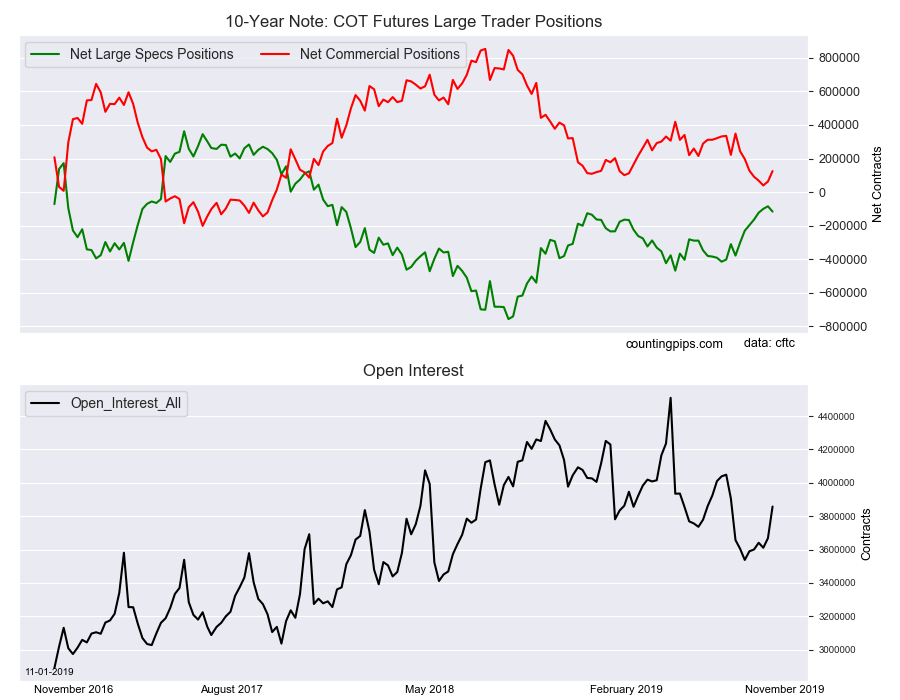

10-Year Note Non-Commercial Speculator Positions:

Large bond speculators increased their bearish net positions in the US 10 Year T-Note Futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of 10-Year Note futures, traded by large speculators and hedge funds, totaled a net position of -116,066 contracts in the data reported through Tuesday October 29th. This was a weekly change of -31,713 net contracts from the previous week which had a total of -84,353 net contracts.

The week’s net position was the result of the gross bullish position (longs) increasing by 51,897 contracts (to a weekly total of 716,215 contracts) while the gross bearish position (shorts) jumped by a greater amount of 83,610 contracts for the week (to a total of 832,281 contracts).

10-year note speculators raised their bearish bets following seven straight weeks of declining bearish positions. The previous declines had brought the overall position to the least bearish level in ninety-four weeks, dating back to January 2nd of 2018. This week’s reboot of bearish bets pushed the net position back above the -100,000 contract level for the first time since October 8th.

10-Year Note Commercial Positions:

The commercial traders position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of 125,228 contracts on the week. This was a weekly rise of 62,216 contracts from the total net of 63,012 contracts reported the previous week.

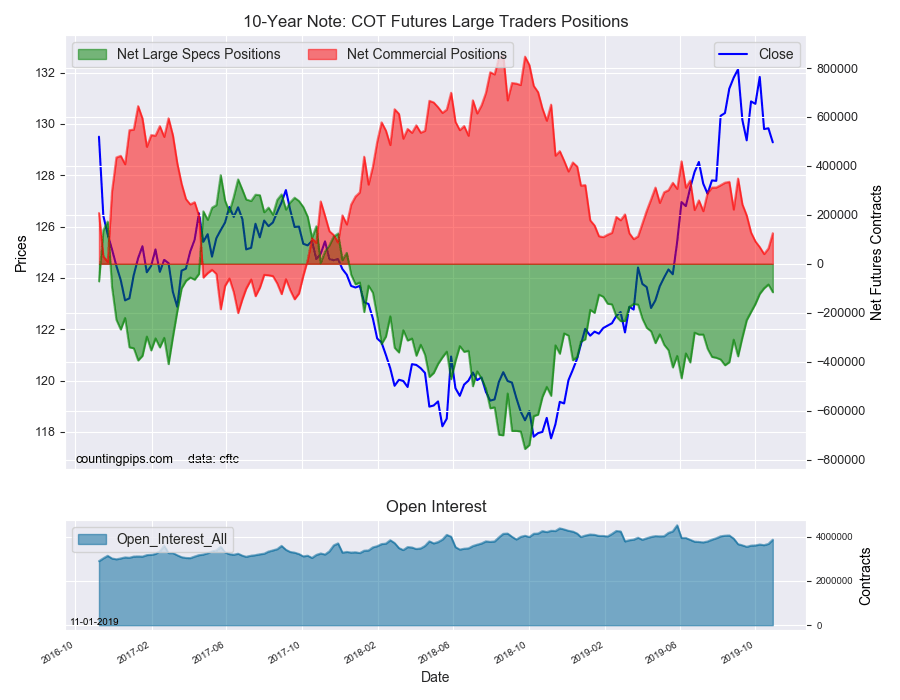

10-Year Note Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the 10-Year Note Futures (Front Month) closed at approximately $129.28 which was a shortfall of $-0.54 from the previous close of $129.82, according to unofficial market data.