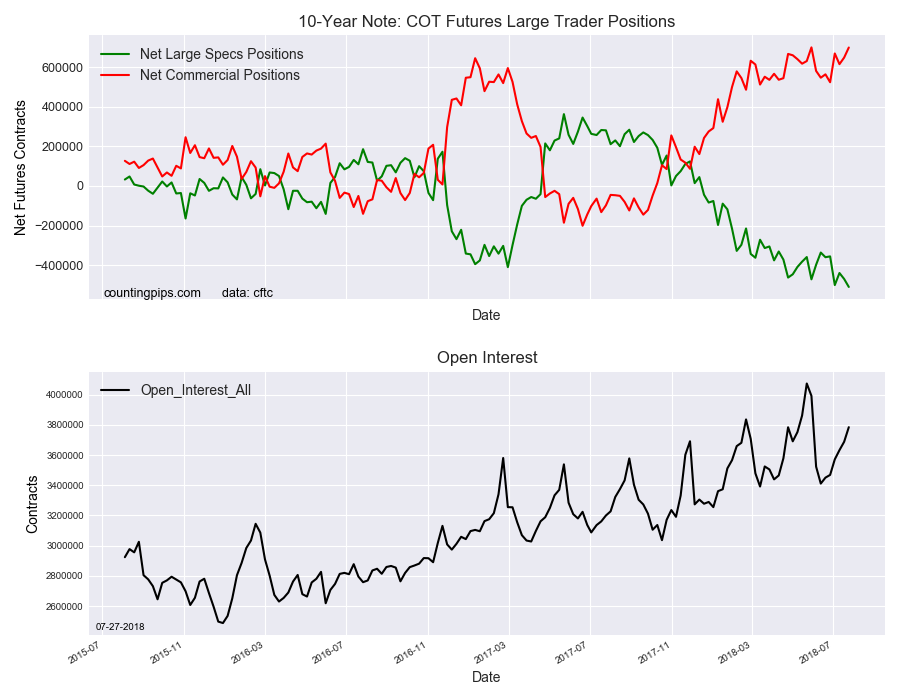

10-Year Note Non-Commercial Speculator Positions:

Large bond speculators raised their bearish net positions in the US 10 Year T-Note Futures markets to a new record high this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of 10-Year Note futures, traded by large speculators and hedge funds, totaled a net position of -509,498 contracts in the data reported through Tuesday July 24th. This was a weekly lowering of -40,360 contracts from the previous week which had a total of -469,138 net contracts.

The speculative bearish position has now increased for two straight weeks and for three out of the past four weeks to the highest bearish level on record. The new record surpasses the previous all-time high that was registered just a month ago when the bearish positions totaled more than -500,000 net contracts for the first time.

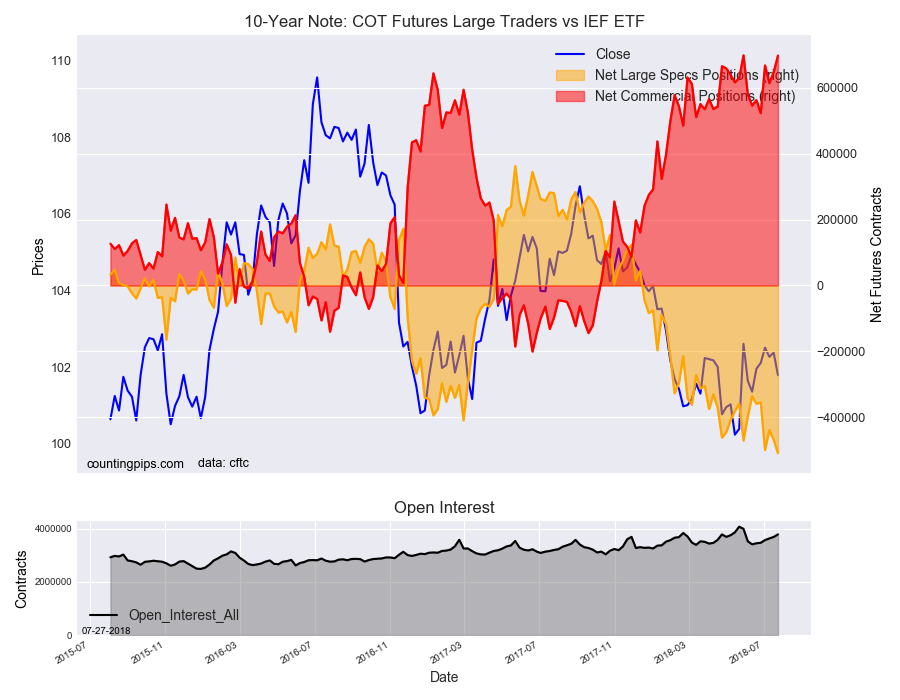

With speculators upping their bearishness on the 10-year notes (when bond prices fall, yield rises), the yield on the 10-year rose to the highest level in two months and almost breached the 3 percent mark.

10-Year Note Commercial Positions:

Meanwhile, the commercial traders position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of 698,504 contracts on the week. This was a weekly advance of 50,829 contracts from the total net of 647,675 contracts reported the previous week.

iShares 7-10 Year Treasury Bond (NASDAQ:IEF) ETF:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the 7-10 Year Treasury Bond ETF (IEF) closed at approximately $101.79 which was a decline of $-0.59 from the previous close of $102.38, according to unofficial market data.