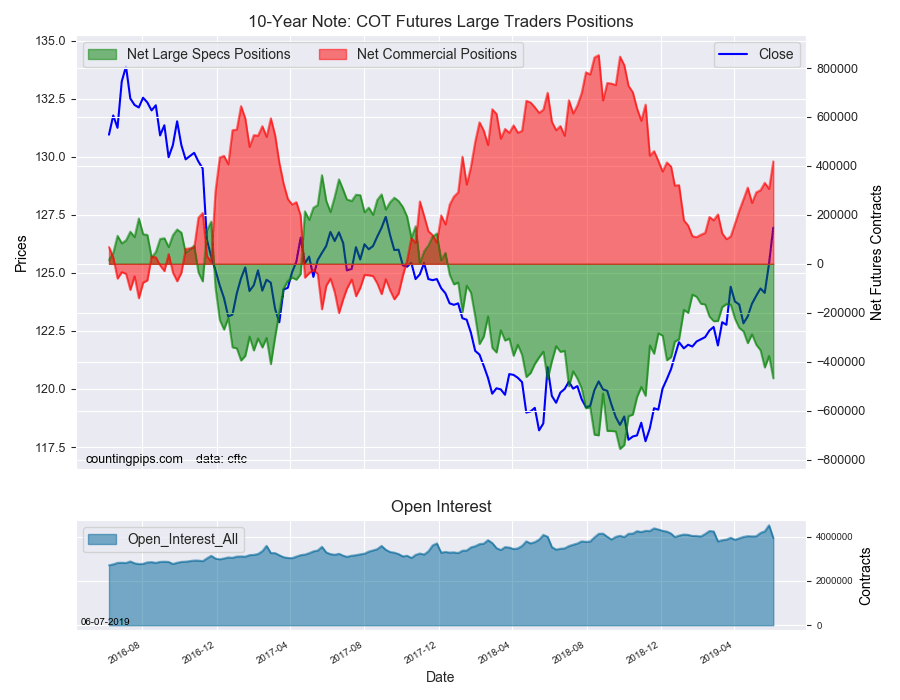

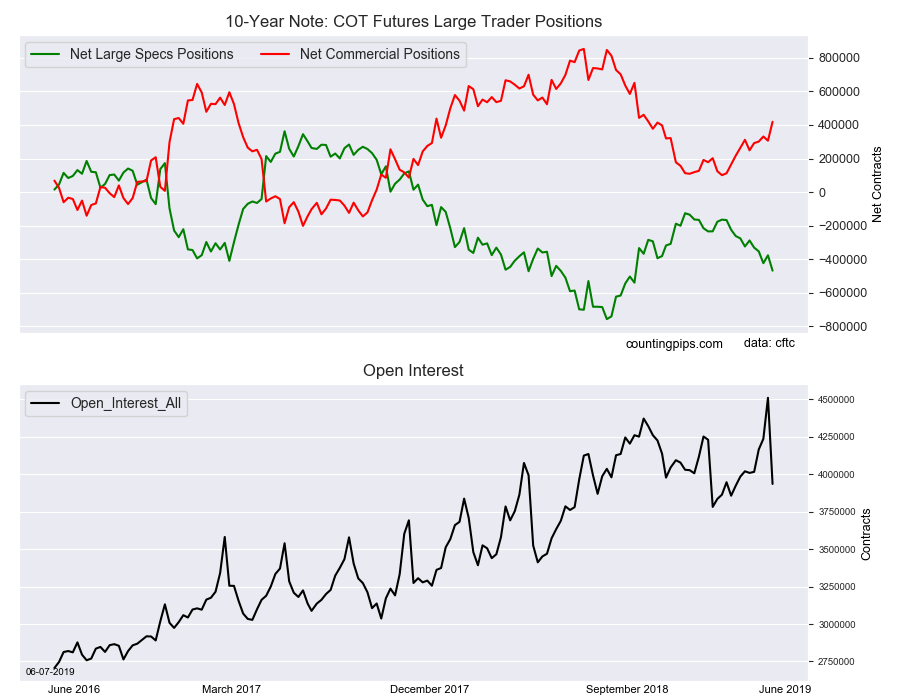

10-Year Note Non-Commercial Speculator Positions:

Large bond speculators increased their bearish net positions in the 10-Year Note futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of 10-Year Note futures, traded by large speculators and hedge funds, totaled a net position of -467,702 contracts in the data reported through Tuesday, June 4th. This was a weekly change of -91,529 net contracts from the previous week which had a total of -376,173 net contracts.

The week’s net position was the result of the gross bullish position (longs) rising by 5,317 contracts (to a weekly total of 613,273 contracts) and being more than offset by the gross bearish position (shorts) that jumped by 96,846 contracts for the week (to a total of 1,080,975 contracts).

The net speculative position has now had rising bearish bets in four out of the past five weeks. The bearish position has added a total of -179,781 contracts in that time-frame and is now at the most bearish standing since November 6th of 2018 when the level was -539,186 contracts.

Despite the speculators' bearish sentiment, the 10-year note price has been very strong and rapidly increasing over the past month (yields falling), catching the speculators especially wrong-footed.

10-Year Note Commercial Positions:

The commercial traders' position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of 418,961 contracts on the week. This was a weekly uptick of 112,652 contracts from the total net of 306,309 contracts reported the previous week.

10-Year Note Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the 10-Year Note Futures (Front Month) closed at approximately $126.95 which was a boost of $1.56 from the previous close of $125.39, according to unofficial market data.