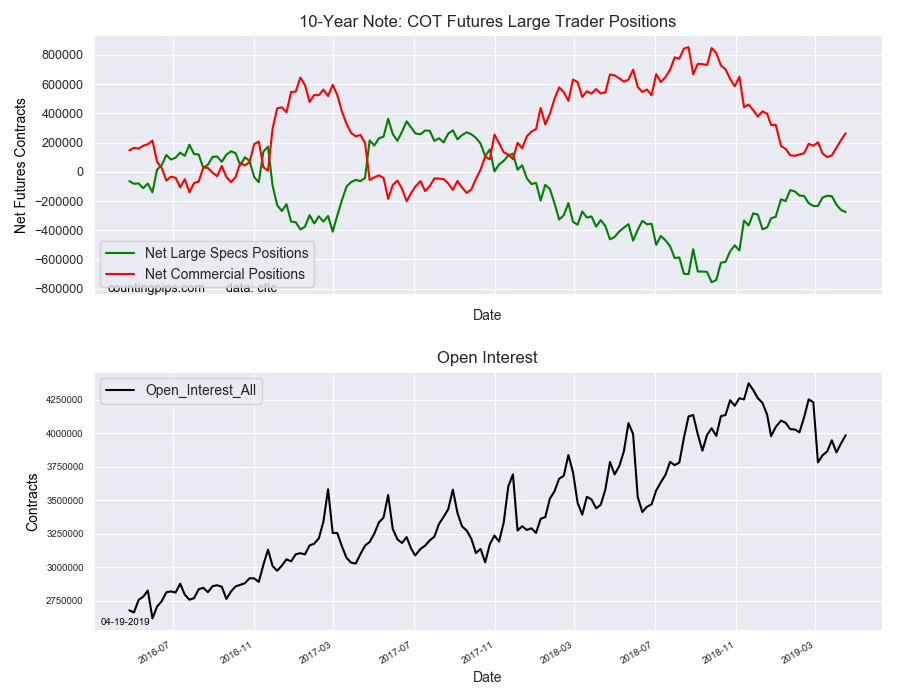

10-Year Note Non-Commercial Speculator Positions:

Large bond speculators continued to boost their bearish net positions in the 10-Year Note futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of 10-Year Note futures, traded by large speculators and hedge funds, totaled a net position of -275,650 contracts in the data reported through Tuesday, April 16th. This was a weekly change of -14,086 net contracts from the previous week which had a total of -261,564 net contracts.

The week’s net position was the result of the gross bullish position (longs) sinking by -9,869 contracts to a weekly total of 620,384 contracts which combined with the gross bearish position (shorts) that saw an advance by 4,217 contracts for the week to a total of 896,034 contracts.

The net speculative bearish position has now risen for four straight weeks and by a total of -111,676 net contracts over that time-period. The current net position is at the most bearish level since December 31st (-308,287 contracts) but remains a far ways off the levels of the August-to-October period which had peaks of more than -700,000 contracts.

10-Year Note Commercial Positions:

The commercial traders' position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of 263,707 contracts on the week. This was a weekly advance of 46,473 contracts from the total net of 217,234 contracts reported the previous week.

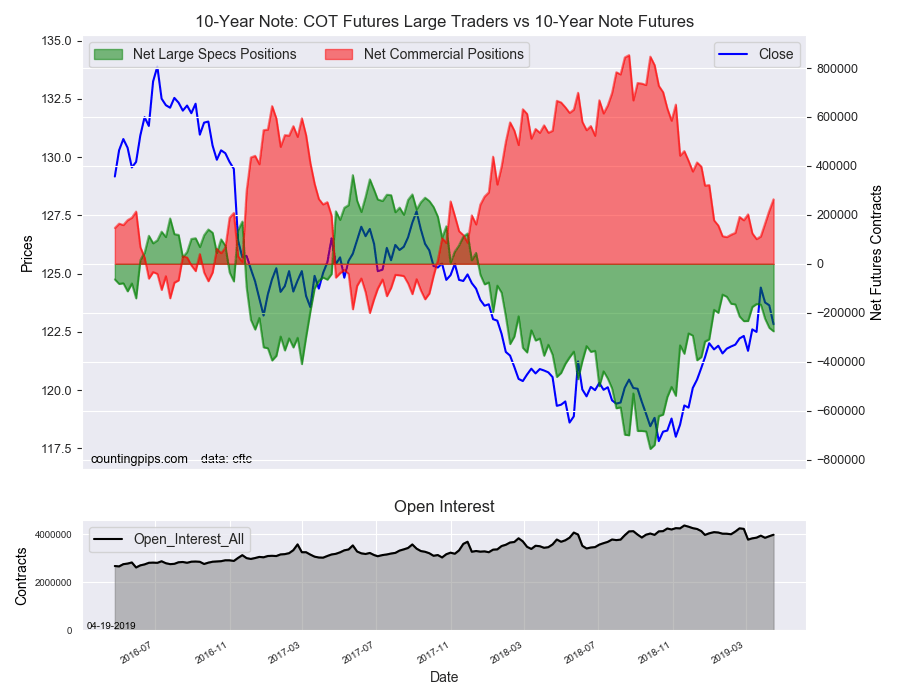

10-Year Note Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the 10-Year Note Futures (Front Month) closed at approximately $122.82 which was a decrease of $-0.82 from the previous close of $123.64, according to unofficial market data.