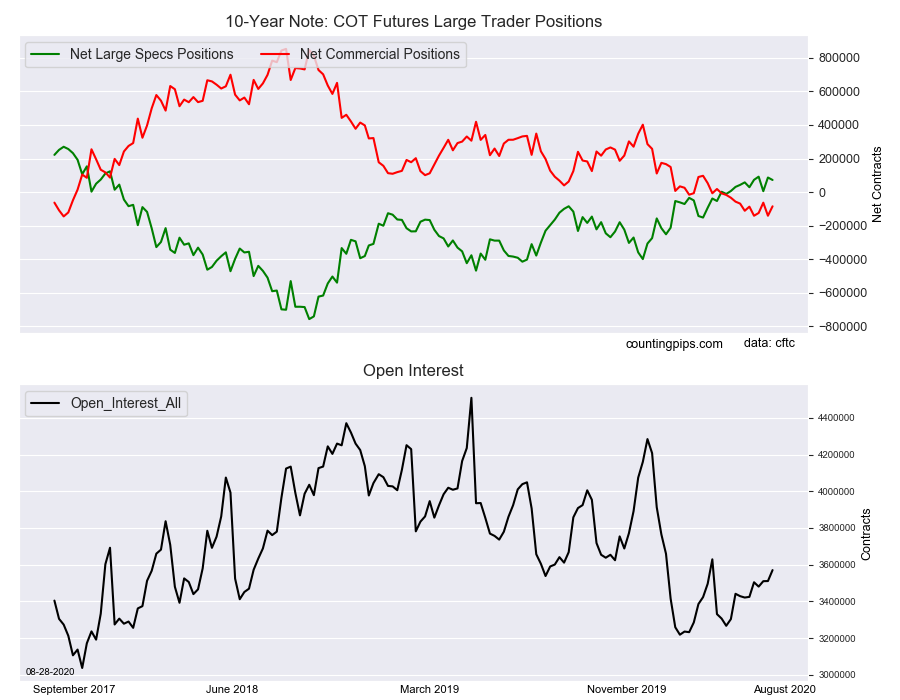

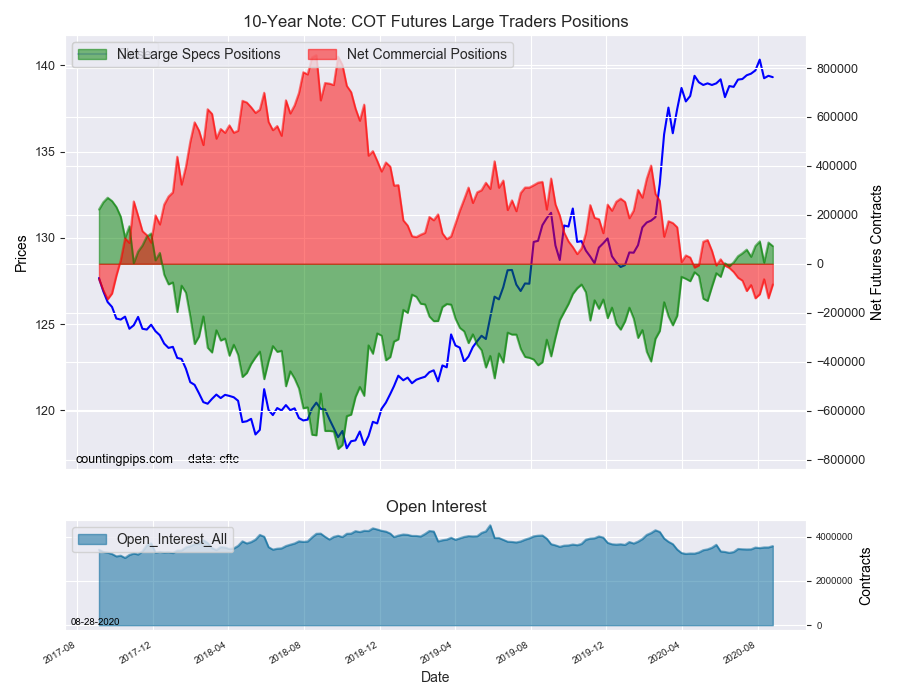

10-Year Note Non-Commercial Speculator Positions:

Large bond speculators lowered their bullish net positions in the 10-Year Note futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of 10-Year Note futures, traded by large speculators and hedge funds, totaled a net position of 72,337 contracts in the data reported through Tuesday August 25th. This was a weekly decline of -14,667 net contracts from the previous week which had a total of 87,004 net contracts.

The week’s net position was the result of the gross bullish position (longs) sinking by -83,594 contracts (to a weekly total of 636,482 contracts) while the gross bearish position (shorts) fell by a lesser amount of -68,927 contracts for the week (to a total of 564,145 contracts).

The 10-Year speculators reduced their bullish bets this week after a strong rebound by over +81,504 contracts last week. The speculative position has fallen in two out of the past three weeks but remains steady in a small bullish position. Overall, the 10-year standing has been in bullish territory for ten straight weeks as the demand for 10-year notes continues to be strong with prices staying high and the yield of these notes remaining well under 1 percent.

10-Year Note Commercial Positions:

The commercial traders' position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of -84,544 contracts on the week. This was a weekly uptick of 56,110 contracts from the total net of -140,654 contracts reported the previous week.

10-Year Note Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the 10-Year Note Futures (Front Month) closed at approximately $139.31 which was a shortfall of $-0.08 from the previous close of $139.39, according to unofficial market data.