10-Year Note Non-Commercial Speculator Positions:

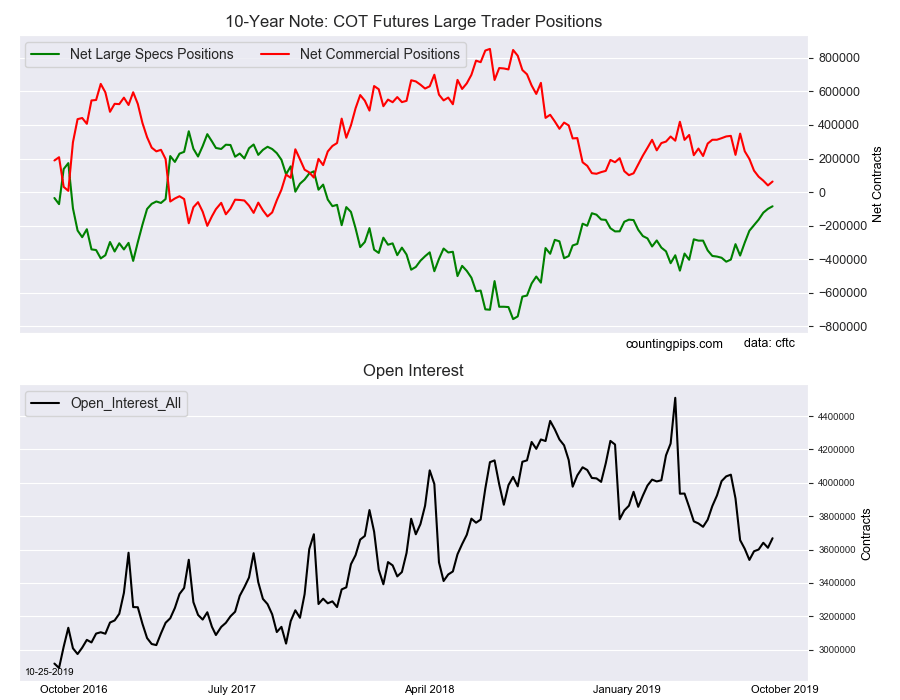

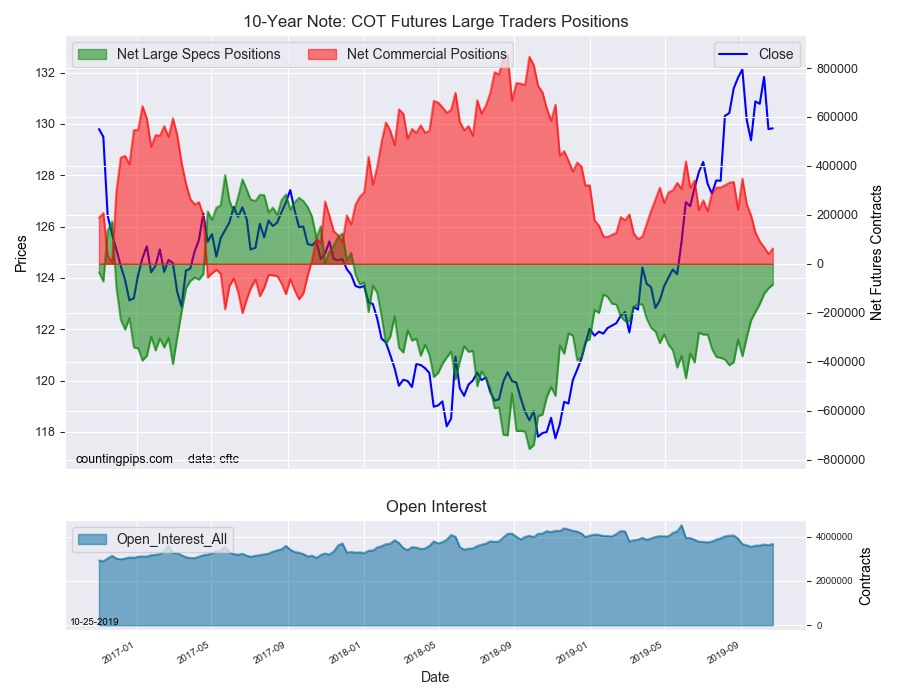

Large bond speculators once again cut back on their bearish net positions in the 10-Year Note futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of 10-Year Note futures, traded by large speculators and hedge funds, totaled a net position of -84,353 contracts in the data reported through Tuesday October 22nd. This was a weekly change of 15,339 net contracts from the previous week which had a total of -99,692 net contracts.

The week’s net position was the result of the gross bullish position (longs) going up by just 2,979 contracts (to a weekly total of 664,318 contracts) while the gross bearish position (shorts) lowered by -12,360 contracts for the week (to a total of 748,671 contracts).

10-year treasury speculators once again decreased their bearish bets for a seventh straight week and now by a total of 293,514 contracts over that period. The decrease in bearish sentiment has brought the position to its least bearish standing in ninety-four weeks dating back to January 2nd of 2018.

10-Year Note Commercial Positions:

The commercial traders position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of 63,012 contracts on the week. This was a weekly boost of 23,023 contracts from the total net of 39,989 contracts reported the previous week.

10-Year Note Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the 10-Year Note Futures (Front Month) closed at approximately $129.82 which was an uptick of $0.03 from the previous close of $129.79, according to unofficial market data.