10-Year Note Non-Commercial Speculator Positions:

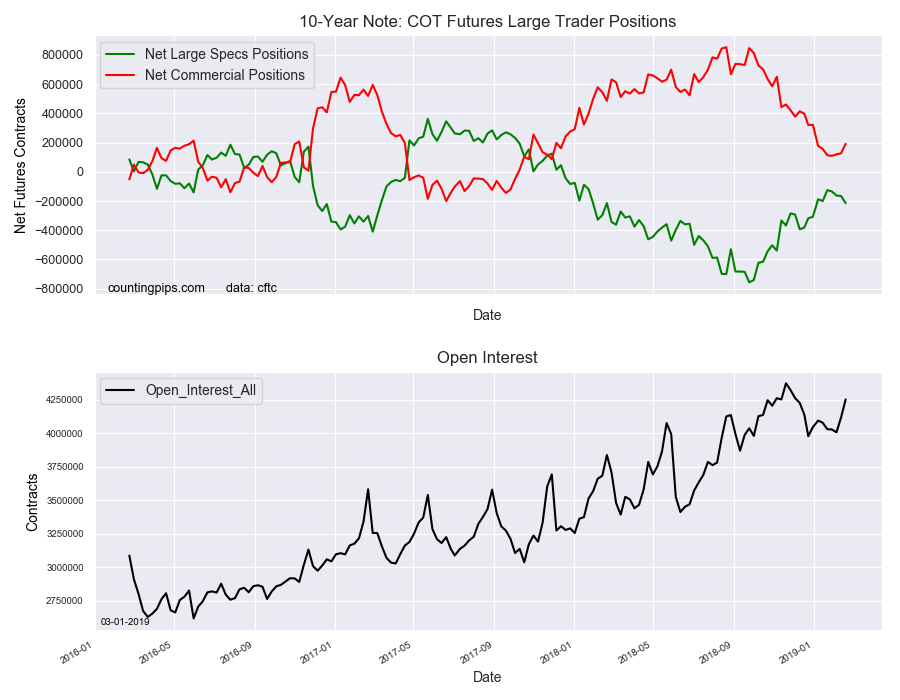

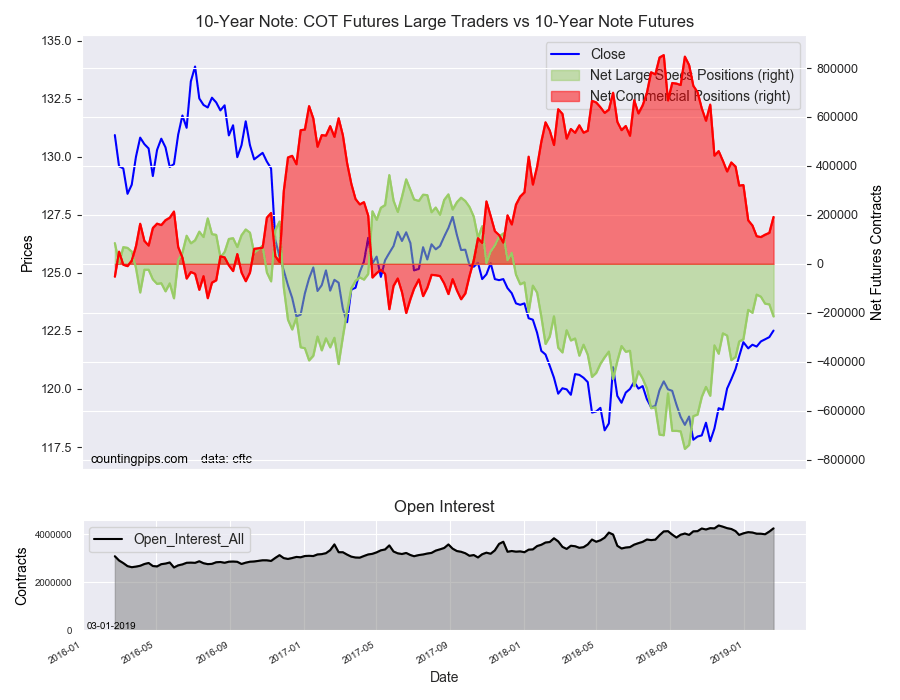

Large bond speculators added to their bearish net positions in the 10-Year Note futures markets in February, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

This latest COT data is from the middle of February due to the government shutdown which suspended the releases for approximately a month. The CFTC is releasing data on Tuesdays and Fridays going forward until the data is back up to date.

The non-commercial futures contracts of 10-Year Note futures, traded by large speculators and hedge funds, totaled a net position of -215,091 contracts in the data reported through Tuesday, February 19th. This was a weekly decline of -49,602 net contracts from the previous week which had a total of -165,489 net contracts.

The week’s net position was the result of the gross bullish position (longs) advancing by 8,766 contracts to a weekly total of 702,945 contracts compared to the gross bearish position (shorts) which saw a boost by 58,368 contracts for the week to a total of 918,036 contracts.

The speculative 10-year positioning saw greater bearish bets for the fourth week in a row and to the highest level in the previous seven weeks, according to the latest data. The overall net standing rose back over the -200,000 contract level for the first time since January 15th.

10-Year Note Commercial Positions:

The commercial traders position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of 191,580 contracts on the week. This was a weekly boost of 64,977 contracts from the total net of 126,603 contracts reported the previous week.

10-Year Note Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the 10-Year Note Futures (Front Month) closed at approximately $122.51 which was an uptick of $0.28 from the previous close of $122.23, according to unofficial market data.