10-Year Note Non-Commercial Speculator Positions:

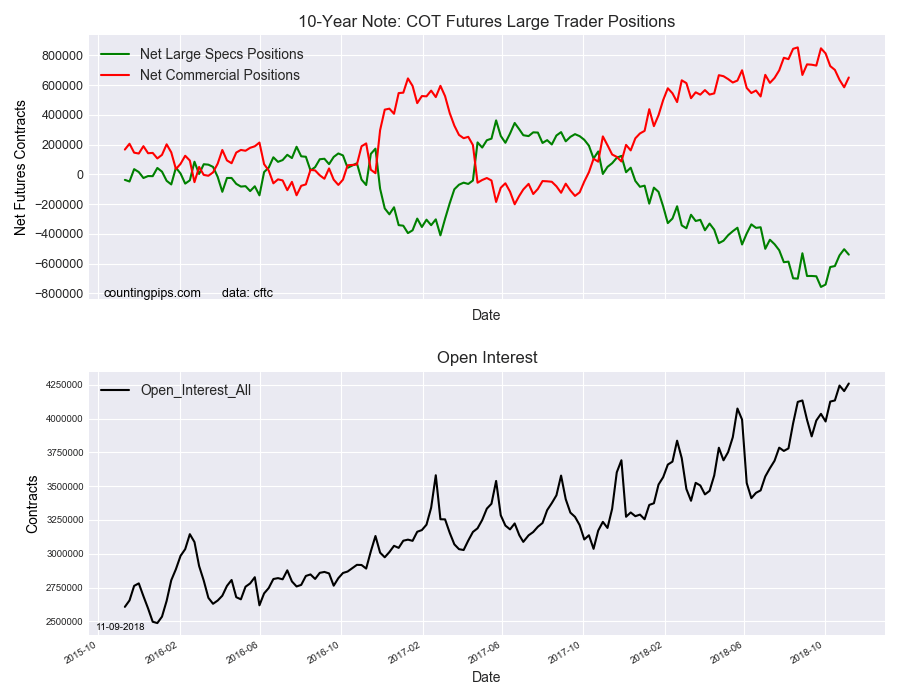

Large bond speculators raised their bearish net positions in the US 10 Year T-Note Futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of 10-Year Note futures, traded by large speculators and hedge funds, totaled a net position of -539,186 contracts in the data reported through Tuesday November 6th. This was a weekly change of -36,347 net contracts from the previous week which had a total of -502,839 net contracts.

This week’s net position was the result of the gross bullish position increasing by 7,074 contracts to a weekly total of 586,963 contracts but being overtaken by the gross bearish position which saw a boost by 43,421 contracts for the week to a total of 1,126,149 contracts .

The speculative bets in the 10-year has seen five straight weeks of declining bearish bets before this week’s turnaround. The current standing remains highly bearish but is more than 200,000 contracts less than the all-time high bearish position that was recorded on September 25th at -756,316 contracts.

10-Year Note Commercial Positions:

The commercial traders position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of 650,680 contracts on the week. This was a weekly gain of 65,845 contracts from the total net of 584,835 contracts reported the previous week.

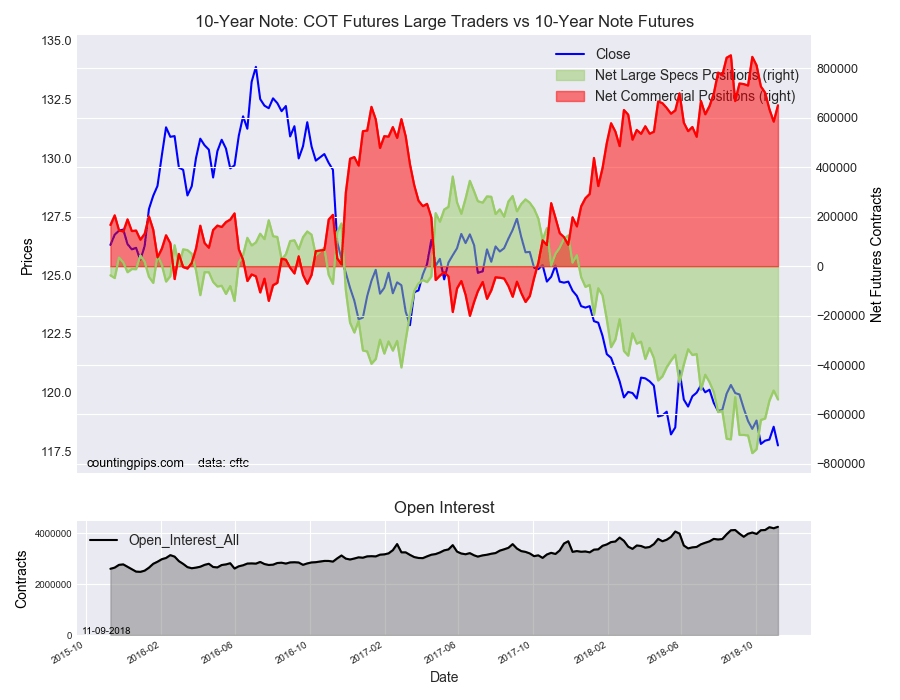

10-Year Note Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the 10-Year Note Futures (Front Month) closed at approximately $117.75 which was a decrease of $-0.79 from the previous close of $118.54, according to unofficial market data.