10-Year Note Non-Commercial Speculator Positions:

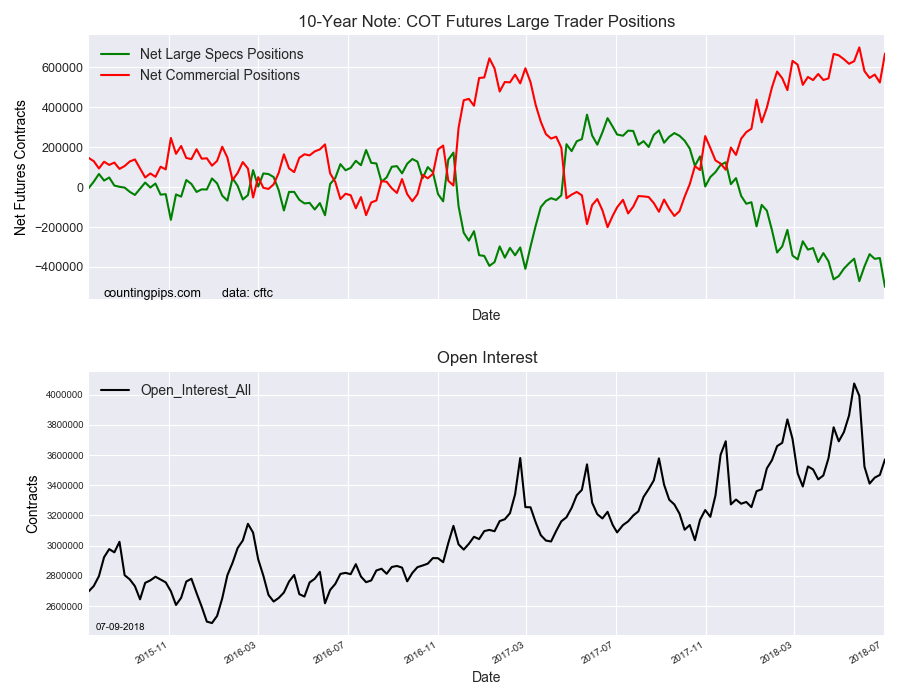

Large bond market speculators very sharply boosted their bearish net positions in the US 10 Year T-Note Futures markets last week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Monday due to the 4th of July holiday.

The non-commercial futures contracts of 10-Year Note futures, traded by large speculators and hedge funds, totaled a net position of -500,076 contracts in the data reported through Tuesday July 3rd. This was a weekly plunge of -144,752 contracts from the previous week which had a total of -355,324 net contracts.

The surge in bearish bets last week brought the overall bearish position to a new record high bearish level over the -500,000 net contract threshold. This latest data beats out the previous record bearishness that was registered recently on May 29th with a total position of -471,067 contracts.

10-Year Note Commercial Positions:

The commercial traders position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of 668,468 contracts on the week. This was a weekly jump of 145,116 contracts from the total net of 523,352 contracts reported the previous week.

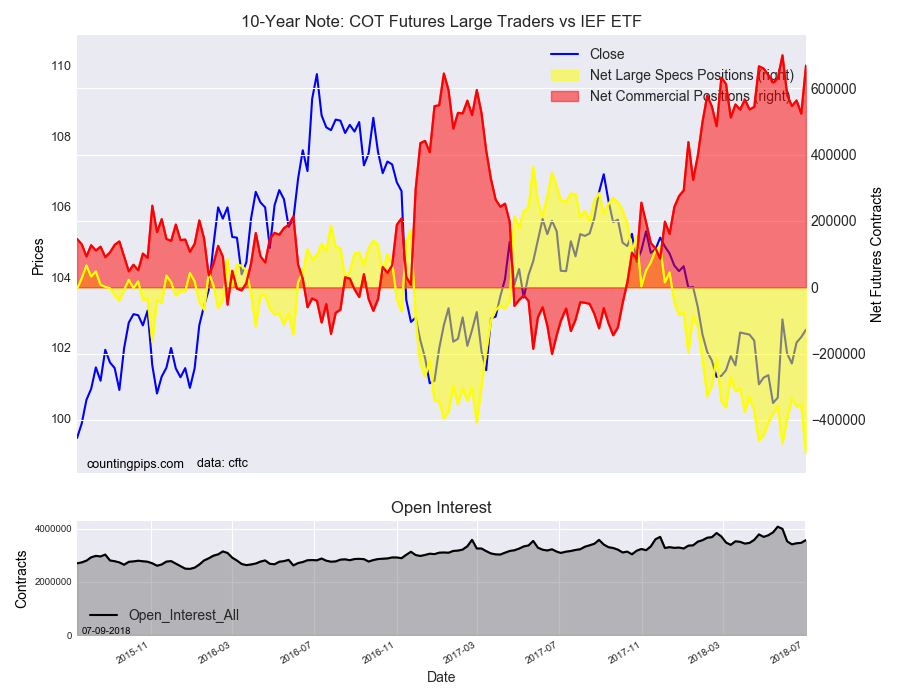

iShares 7-10 Year Treasury Bond (NASDAQ:IEF):

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the 7-10 Year Treasury Bond ETF (IEF) closed at approximately $102.51 which was a rise of $0.21 from the previous close of $102.3, according to unofficial market data.