10-Year Note Non-Commercial Speculator Positions:

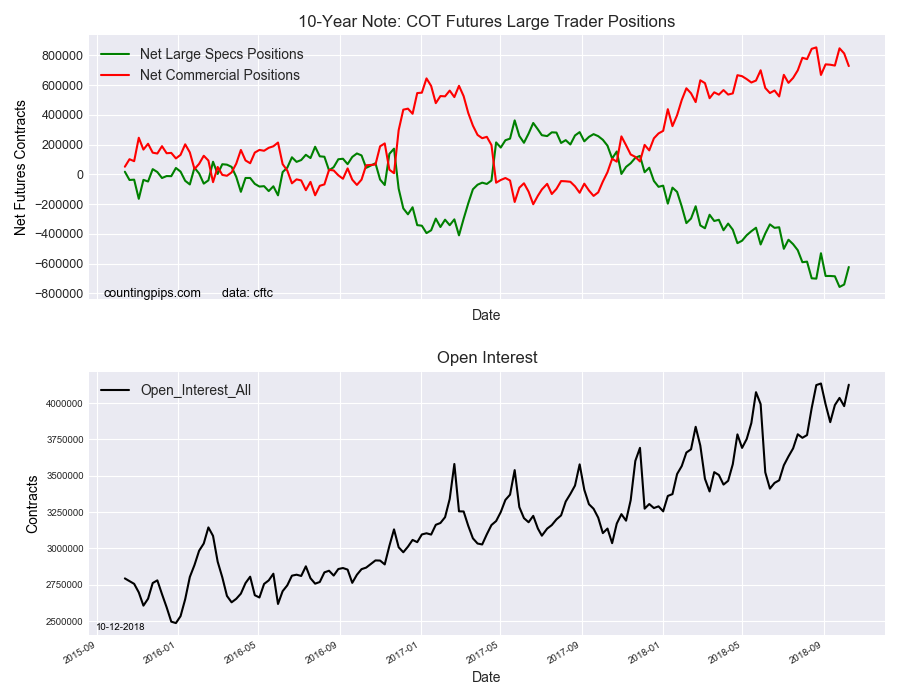

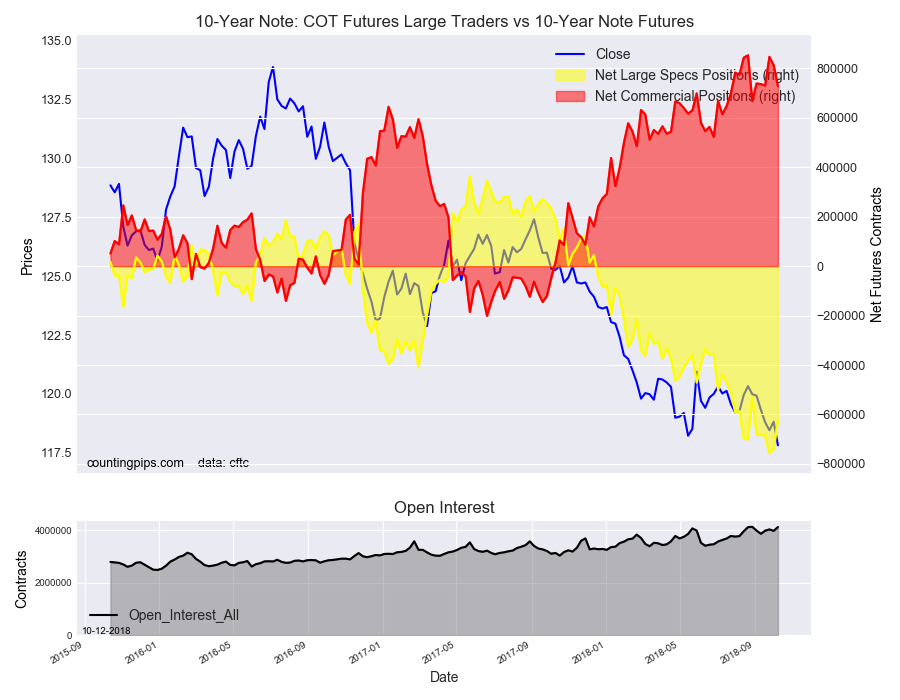

Large bond speculators sharply pulled back on their bearish net positions in the US 10 Year T-Note Futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of 10-Year Note futures, traded by large speculators and hedge funds, totaled a net position of -622,422 contracts in the data reported through Tuesday October 9th. This was a weekly boost of 117,770 contracts from the previous week which had a total of -740,192 net contracts.

The speculative bearish sentiment declined for the second straight week after surging to an all-time record high bearish level on September 25th at over -750,000 net contracts. This week’s sharp retreat in bearish bets through Tuesday brought the current standing to under -680,000 contracts for the first time in six weeks.

10-Year Note Commercial Positions:

The commercial traders position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of 727,351 contracts on the week. This was a weekly loss of -84,973 contracts from the total net of 812,324 contracts reported the previous week.

10-Year Note Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the 10-Year Note Futures (Front Month) closed at approximately $117.81 which was a loss of $-1.0 from the previous close of $118.81, according to unofficial market data.