10-Year Note Non-Commercial Speculator Positions:

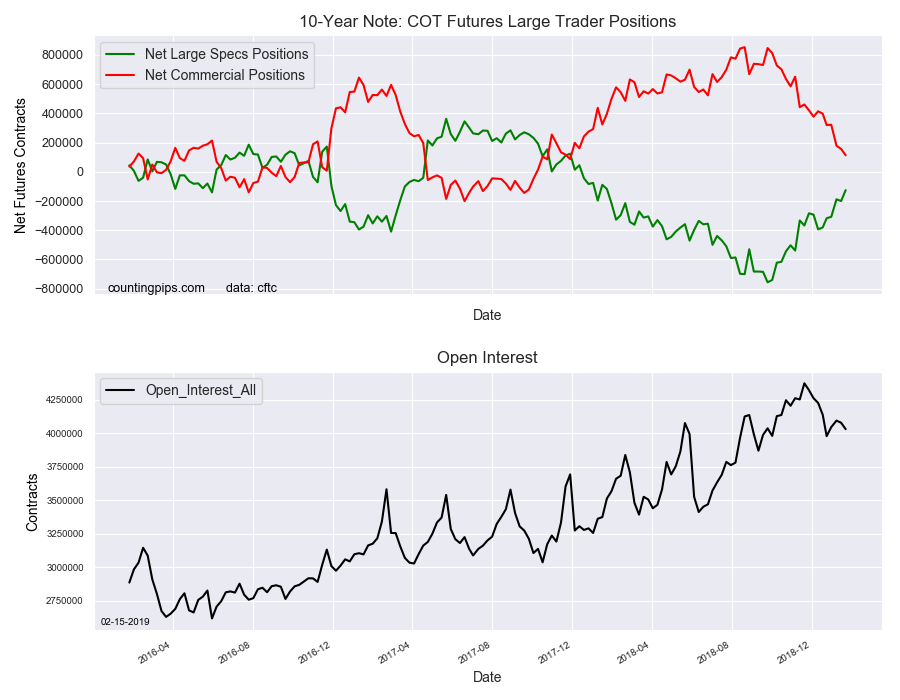

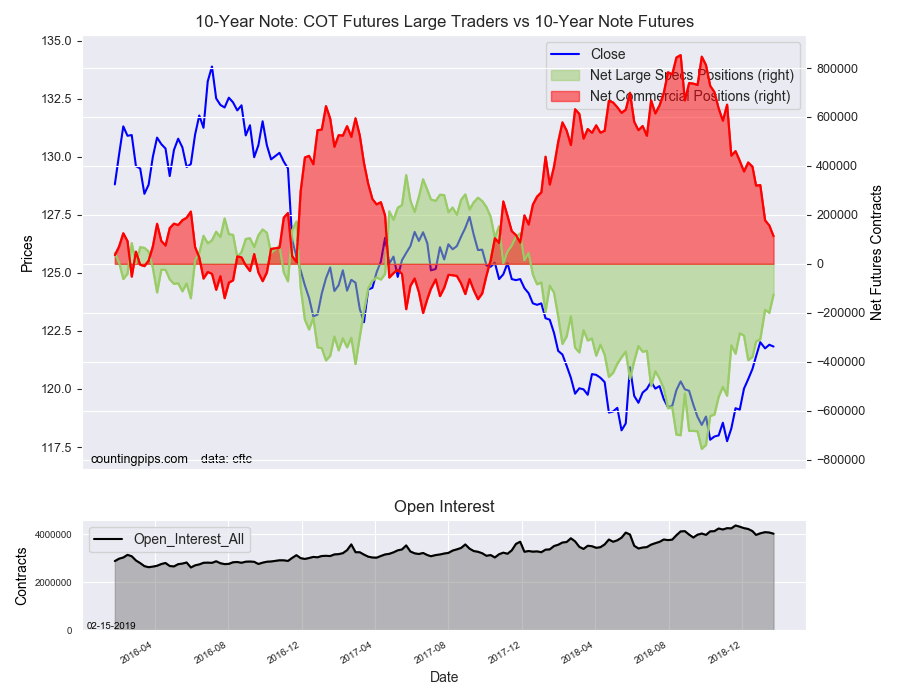

Large bond speculators continued to reduce their bearish net positions in the 10-Year Note futures markets in January, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

This latest COT data is from later in January due to the government shutdown which suspended the releases. The CFTC is releasing data on Tuesdays and Fridays going forward until the data is back up to date.

The non-commercial futures contracts of 10-Year Note futures, traded by large speculators and hedge funds, totaled a net position of -125,752 contracts in the data reported through Tuesday January 22nd. This was a weekly gain of 74,432 net contracts from the previous week which had a total of -200,184 net contracts.

The week’s net position was the result of the gross bullish position (longs) advancing by 36,952 contracts to a weekly total of 686,934 contracts compared to the gross bearish position (shorts) which saw a decline by -37,480 contracts for the week to a total of 812,686 contracts.

The net speculative position continued to shed bearish bets through January 22nd. The bearish position has now declined from a net position of -380,779 contracts on December 18th to a total of -125,752 contracts on January 22nd. The speculative standing marked the lowest bearish level in almost exactly one year (January 23, 2018).

10-Year Note Commercial Positions:

The commercial traders position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of 112,854 contracts on the week. This was a weekly fall of -43,744 contracts from the total net of 156,598 contracts reported the previous week.

10-Year Note Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the 10-Year Note Futures (Front Month) closed at approximately $121.82 which was a drop of $-0.07 from the previous close of $121.90, according to unofficial market data.