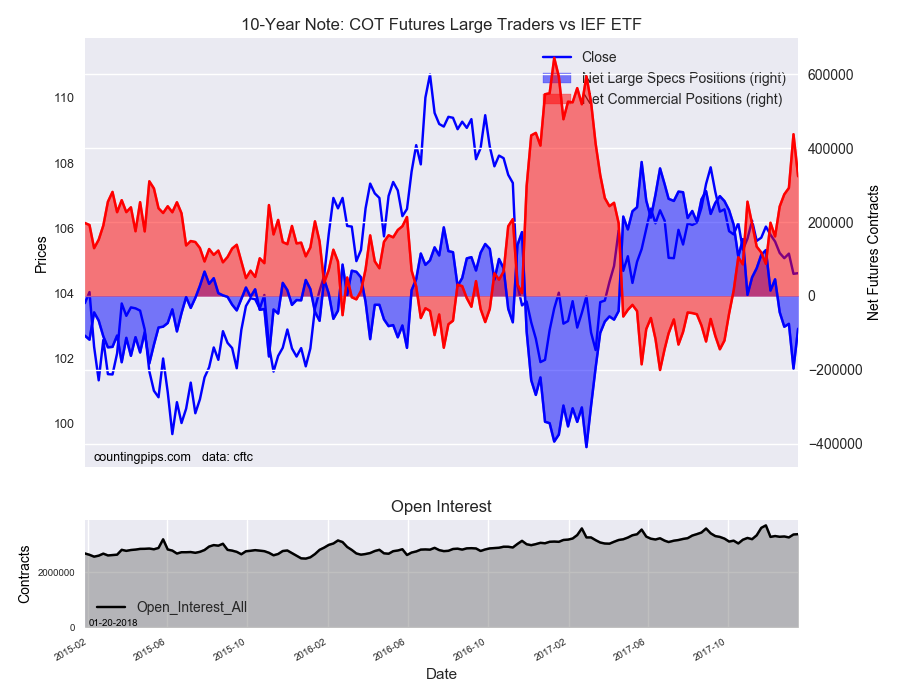

The commercial traders position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of 323,916 contracts on the week. This was a weekly fall of -113,842 contracts from the total net of 437,758 contracts reported the previous week.

iShares Core MSCI EAFE (NYSE:IEFA) ETF:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the 7-10 Year Treasury Bond ETF (IEF) closed at approximately $104.62 which was an advance of $0.02 from the previous close of $104.60, according to unofficial market data.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI