10-Year Note Non-Commercial Speculator Positions:

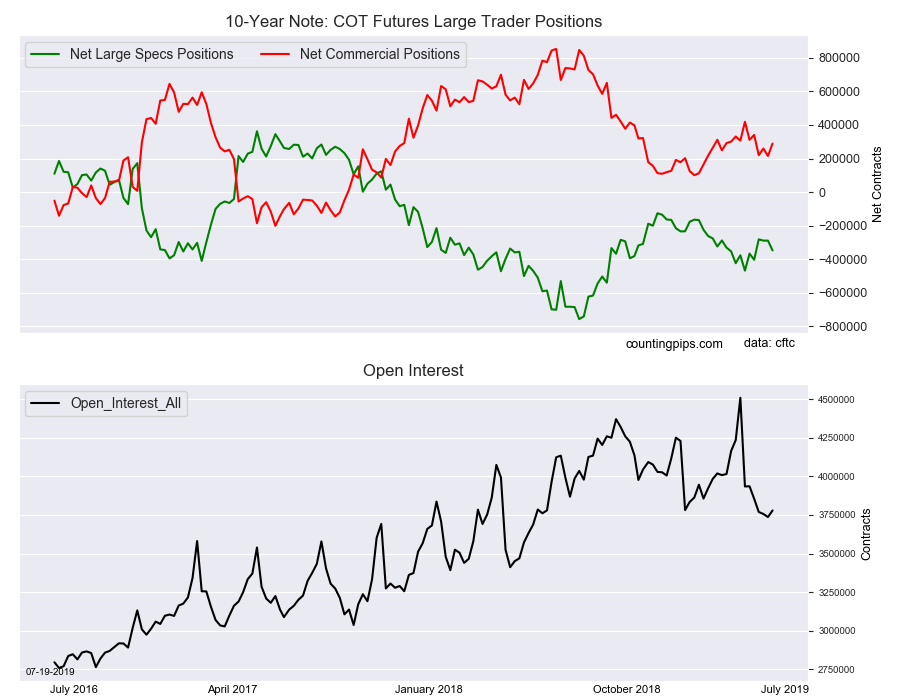

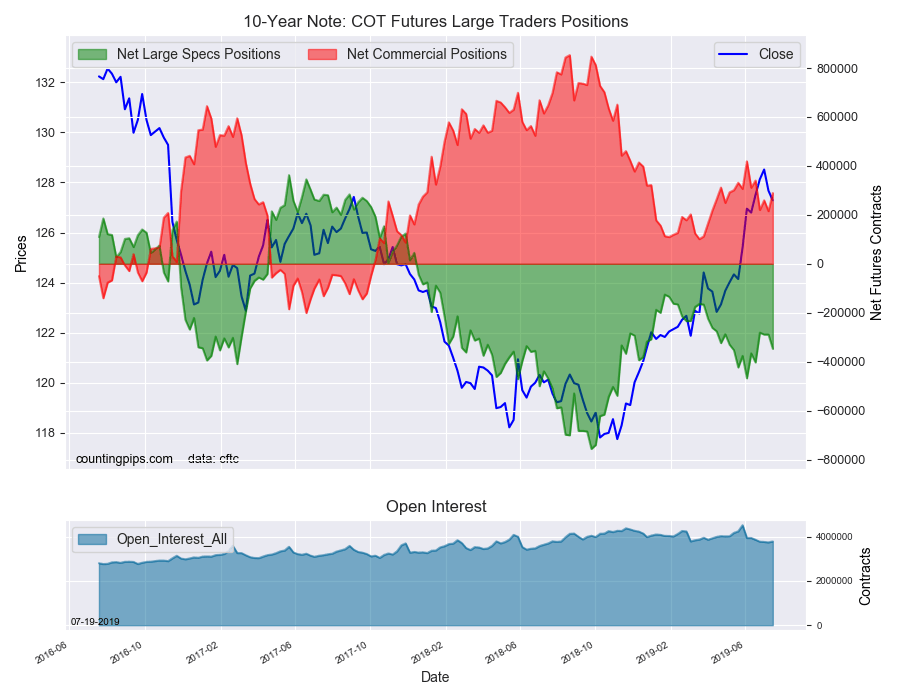

Large bond speculators raised their bearish net positions in the 10-Year Note futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of 10-Year Note futures, traded by large speculators and hedge funds, totaled a net position of -347,222 contracts in the data reported through Tuesday July 16th. This was a weekly change of -58,386 net contracts from the previous week which had a total of -288,836 net contracts.

The week’s net position was the result of the gross bullish position (longs) falling by -1,435 contracts (to a weekly total of 680,971 contracts) while the gross bearish position (shorts) jumped by 56,951 contracts for the week (to a total of 1,028,193 contracts).

Large speculators added to their existing bearish positions by the most in six weeks and pushed the current bearish standing above the -300,000 net contract level for the first time in a month.

Speculators are usually reliable trend-followers and momentum traders but have been betting against higher 10-year bond prices in recent months despite prices go higher.

10-Year Note Commercial Positions:

The commercial traders position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of 289,324 contracts on the week. This was a weekly advance of 74,147 contracts from the total net of 215,177 contracts reported the previous week.

10-Year Note Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the 10-Year Note Futures (Front Month) closed at approximately $127.28 which was a fall of $-0.39 from the previous close of $127.67, according to unofficial market data.