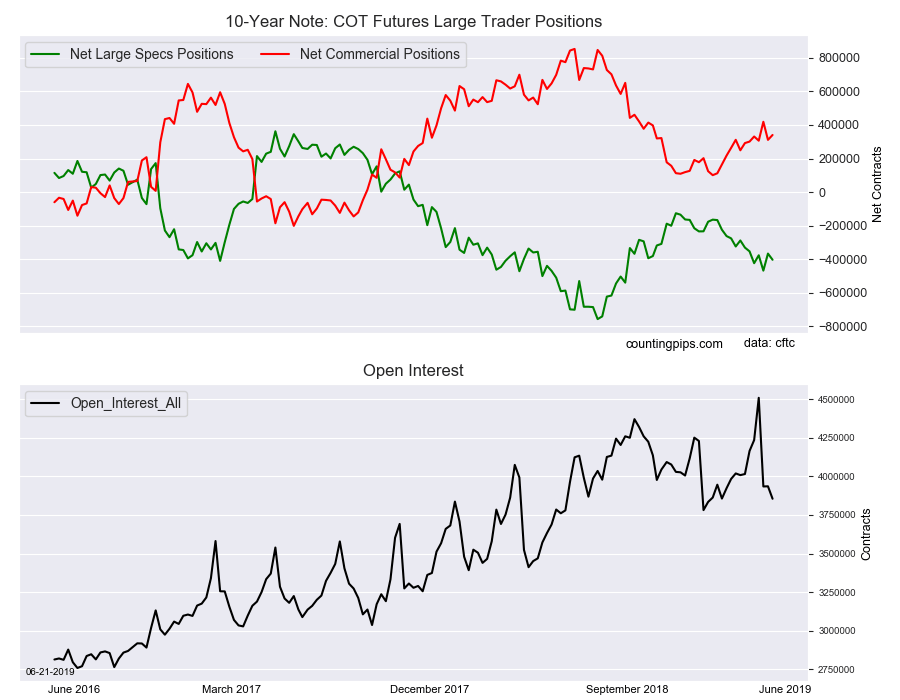

10-Year Note Non-Commercial Speculator Positions:

Large bond speculators increased their bearish net positions in the 10-Year Note futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of 10-Year Note futures, traded by large speculators and hedge funds, totaled a net position of -402,984 contracts in the data reported through Tuesday June 18th. This was a weekly change of -36,996 net contracts from the previous week which had a total of -365,988 net contracts.

The week’s net position was the result of the gross bullish position (longs) declining by -22,496 contracts (to a weekly total of 621,005 contracts) while the gross bearish position (shorts) increased by 14,500 contracts for the week (to a total of 1,023,989 contracts).

The large speculators raised their bearish bets this week following a sharp contraction by 101,714 contracts last week. Despite the strength of the 10-Year bond notes recently, speculator bets have continued to be more bearish than bullish (bearish bets have risen in five out of the last seven weeks with a net change of -115,063 contracts over that period).

Currently, the overall bearish position is back above the -400,000 net contract level which marks just the third time bets have been this bearish since November 2018.

10-Year Note Commercial Positions:

The commercial traders' position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of 340,399 contracts on the week. This was a weekly advance of 29,275 contracts from the total net of 311,124 contracts reported the previous week.

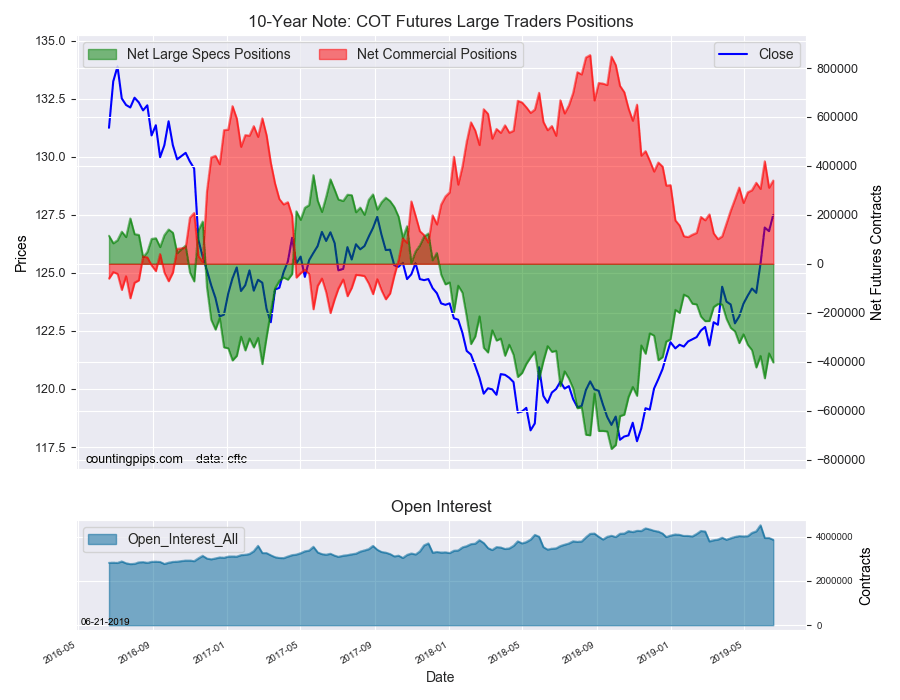

10-Year Note Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the 10-Year Note Futures (Front Month) closed at approximately $127.50 which was a rise of $0.70 from the previous close of $126.80, according to unofficial market data.