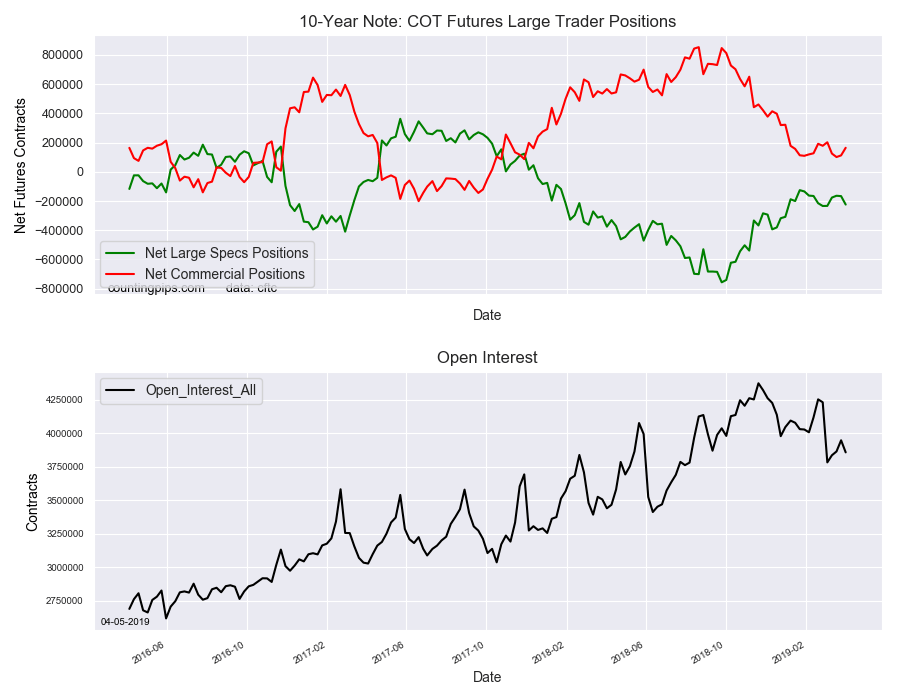

10-Year Note Non-Commercial Speculator Positions:

Large bond speculators raised their bearish net positions in the 10-Year Note futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of 10-Year Note futures, traded by large speculators and hedge funds, totaled a net position of -224,223 contracts in the data reported through Tuesday April 2nd. This was a weekly change of -57,705 net contracts from the previous week which had a total of -166,518 net contracts.

The week’s net position was the result of the gross bullish position (longs) declining by -55,282 contracts to a weekly total of 644,470 contracts in addition to the gross bearish position (shorts) which saw a rise by 2,423 contracts for the week to a total of 868,693 contracts.

The net speculator bearish position rose for a second straight week after three weeks of declining bearish bets. This week’s rise in bearish positions pushed the current standing back over the -200,000 net contract level for the first time since the beginning of March.

Overall, the net short position is relatively small compared to the levels of the fall where net positions reached as high as -740,192 contracts in early October.

10-Year Note Commercial Positions:

The commercial traders position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of 164,266 contracts on the week. This was a weekly uptick of 52,164 contracts from the total net of 112,102 contracts reported the previous week.

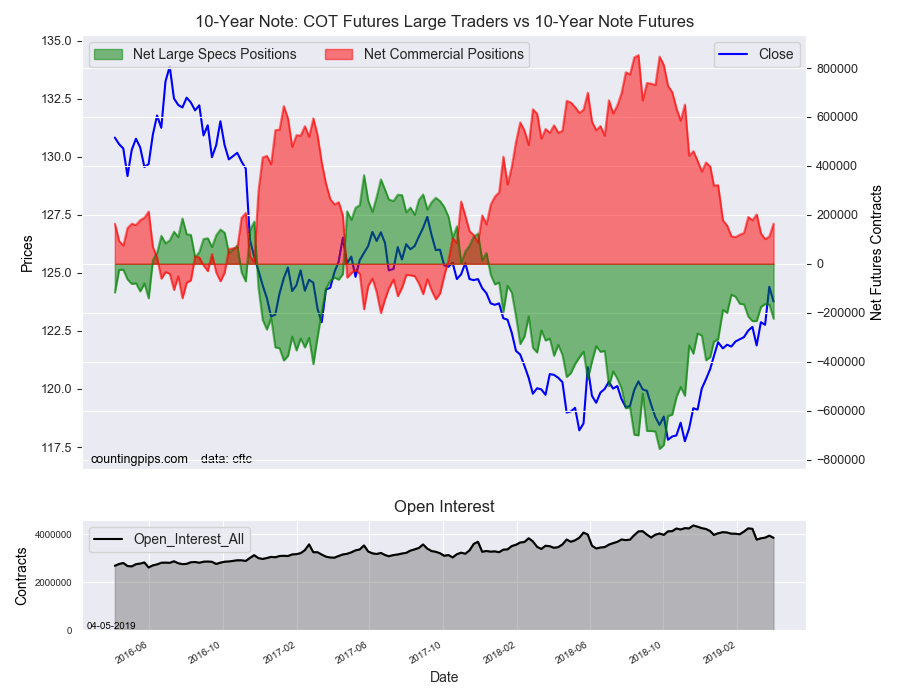

10-Year Note Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the 10-Year Note Futures (Front Month) closed at approximately $123.76 which was a fall of $-0.64 from the previous close of $124.40, according to unofficial market data.