10-Year Note Non-Commercial Speculator Positions:

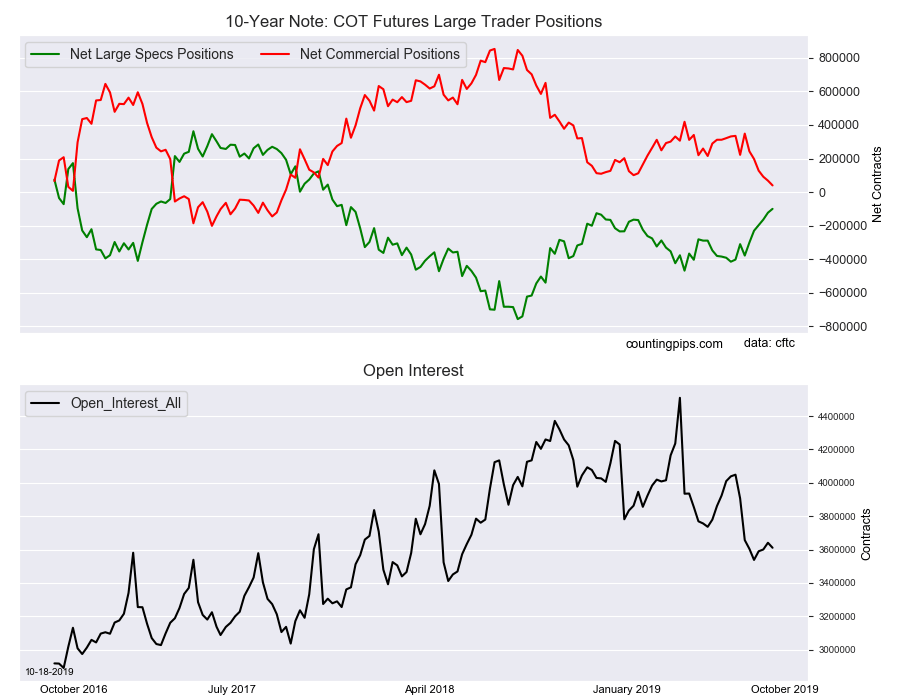

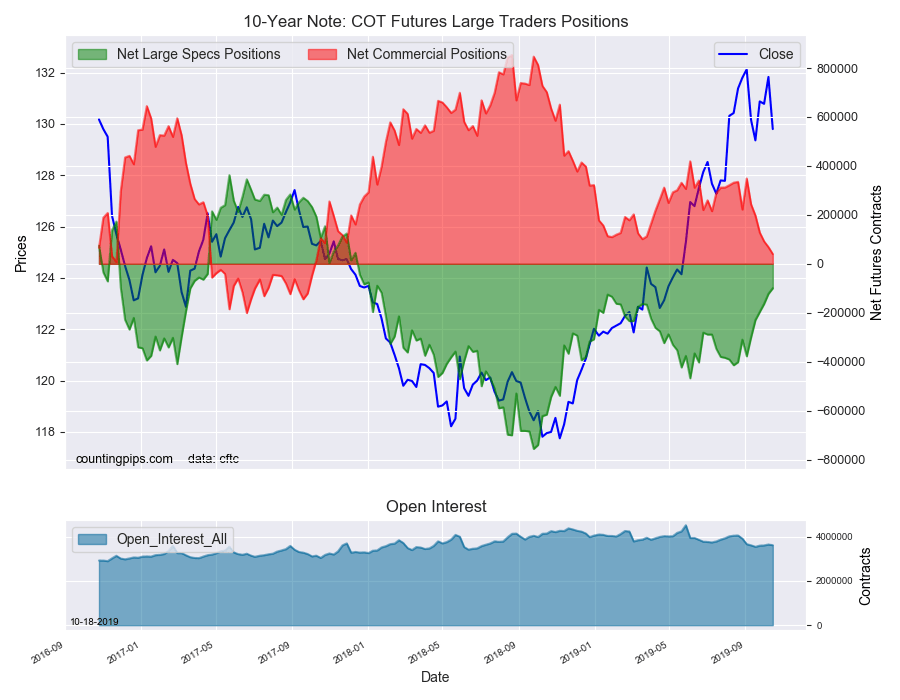

Large bond speculators continued to decrease their bearish net positions in the 10-Year Note futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of 10-Year Note futures, traded by large speculators and hedge funds, totaled a net position of -99,692 contracts in the data reported through Tuesday, October 15th. This was a weekly change of 22,868 net contracts from the previous week which had a total of -122,560 net contracts.

The week’s net position was the result of the gross bullish position (longs) gaining by 56,551 contracts (to a weekly total of 661,339 contracts) while the gross bearish position (shorts) also rose by 33,683 contracts for the week (to a total of 761,031 contracts).

10-Year speculators cut back on their bearish positions for the sixth consecutive week this week. Speculators have now reduced their bearish bets by a total of 278,175 contracts over that six-week period. The speculative standing is now at the least bearish level since January 16th of 2018 which is a span of ninety-one straight weeks.

10-Year Note Commercial Positions:

The commercial traders' position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of 39,989 contracts on the week. This was a weekly decline of -28,372 contracts from the total net of 68,361 contracts reported the previous week.

10-Year Note Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the 10-Year Note Futures (Front Month) closed at approximately $129.79 which was a decline of $-2.03 from the previous close of $131.82, according to unofficial market data.