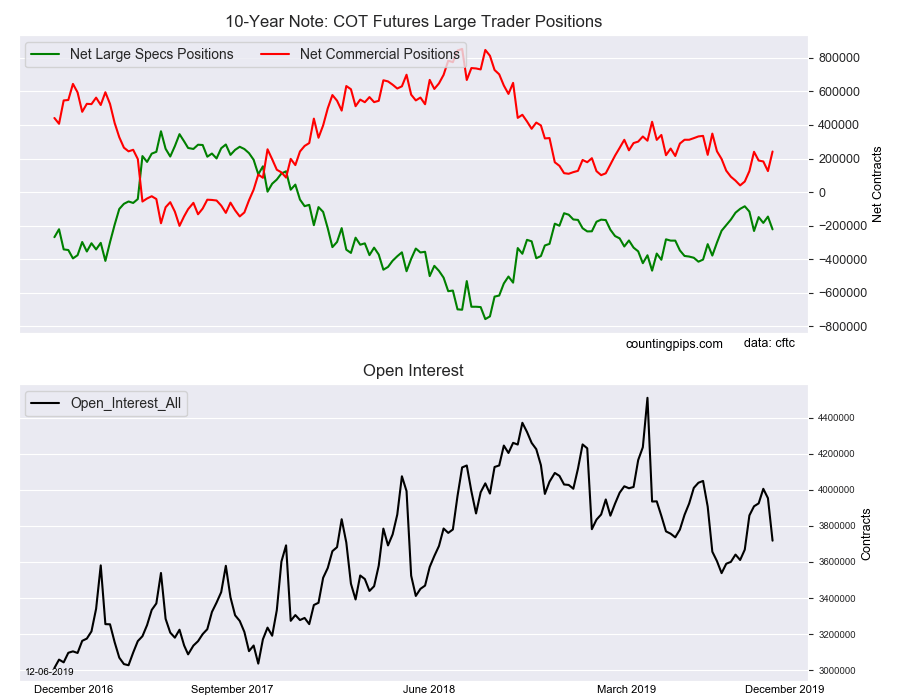

10-Year Note Non-Commercial Speculator Positions:

Large bond speculators added to their bearish net positions in the 10-Year Note futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of 10-Year Note futures, traded by large speculators and hedge funds, totaled a net position of -221,895 contracts in the data reported through Tuesday December 3rd. This was a weekly change of -76,150 net contracts from the previous week which had a total of -145,745 net contracts.

The week’s net position was the result of the gross bullish position (longs) tumbling by -5,978 contracts (to a weekly total of 702,318 contracts) while the gross bearish position (shorts) jumped by 70,172 contracts for the week (to a total of 924,213 contracts).

10-Year speculators added to their bearish bets for the second time in three weeks and by a total of -73,101 contracts over that time-frame. This rise in bearishness pushed the overall bearish standing to the highest level in eleven weeks, dating back to September 17th. Despite the recent uptick in bearish bets, the current level (-221,895 contracts) remains below the 2019 average level of -257,672 contracts.

10-Year Note Commercial Positions:

The commercial traders position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of 241,919 contracts on the week. This was a weekly increase of 116,614 contracts from the total net of 125,305 contracts reported the previous week.

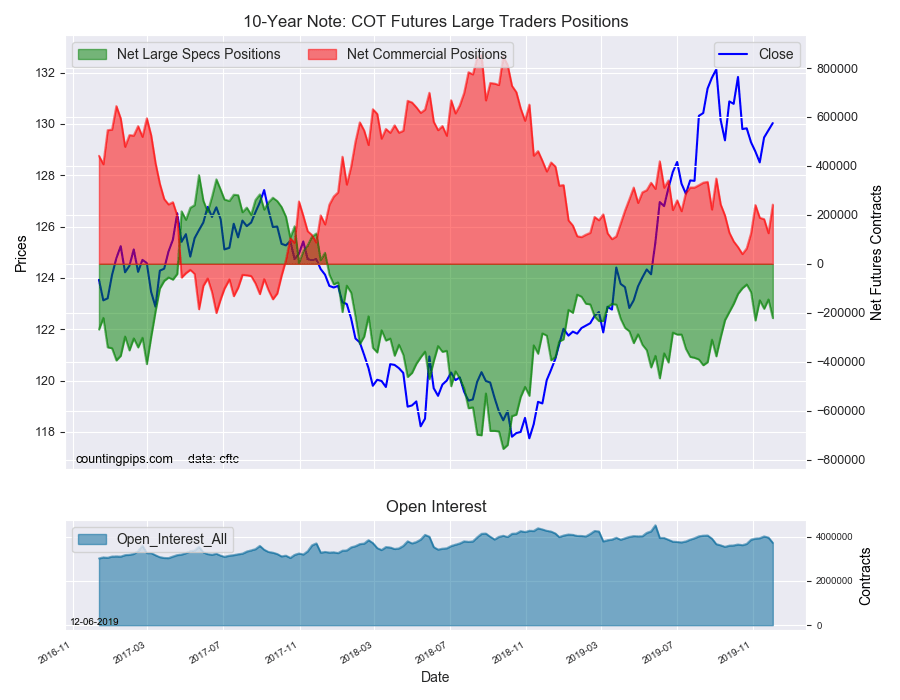

10-Year Note Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the 10-Year Note Futures (Front Month) closed at approximately $130.03 which was an advance of $0.28 from the previous close of $129.75, according to unofficial market data.