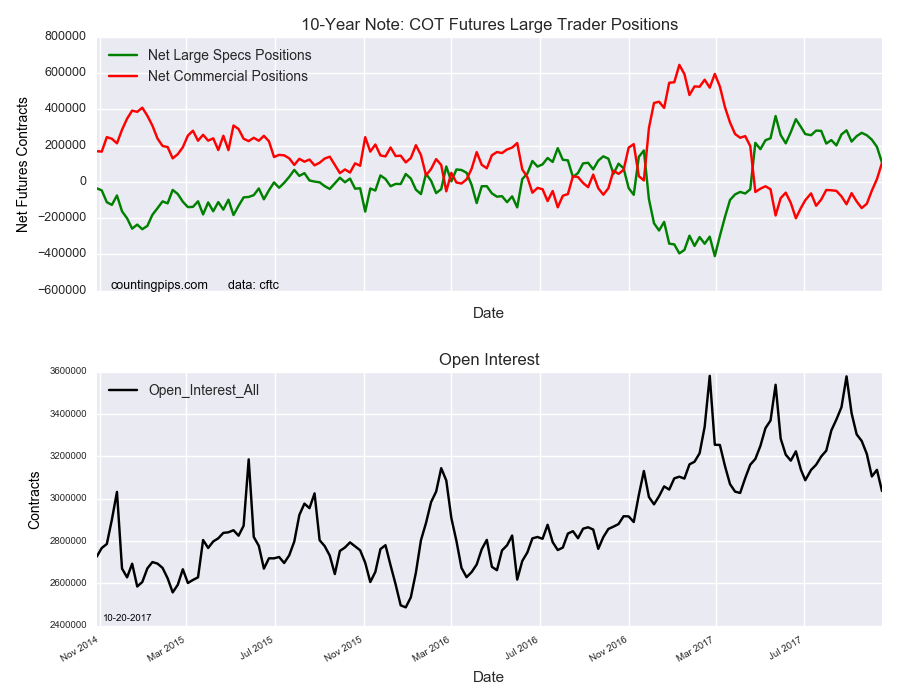

10-Year Note Non-Commercial Speculator Positions:

Large treasury speculators reduced their bullish net positions in the 10-Year Note futures markets again this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of 10-Year Note futures, traded by large speculators and hedge funds, totaled a net position of 106,291 contracts in the data reported through Tuesday October 17th. This was a weekly decline of -86,315 contracts from the previous week which had a total of 192,606 net contracts.

Speculative positions have dropped by -163,829 contracts over the past four weeks and are now at the lowest bullish level since April 18th when net positions were negative and totaled -41,300 contracts.

10-Year Note Commercial Positions:

The commercial traders position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of 104,546 contracts on the week. This was a weekly advance of 89,841 contracts from the total net of 14,705 contracts reported the previous week.

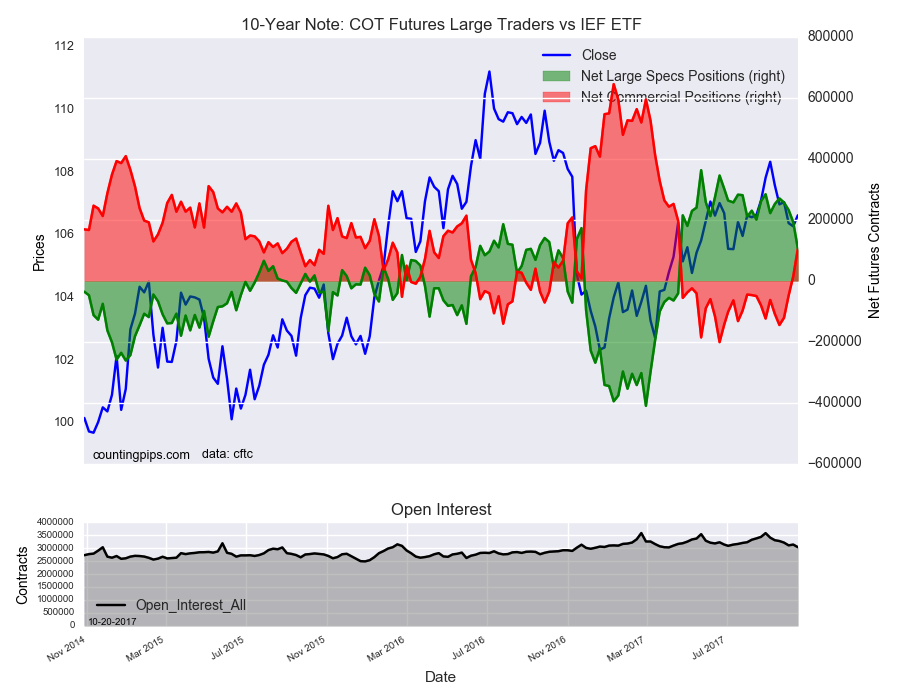

iShares Core MSCI EAFE (NYSE:IEFA) ETF:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the 7-10 Year Treasury Bond ETF (IEF) closed at approximately $106.64 which was an advance of $0.35 from the previous close of $106.29, according to unofficial market data.