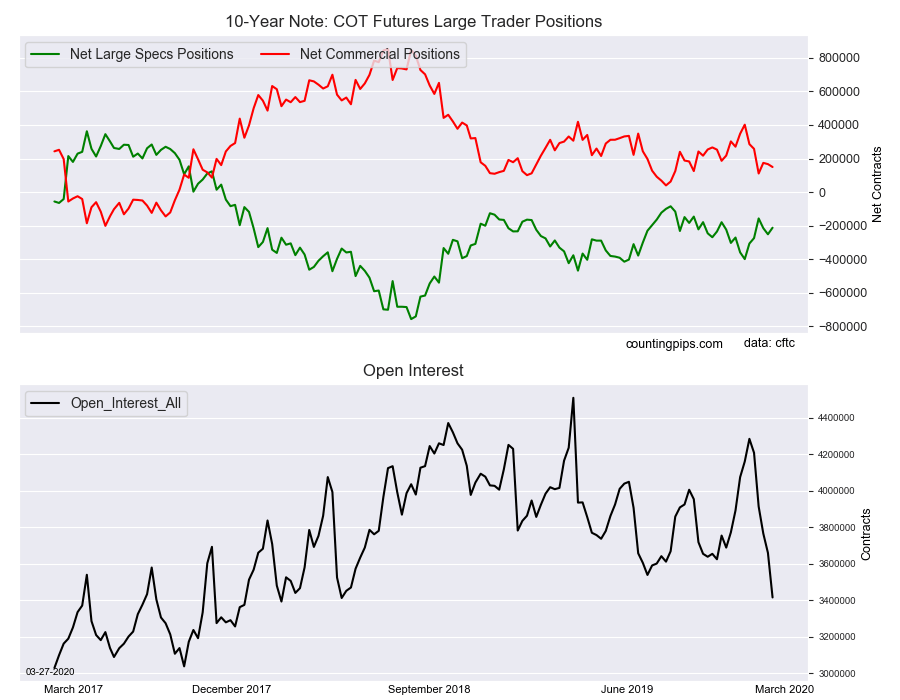

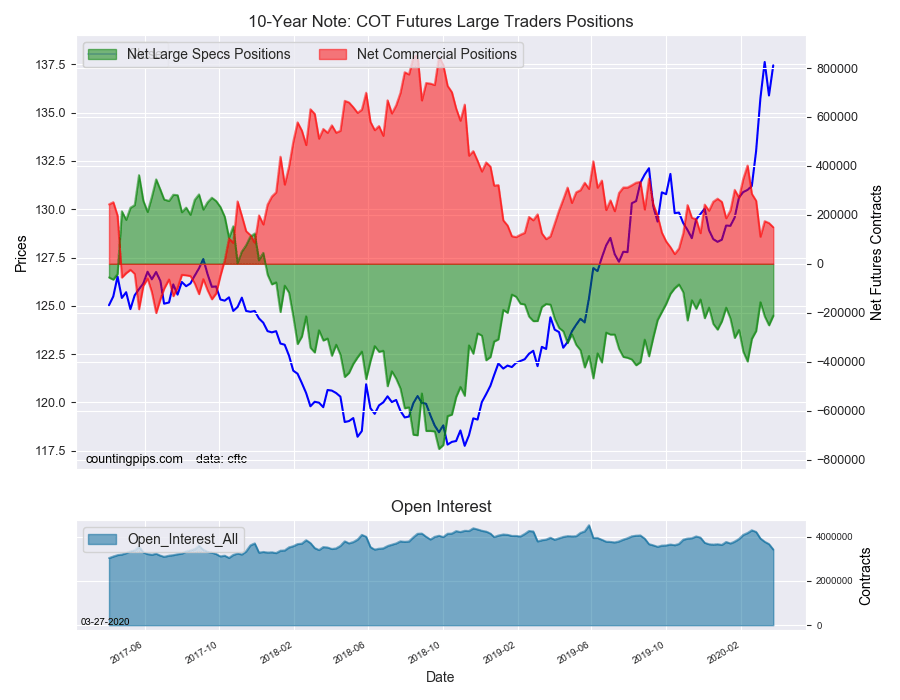

10-Year Note Non-Commercial Speculator Positions:

Large bond speculators trimmed their bearish net positions in the 10-Year Note futuresmarkets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of 10-Year Note futures, traded by large speculators and hedge funds, totaled a net position of -212,029 contracts in the data reported through Tuesday, March 24th. This was a weekly change of 39,084 net contracts from the previous week which had a total of -251,113 net contracts.

The week’s net position was the result of the gross bullish position (longs) declining by -43,637 contracts (to a weekly total of 483,608 contracts) while the gross bearish position (shorts) dropped by a greater amount of -82,721 contracts for the week (to a total of 695,637 contracts).

The 10-Year speculators had increased their bearish bets in the previous two weeks before this week’s reduction. Overall, the bearish position has now fallen by almost half since February 11th when the net position totaled -398,919 contracts and is currently below the 2020 weekly average of +262,361 contracts. The last time speculators were actually bullish in the 10-Year contracts was in December of 2017.

10-Year Note Commercial Positions:

The commercial traders' position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of 149,573 contracts on the week. This was a weekly drop of -17,164 contracts from the total net of 166,737 contracts reported the previous week.

10-Year Note Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the 10-Year Note Futures (Front Month) closed at approximately $137.45which was an advance of $1.56 from the previous close of $135.89, according to unofficial market data.