10-Year Note Non-Commercial Speculator Positions:

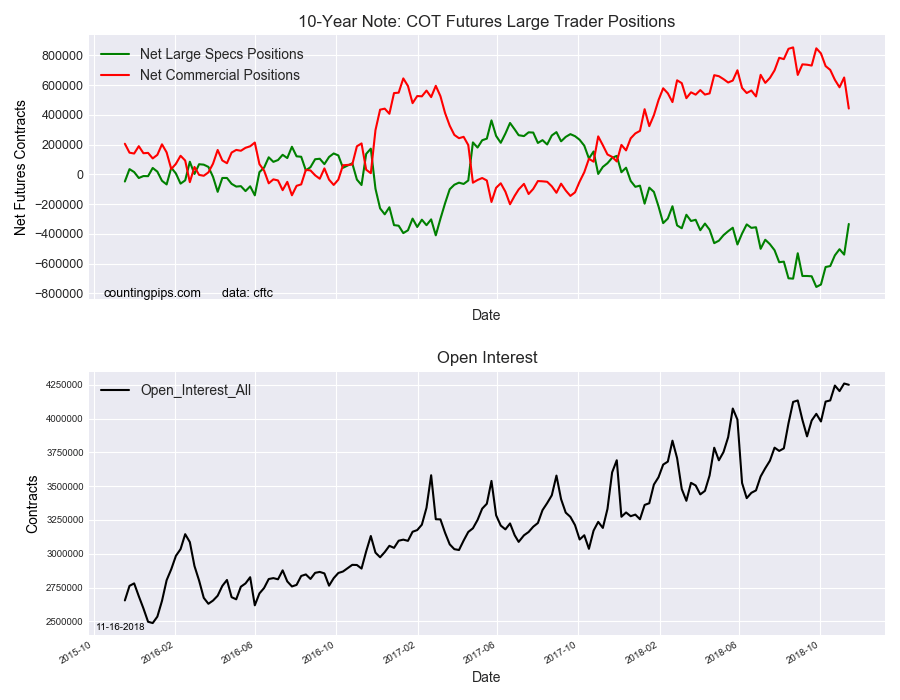

Large bond speculators strongly reduced their bearish net positions in the US 10 Year T-Note Futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of 10-Year Note futures, traded by large speculators and hedge funds, totaled a net position of -333,195 contracts in the data reported through Tuesday November 13th. This was a weekly change of 205,991 net contracts from the previous week which had a total of -539,186 net contracts.

This week’s net position was the result of the gross bullish position gaining by 79,328 contracts to a weekly total of 666,291 contracts in addition to the gross bearish position dropping by -126,663 contracts for the week to a total of 999,486 contracts.

The speculative position this week saw the largest one-week gain in net positions since April 25th of 2017 when the net position had gained by +255,942 contracts. The current 10-year standing is now at the least bearish level since April 10th of this year when the net position totaled -330,635 contracts.

10-Year Note Commercial Positions:

The commercial traders position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of 442,166 contracts on the week. This was a weekly fall of -208,514 contracts from the total net of 650,680 contracts reported the previous week.

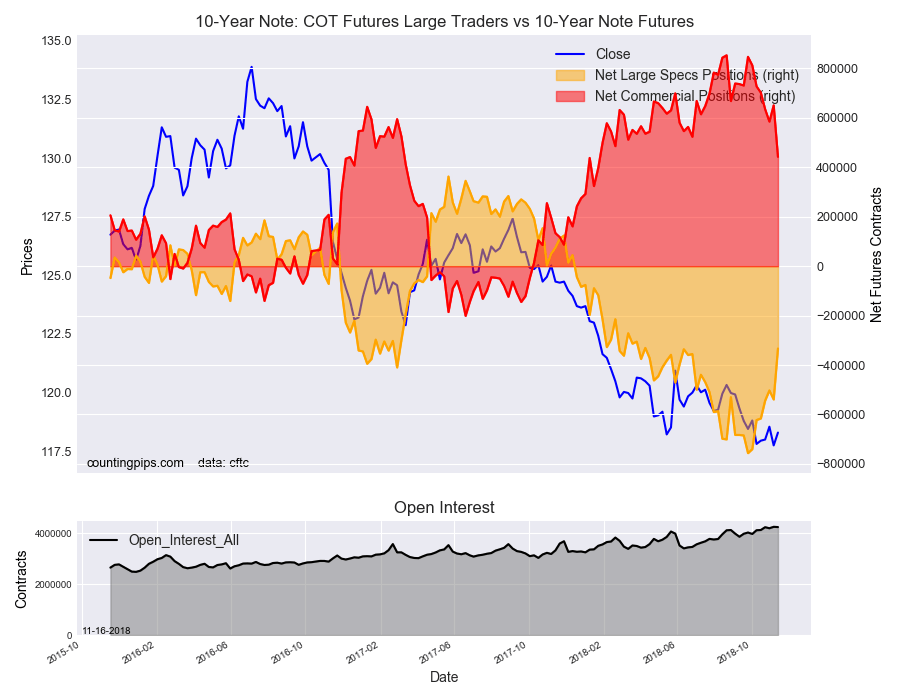

10-Year Note Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the 10-Year Note Futures (Front Month) closed at approximately $118.29 which was an uptick of $0.54 from the previous close of $117.75, according to unofficial market data.