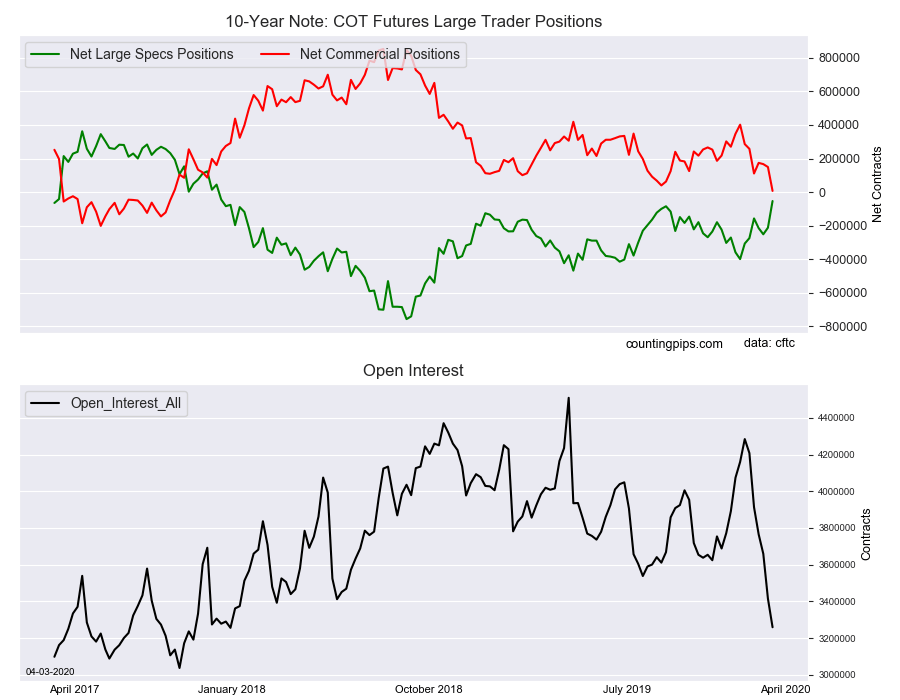

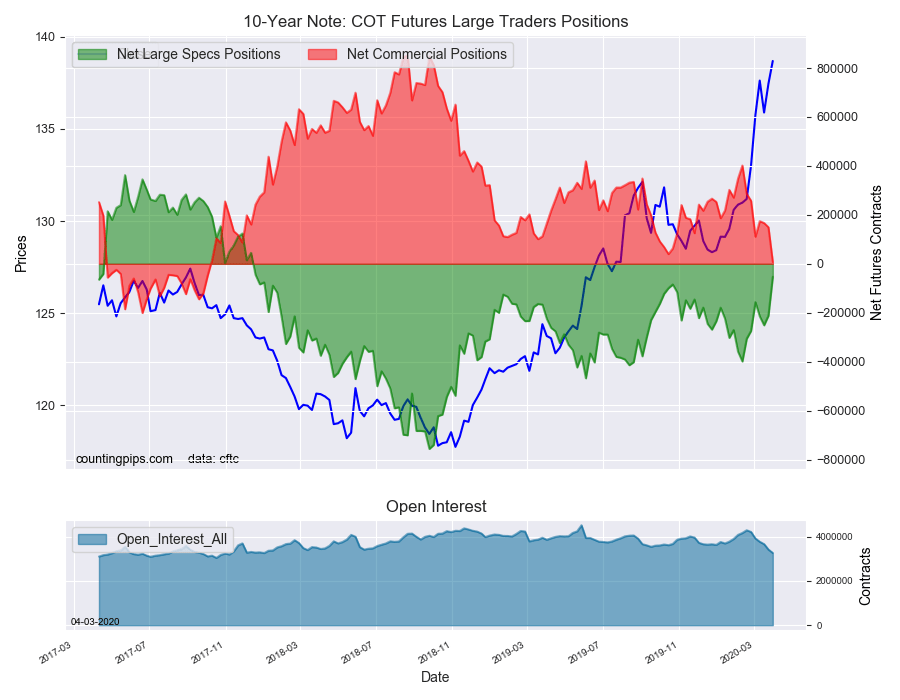

10-Year Note Non-Commercial Speculator Positions:

Large bond speculators sharply cut back on their bearish net positions in the 10-Year Note futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of 10-Year Note futures, traded by large speculators and hedge funds, totaled a net position of -53,036 contracts in the data reported through Tuesday, March 31st. This was a weekly change of 158,993 net contracts from the previous week which had a total of -212,029 net contracts.

The week’s net position was the result of the gross bullish position (longs) going up by 23,339 contracts (to a weekly total of 506,947 contracts) while the gross bearish position (shorts) fell by -135,654 contracts for the week (to a total of 559,983 contracts).

10-Year Treasury speculators dropped their bearish bets for a second straight week and by the largest one-week amount in the past seventy-two weeks, dating back to January of 2018. The trimming of the speculator’s bearish position brings the current overall standing (-53,036 contracts) to it’s least bearish level since December of 2017 and basically to almost a neutral level. The 10-Year price action, meanwhile, has continued to remain strongly bid as a result of safe haven flows.

10-Year Note Commercial Positions:

The commercial traders' position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of 7,156 contracts on the week. This was a weekly fall of -142,417 contracts from the total net of 149,573 contracts reported the previous week.

10-Year Note Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the 10-Year Note Futures (Front Month) closed at approximately $138.68 which was a rise of $1.23 from the previous close of $137.45, according to unofficial market data.