10-Year Note Non-Commercial Speculator Positions:

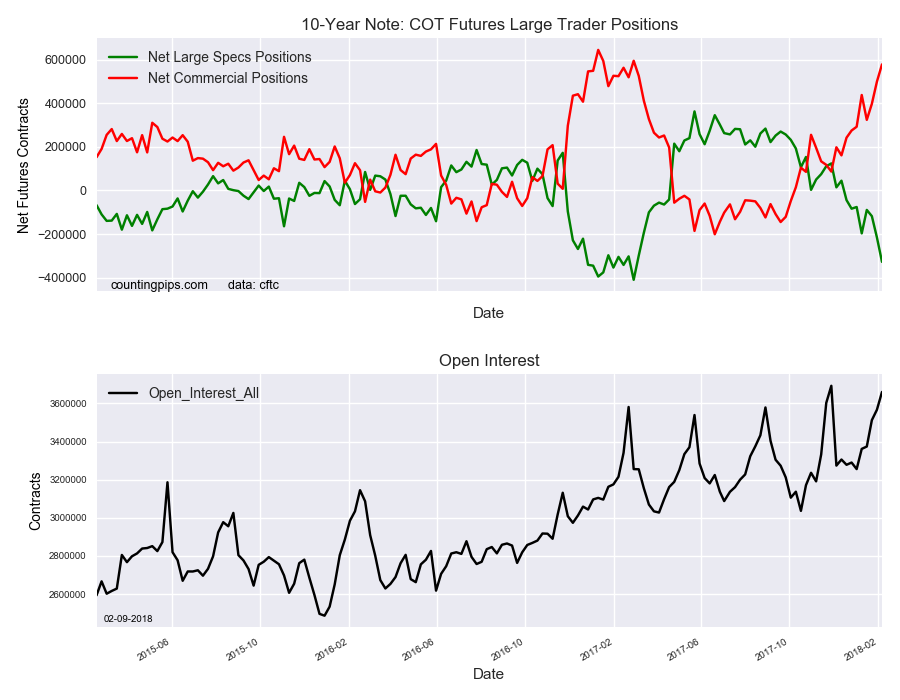

Large bond speculators sharply added to their bearish net positions in the 10-Year Note futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of 10-Year Note futures, traded by large speculators and hedge funds, totaled a net position of -327,540 contracts in the data reported through Tuesday February 6th. This was a weekly lowering of -111,940 contracts from the previous week which had a total of -215,600 net contracts.

Speculative positions have now fallen for three straight weeks and the overall bearish level is now at the highest standing since February 28th of 2017 when net positions totaled -409,659 contracts.

10-Year Note Commercial Positions:

The commercial traders position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of 578,177 contracts on the week. This was a weekly uptick of 78,912 contracts from the total net of 499,265 contracts reported the previous week.

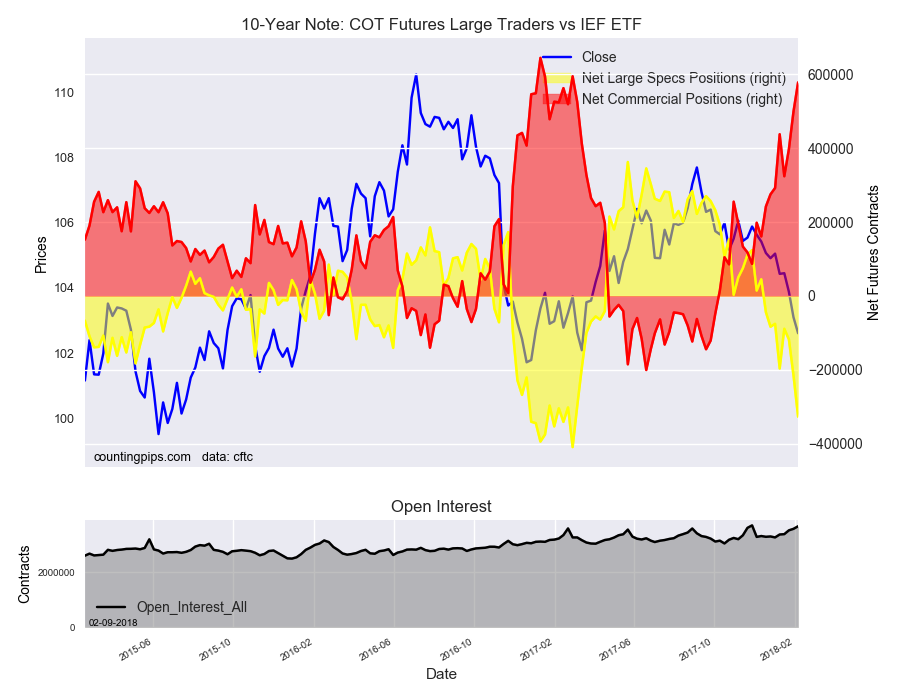

iShares Core MSCI EAFE (NYSE:IEFA) ETF:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the 7-10 Year Treasury Bond ETF (IEF) closed at approximately $102.61 which was a fall of $-0.49 from the previous close of $103.1, according to unofficial market data.