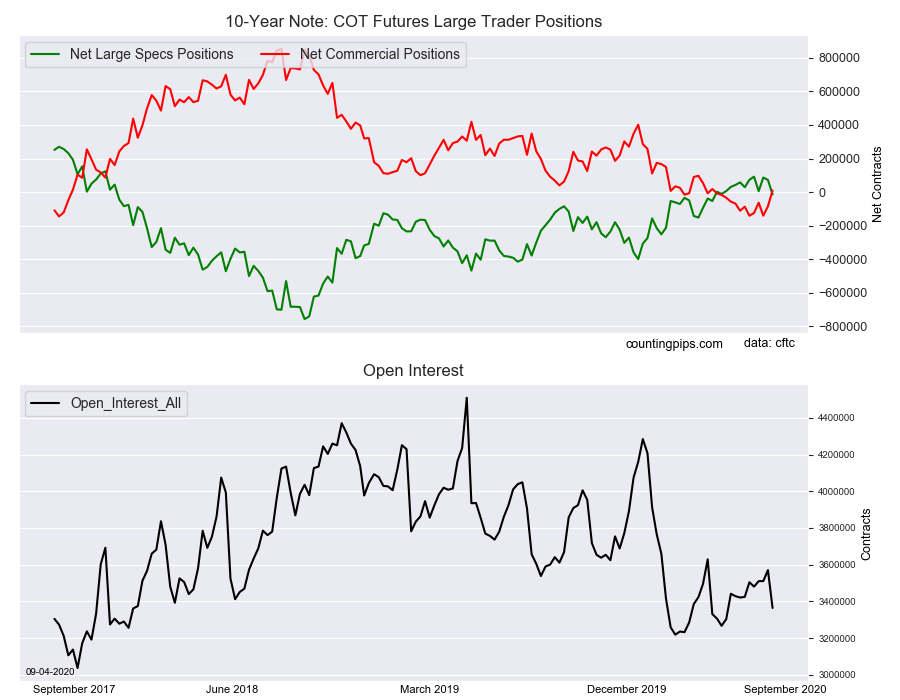

10-Year Note Non-Commercial Speculator Positions:

Large bond speculators cut back on their net positions in the 10-Year Note futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of 10-Year Note futures, traded by large speculators and hedge funds, totaled a net position of -13,477 contracts in the data reported through Tuesday, September 1st. This was a weekly change of -85,814 net contracts from the previous week which had a total of 72,337 net contracts.

The week’s net position was the result of the gross bullish position (longs) gaining by 4,197 contracts (to a weekly total of 640,679 contracts) while the gross bearish position (shorts) jumped by 90,011 contracts for the week (to a total of 654,156 contracts).

The 10-Year speculative position fell for a second straight week this week and crossed over into bearish territory for the first time in eleven weeks. The 10-Year bets have fallen by a total of -100,481 contracts over the past two weeks which erased the positive gains of the previous ten weeks. The speculative position had previously been overwhelmingly bearish from December of 2017 all the way up to June of this year when the specs turned slightly bullish. The current standing is now at the lowest level since June 2nd but in the overall big picture, the current position is essentially a neutral level for the 10-Year contracts.

10-Year Note Commercial Positions:

The commercial traders' position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of 10,080 contracts on the week. This was a weekly boost of 94,624 contracts from the total net of -84,544 contracts reported the previous week.

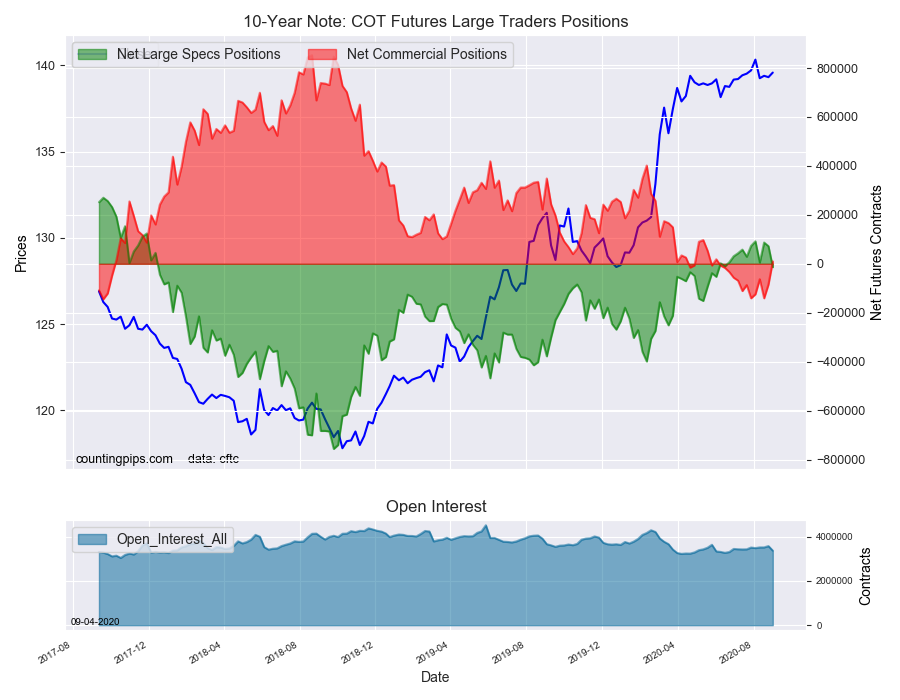

10-Year Note Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the 10-Year Note Futures (Front Month) closed at approximately $139.57 which was an uptick of $0.26 from the previous close of $139.31, according to unofficial market data.