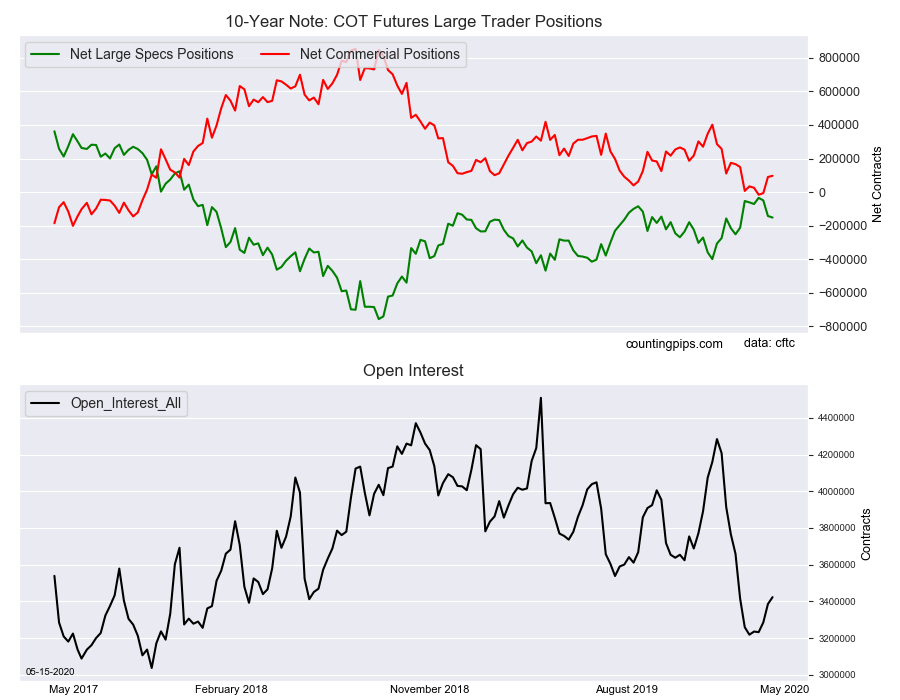

10-Year Note Non-Commercial Speculator Positions:

Large bond speculators continued to increase their bearish net positions in the 10-Year Note futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of 10-Year Note futures, traded by large speculators and hedge funds, totaled a net position of -151,487 contracts in the data reported through Tuesday, May 12th. This was a weekly change of -9,216 net contracts from the previous week which had a total of -142,271 net contracts.

The week’s net position was the result of the gross bullish position (longs) rising by 22,140 contracts (to a weekly total of 597,109 contracts) but being overcome by the gross bearish position (shorts) which increased by 31,356 contracts for the week (to a total of 748,596 contracts).

The 10-Year speculators pushed their bearish bets higher for the third straight week and for the fifth time in the past six weeks. The speculative bearish position had fallen as low as -34,098 contracts on April 21st but have now risen by a total of -117,389 contracts since then to hit a seven-week high of -151,487 contracts this week.

10-Year Note Commercial Positions:

The commercial traders' position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of 97,267 contracts on the week. This was a weekly gain of 7,169 contracts from the total net of 90,098 contracts reported the previous week.

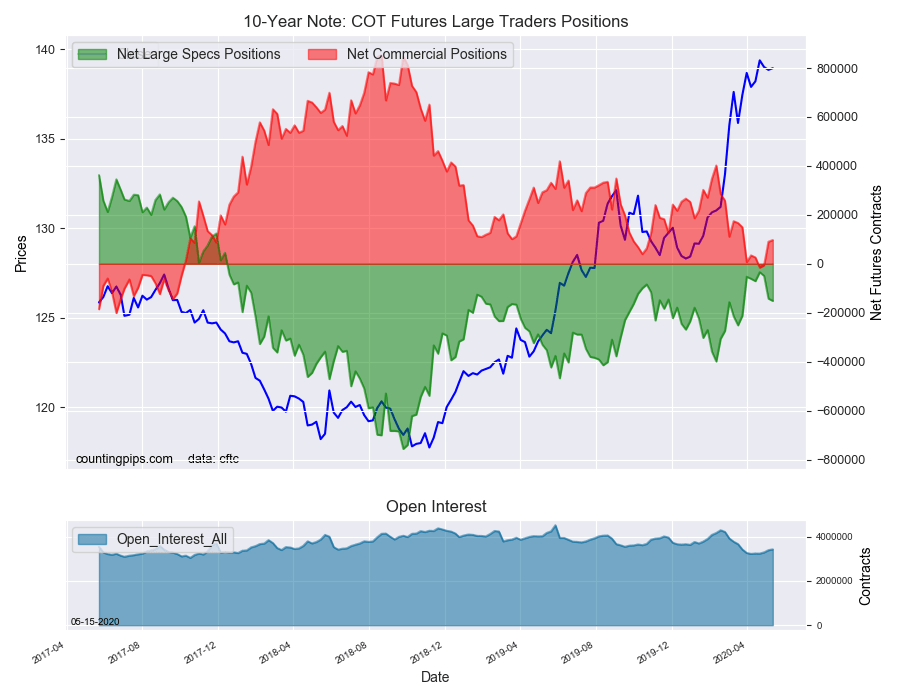

10-Year Note Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the 10-Year Note Futures (Front Month) closed at approximately $138.95 which was an advance of $0.09 from the previous close of $138.85, according to unofficial market data.