10-Year Note Non-Commercial Speculator Positions:

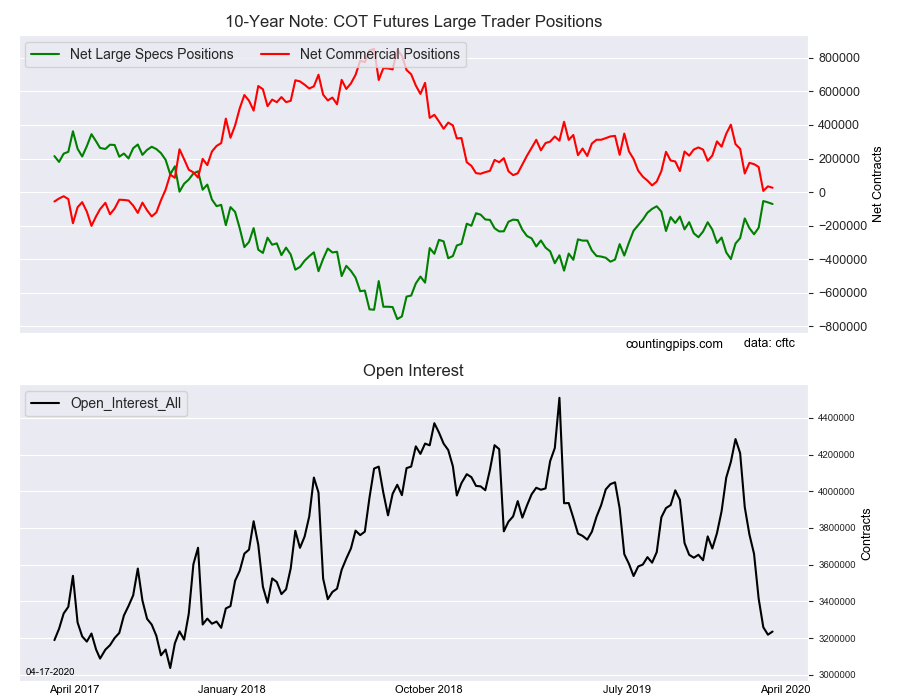

Large bond speculators raised their bearish net positions in the 10-Year Note Futures markets again this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of 10-Year Note futures, traded by large speculators and hedge funds, totaled a net position of -70,798 contracts in the data reported through Tuesday April 14th. This was a weekly change of -9,774 net contracts from the previous week which had a total of -61,024 net contracts.

The week’s net position was the result of the gross bullish position (longs) growing by 45,053 contracts (to a weekly total of 551,217 contracts) while the gross bearish position (shorts) rose by a greater amount of 54,827 contracts for the week (to a total of 622,015 contracts).

10-Year Speculators slightly added to their bearish bets for a second week following a huge sell-off in bearish positions starting in February and into March. Speculators have added a total of 17,762 contracts in the past two weeks to the existing bearish standing that now sits at a total of -70,798 contracts. Bearish positions rose as high as a total of -398,919 contracts on February 11th which shows that speculators have now effectively shed approximately 320,000 bearish contracts since February and as the market turmoil pushed investors into the 10-Year as a strong safe-haven destination.

10-Year Note Commercial Positions:

The commercial traders position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of 25,955 contracts on the week. This was a weekly loss of -8,391 contracts from the total net of 34,346 contracts reported the previous week.

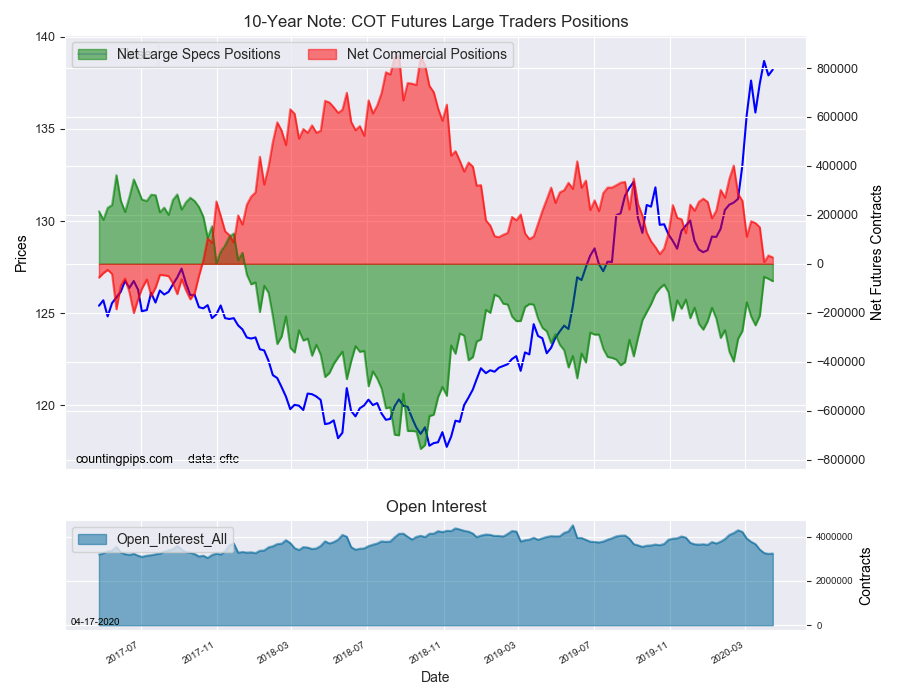

10-Year Note Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the 10-Year Note Futures (Front Month) closed at approximately $138.21 which was an advance of $0.31 from the previous close of $137.90, according to unofficial market data.