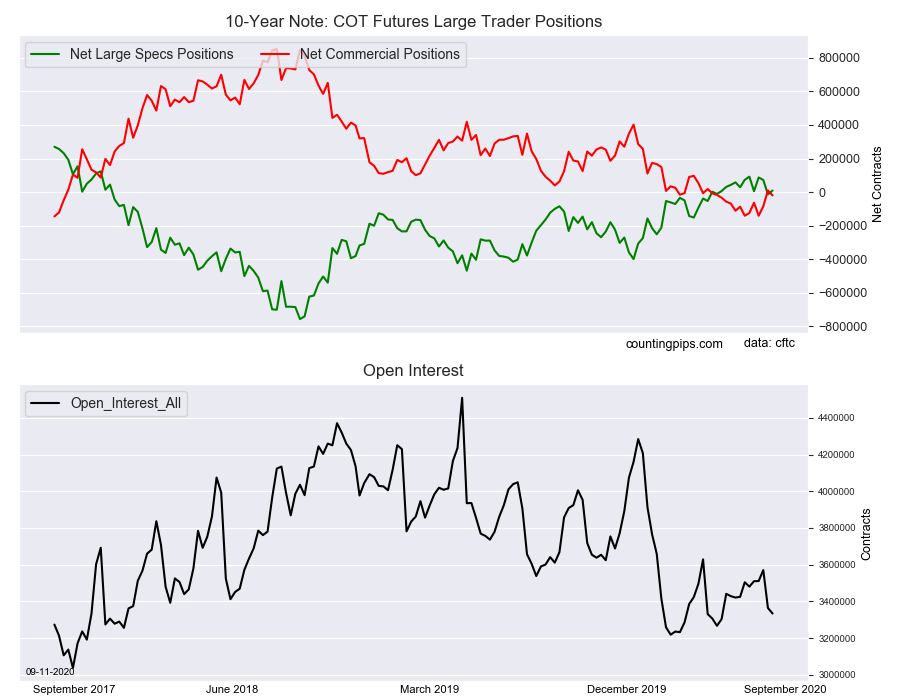

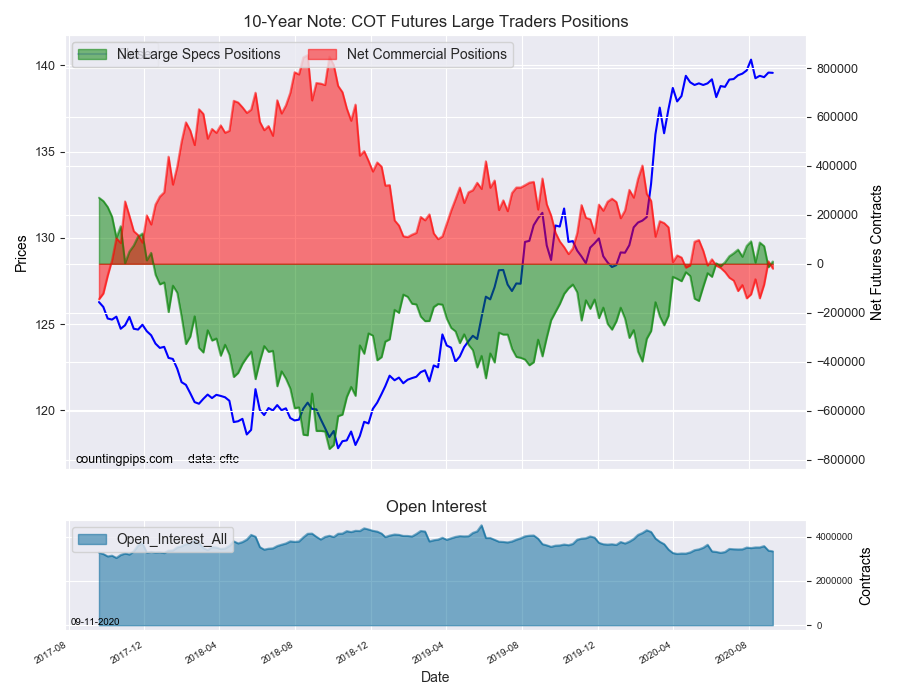

Large bond speculators increased their net positions in the 10-Year Note futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of 10-Year Note futures, traded by large speculators and hedge funds, totaled a net position of 9,507 contracts in the data reported through Tuesday, September 8th. This was a weekly gain of 22,984 net contracts from the previous week which had a total of -13,477 net contracts.

The week’s net position was the result of the gross bullish position (longs) going up by 14,013 contracts (to a weekly total of 654,692 contracts) while the gross bearish position (shorts) decreased by -8,971 contracts for the week (to a total of 645,185 contracts).

The 10-Year speculators increased their net positions this week and pushed their bets into a new bullish standing. The speculative position had fallen in the previous two weeks and dropped the overall net position into bearish territory for the first time in eleven weeks. This week’s gain pushed the net position back into a small bullish position at just +9,507 contracts which is a virtually neutral level in the big picture.

10-Year Note Commercial Positions:

The commercial traders' position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of -19,749 contracts on the week. This was a weekly drop of -29,829 contracts from the total net of 10,080 contracts reported the previous week.

10-Year Note Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the 10-Year Note Futures (Front Month) closed at approximately $139.56 which was a decline of $-0.01 from the previous close of $139.57, according to unofficial market data.