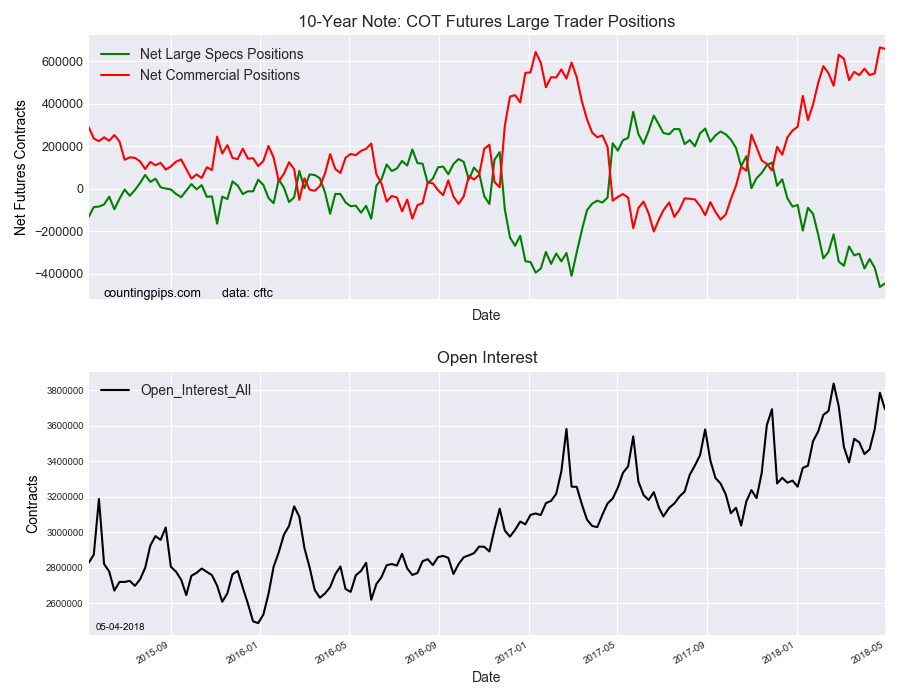

10-Year Note Non-Commercial Speculator Positions:

Large treasury bond speculators reduced their bearish net positions off of a record high level in the 10-Year Note futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of 10-Year Note futures, traded by large speculators and hedge funds, totaled a net position of -445,678 contracts in the data reported through Tuesday May 1st. This was a weekly advance of 16,455 contracts from the previous week which had a total of -462,133 net contracts.

Speculative positions had risen to a record high bearish position last week before this week’s slight turnaround. The overall net position is now above the -400,000 net contract level for a second straight week.

10-Year Note Commercial Positions:

The commercial traders position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of 659,408 contracts on the week. This was a weekly fall of -6,805 contracts from the total net of 666,213 contracts reported the previous week.

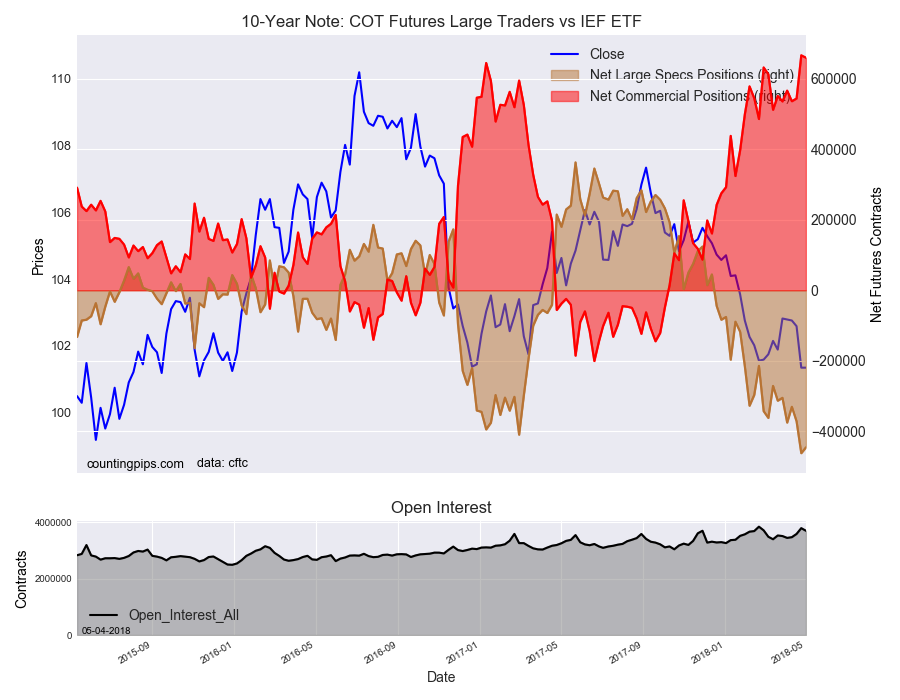

iShares 7-10 Year Treasury Bond (NASDAQ:IEF) ETF:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the 7-10 Year Treasury Bond ETF (IEF) closed at approximately $101.35 which was virtually unchanged for the week, according to unofficial market data.