10-Year Note Non-Commercial Speculator Positions:

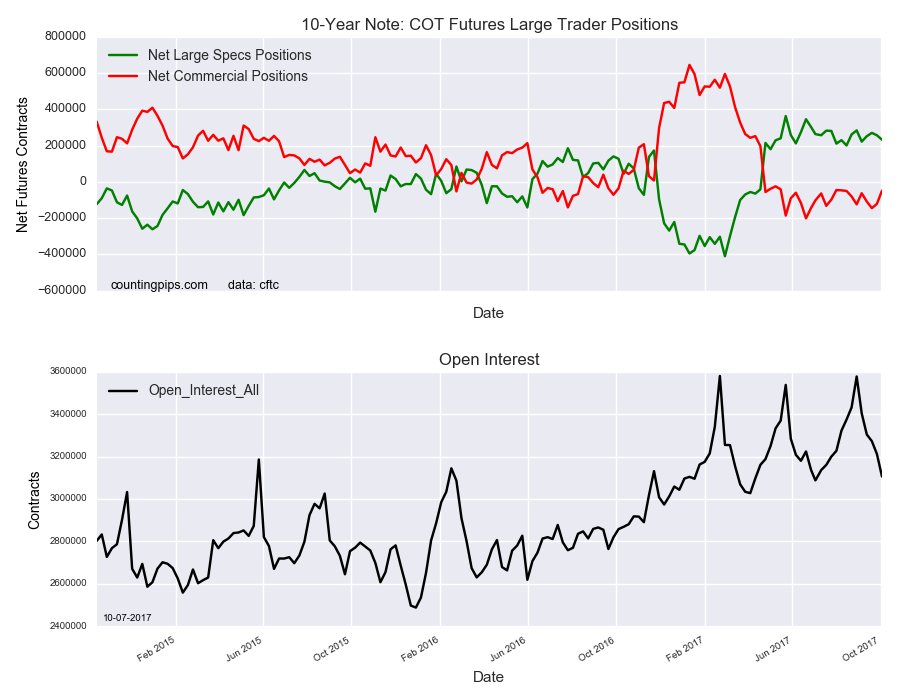

Large treasury speculators reduced their net positions in the US 10 Year T-Note Futures markets for a second straight week this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of 10-Year Note futures, traded by large speculators and hedge funds, totaled a net position of 232,156 contracts in the data reported through Tuesday October 3rd. This was a weekly fall of -24,470 contracts from the previous week which had a total of 256,626 net contracts.

Speculative positions have fallen below the +250,000 net contracts for the first time in four weeks while the net contract level has remained above the +200,000 contract threshold for twenty-two straight weeks.

10-Year Note Commercial Positions:

The commercial traders position, categorized by the CFTC as hedgers or traders engaged in buying and selling for business purposes, totaled a net position of -48,466 contracts on the week. This was a weekly gain of 72,567 contracts from the total net of -121,033 contracts reported the previous week.

iShares Core MSCI EAFE (NYSE:IEFA) ETF:

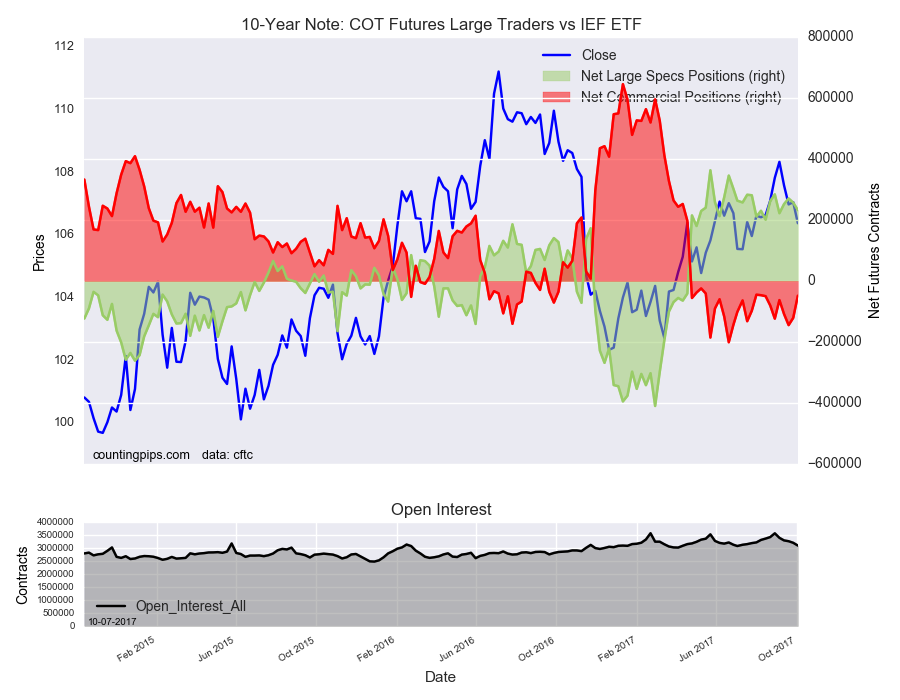

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the 7-10 Year Treasury Bond ETF (IEF) closed at approximately $106.39 which was a loss of $-0.67 from the previous close of $107.06, according to unofficial market data.