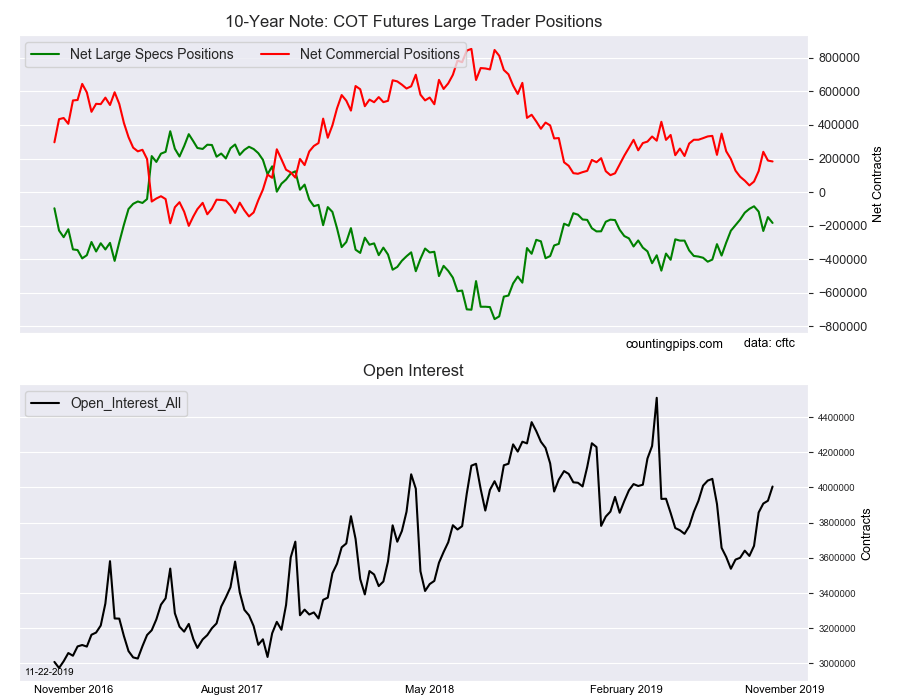

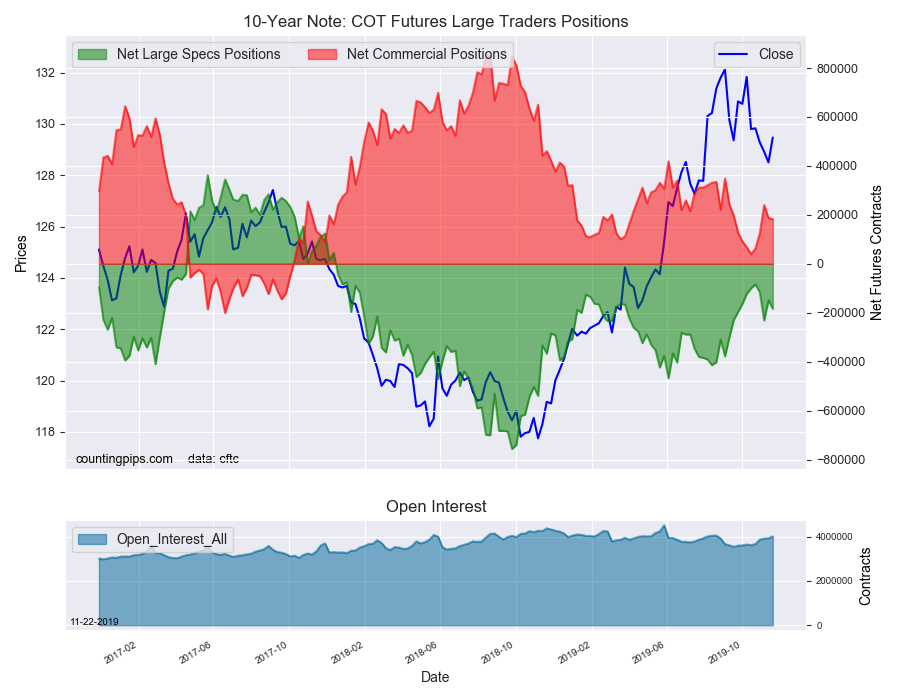

10-Year Note Non-Commercial Speculator Positions:

Large bond speculators pushed their bearish net positions higher in the 10-Year Note futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of 10-Year Note futures, traded by large speculators and hedge funds, totaled a net position of -183,524 contracts in the data reported through Tuesday November 19th. This was a weekly change of -34,730 net contracts from the previous week which had a total of -148,794 net contracts.

The week’s net position was the result of the gross bullish position (longs) going up by 25,397 contracts (to a weekly total of 677,709 contracts) while the gross bearish position (shorts) jumped by a greater amount of 60,127 contracts for the week (to a total of 861,233 contracts).

Ten-year note speculators increased their bearish bets for the third time in the past four weeks. This follows a streak of seven weeks from September 10th to October 22nd where bearish bets fell by a total of 293,514 contracts in that period. The current standing of -185,524 contracts is the fourth straight week with bearish bets above the -100,000 net contract level.

10-Year Note Commercial Positions:

The commercial traders position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of 182,638 contracts on the week. This was a weekly loss of -5,412 contracts from the total net of 188,050 contracts reported the previous week.

10-Year Note Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the 10-Year Note Futures (Front Month) closed at approximately $129.46 which was a rise of $0.96 from the previous close of $128.50, according to unofficial market data.